-

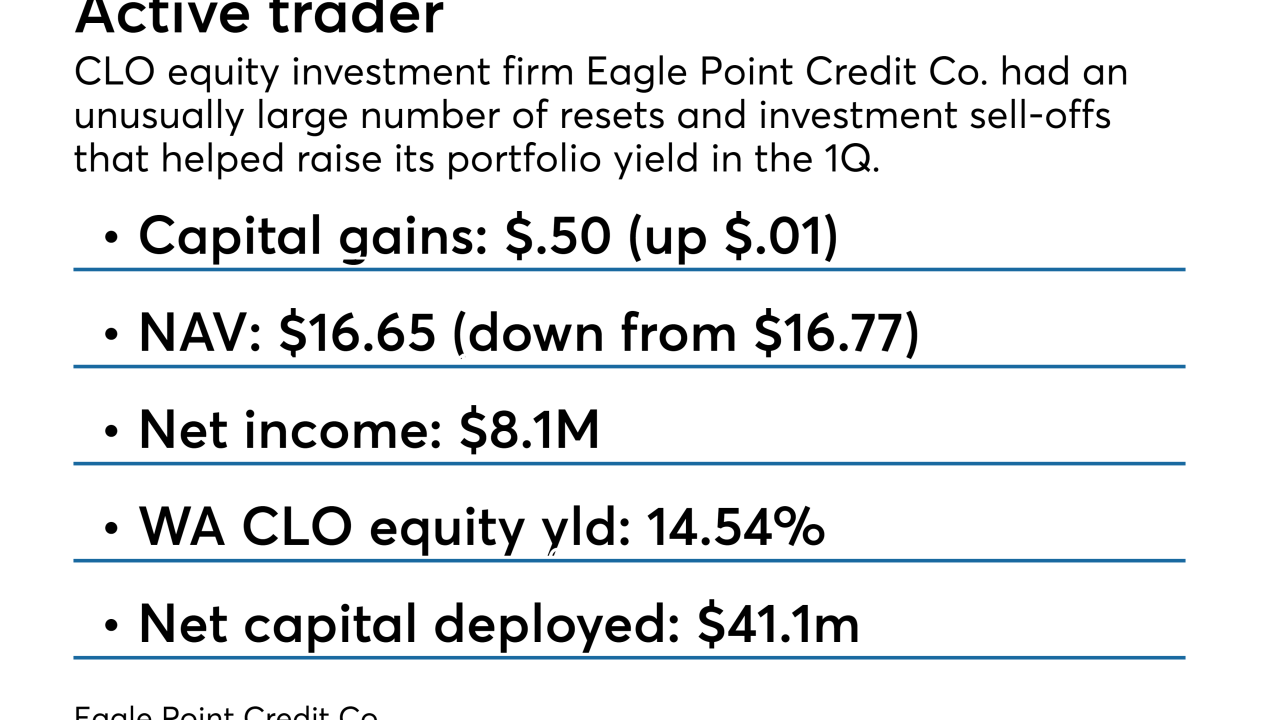

The closed-end fund, a major investor in CLO equity. directed resets of four deals that it controls in the first quarter; this helped end a yearlong slide in its weighted average portfolio yield.

May 18 -

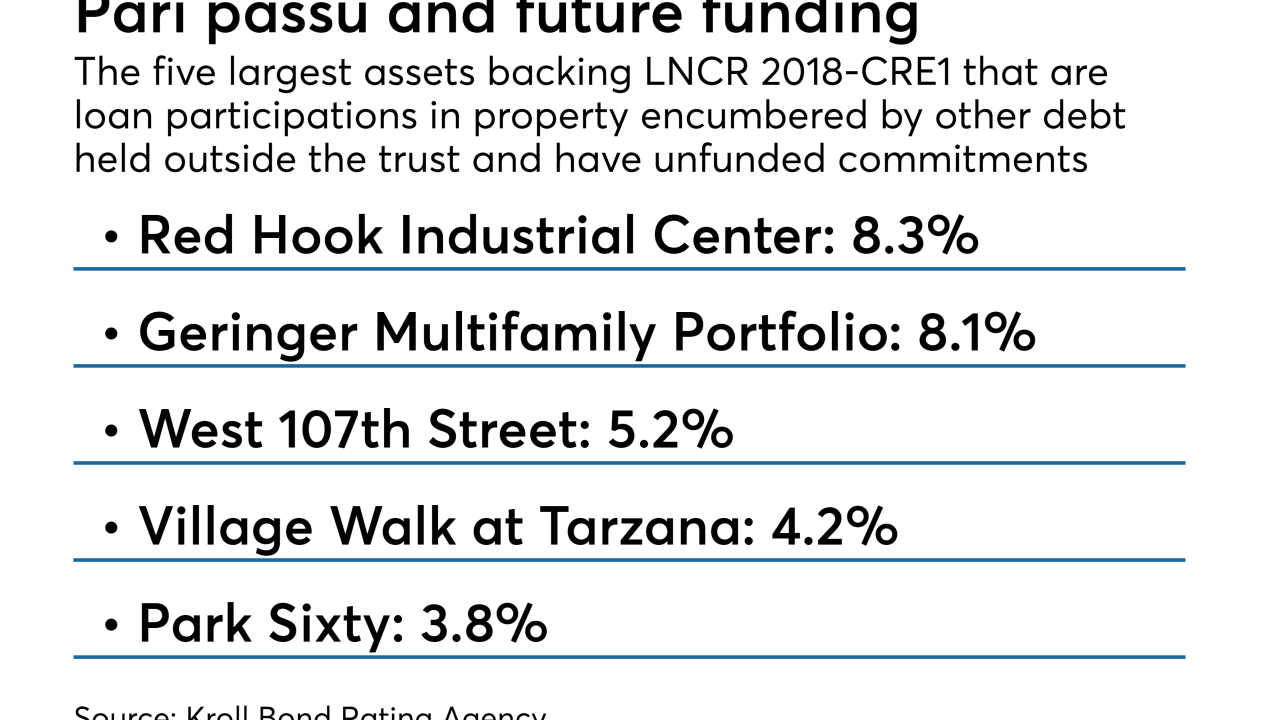

The commercial real estate lender, which is controlled by Canadian and Singapore sovereign wealth funds, included some unusual features in the deal, such as a two-year revolving period.

May 17 -

According to Morgan Stanley, seven of 15 new European CLOs in the pipeline are debut or re-entry deals involving U.S. asset managers.

May 16 -

The average AAA note coupon of 103 basis points above Libor widened from 98.4 in March, which had been the tightest CLO spread level in approximately five years.

May 8 -

“We’re comforted by the fact our position in the market is so strong, and our ability to gain [loan] allocation is quite important," co-CEO Kewsong Lee says.

May 2 -

After the second-busiest quarter for primary European CLO issuance to start 2018, a two-week April lull in the market was ended with deal pricings by Intermediate Capital and Investcorp.

April 16 -

Jay Huang, a longtime Citigroup veteran who joined in January, is developing a high-tech trading-desk operation to enhance the company's portfolio of CLO investments.

April 16 -

It is backed by $499.8 million of trust preferred securities and subordinated debt issued by 63 banks and $380 million of TruPS and surplus notes issued by four insurance companies.

April 13 -

The total volume of CLO refinancings for the month to date has reachd $11.3 billion, as managers continue to take advantage of the repeal of skin-in-the-game rules for this asset