-

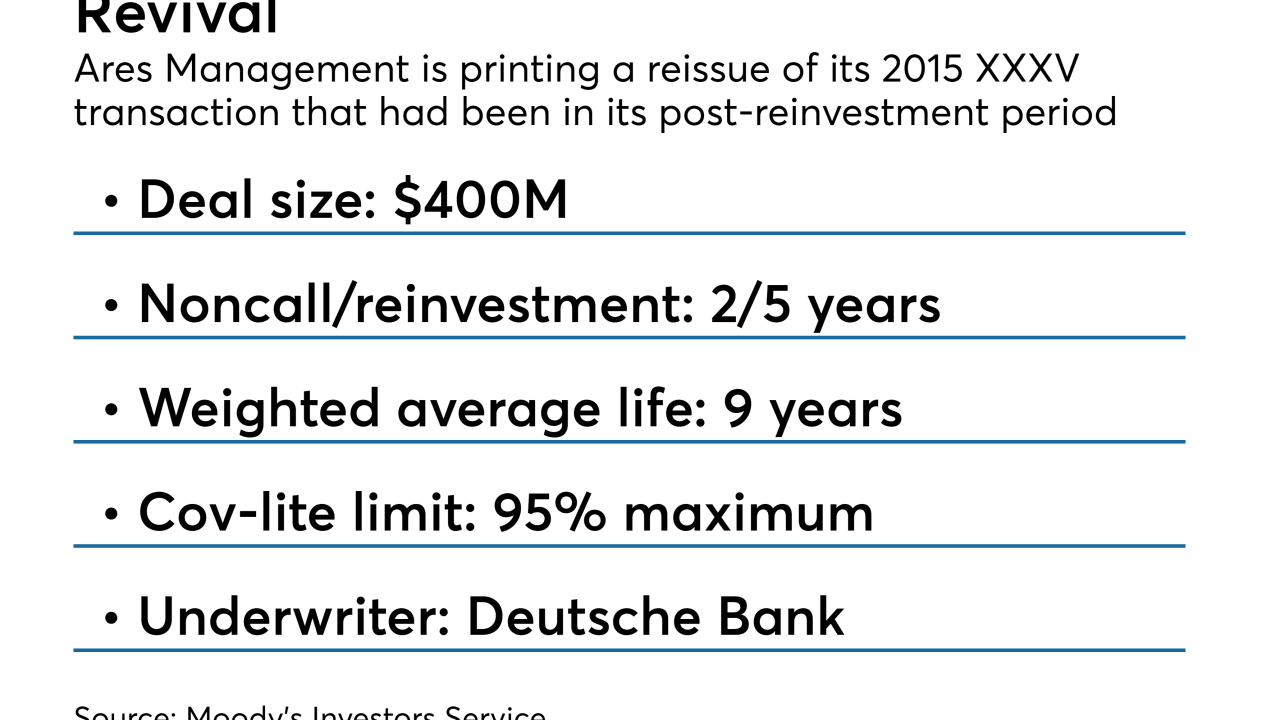

The $71.7 billion-asset manager is replacing notes from a 2015-vintage CLO that had been squeezed on asset quality prior to its October 2017 post-reinvestment period.

June 12 -

The $52 billion in year-to-date volume in resets of collateralized loan obligations is nearly outpacing new-paper issuance of $53.5 billion, reports LPC.

June 11 -

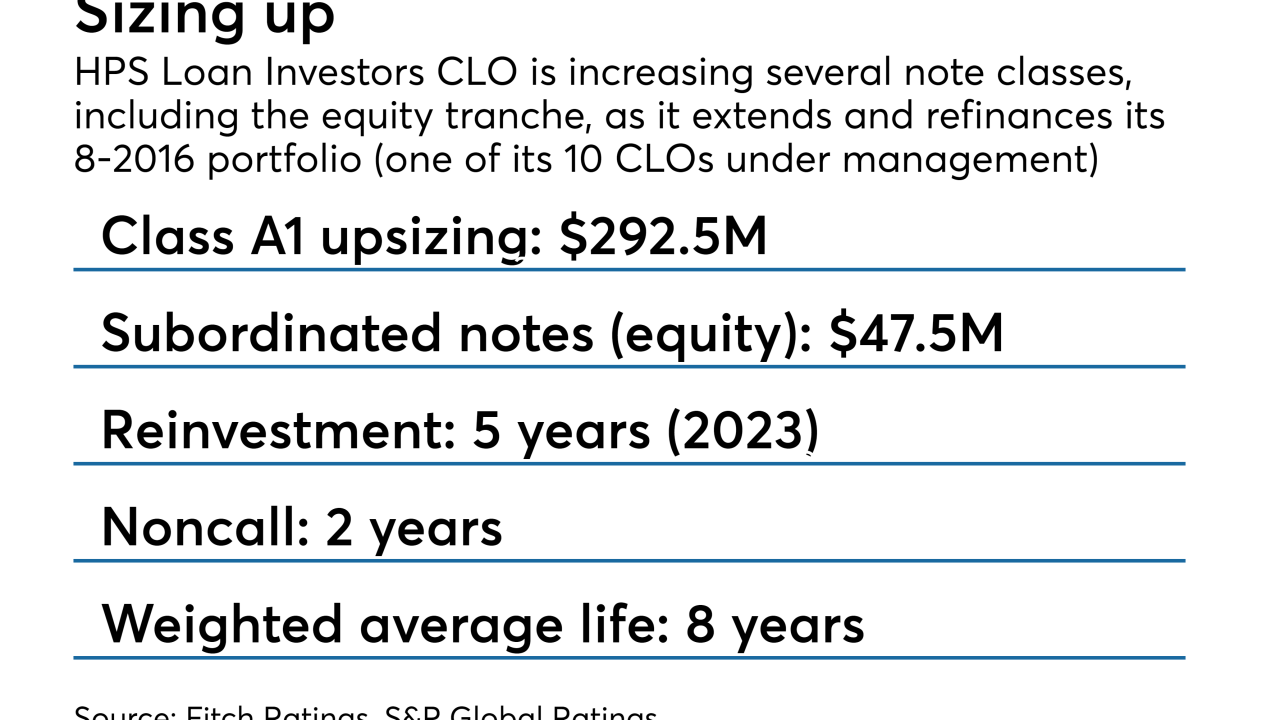

The new notes are not being distributed proportionally across the capital stack, however; instead the refinancing will result in slightly higher subordination for the senior, triple-A-rated Class A notes.

June 8 -

Changes that federal regulators are contemplating to the Volcker Rule could pave the way for CLOs to resume investing in high yield bonds, which they currently cannot do without putting themselves off limits to banks.

June 6 -

The volume of "true" new-issue CLOs (excluding reissued deals of existing collateralized loan portfolios) have declined for four consecutive months after February's high-water 2018 mark of $14.7 billion. But JPMorgan maintains its $115 billion-$130 billion annualized forecast.

June 6 -

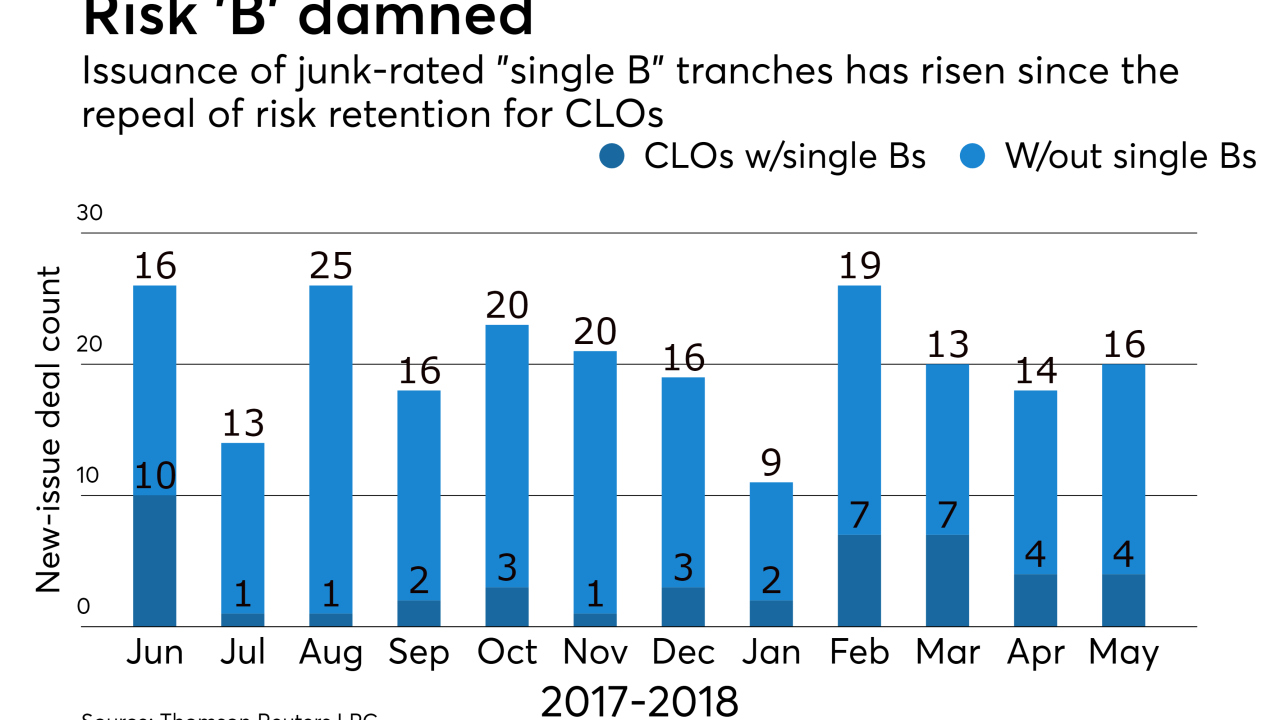

Exempting CLOs from “skin in the game” rules allows managers to unload more of the risk in these transaction; increasingly, they are doing this by issuing a second tranche of speculative- grade notes.

June 5 -

Default risks in retail and media leveraged loans have also risen to the forefront of CLO manager concerns, which a few years ago were centered on oil and gas exposure.

May 24 -

Despite concerns about credit quality, the only constraints on new issuance appear to be the supply of loan collateral and the capacity of warehouse facilities and rating agencies.

May 24 -

Issuance is strong and defaults remain low; yet CLO market participants are concerned about heavy debt loads of the companies they invest in, as well as the lack of investor protections.

May 23 -

Sean Solis has been a partner at Dechert since 2014, advising collateralized loan obligation managers and arrangers through the hoops on U.S. and European risk-retention regulations.

May 21 -

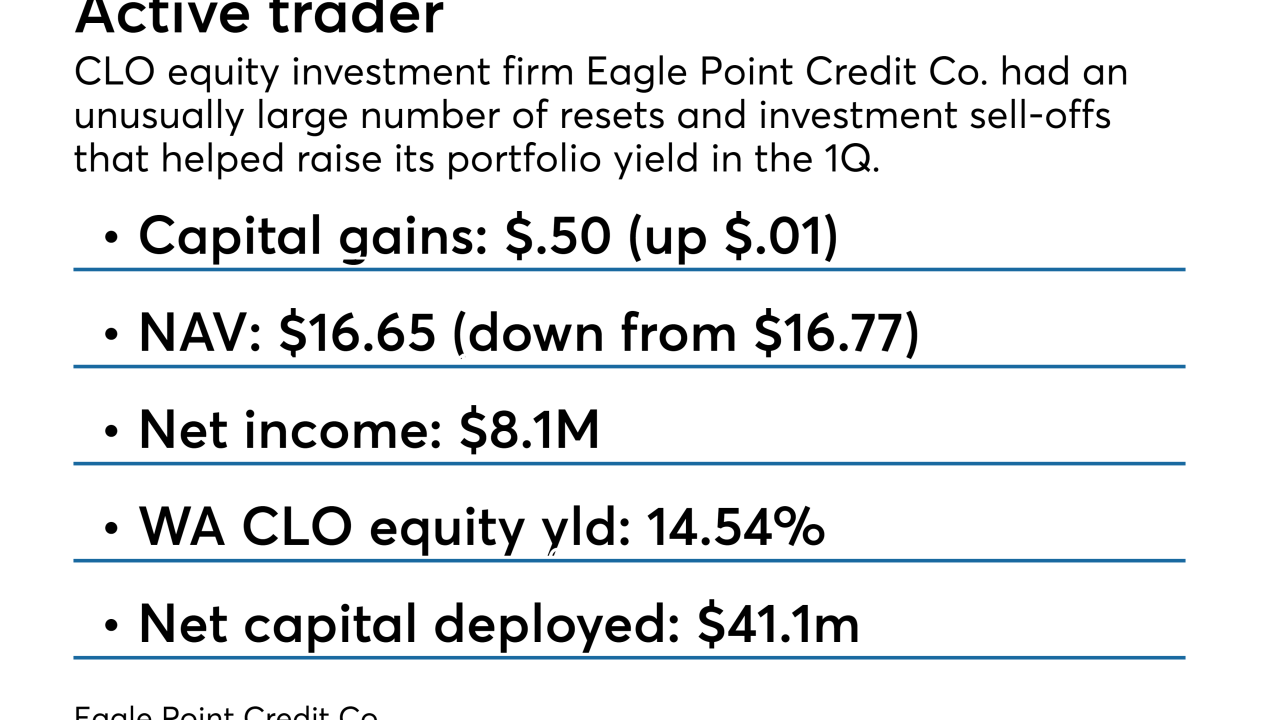

The closed-end fund, a major investor in CLO equity. directed resets of four deals that it controls in the first quarter; this helped end a yearlong slide in its weighted average portfolio yield.

May 18 -

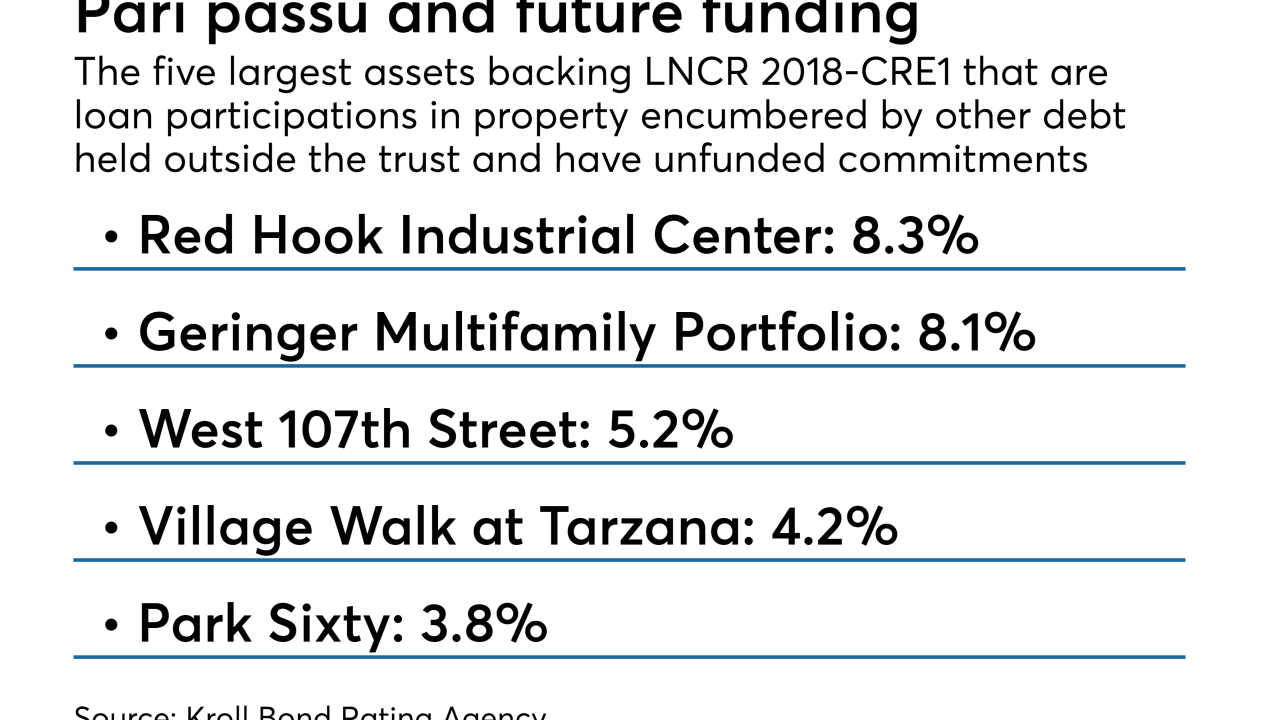

The commercial real estate lender, which is controlled by Canadian and Singapore sovereign wealth funds, included some unusual features in the deal, such as a two-year revolving period.

May 17 -

According to Morgan Stanley, seven of 15 new European CLOs in the pipeline are debut or re-entry deals involving U.S. asset managers.

May 16 -

The average AAA note coupon of 103 basis points above Libor widened from 98.4 in March, which had been the tightest CLO spread level in approximately five years.

May 8 -

“We’re comforted by the fact our position in the market is so strong, and our ability to gain [loan] allocation is quite important," co-CEO Kewsong Lee says.

May 2 -

After the second-busiest quarter for primary European CLO issuance to start 2018, a two-week April lull in the market was ended with deal pricings by Intermediate Capital and Investcorp.

April 16 -

Jay Huang, a longtime Citigroup veteran who joined in January, is developing a high-tech trading-desk operation to enhance the company's portfolio of CLO investments.

April 16 -

It is backed by $499.8 million of trust preferred securities and subordinated debt issued by 63 banks and $380 million of TruPS and surplus notes issued by four insurance companies.

April 13 -

The total volume of CLO refinancings for the month to date has reachd $11.3 billion, as managers continue to take advantage of the repeal of skin-in-the-game rules for this asset class.

April 13 -

With no more concerns about triggering risk retention on its large pile of older deals, Blackstone is dusting off CLO portfolios that have long been eligible for a refi makeover.

April 11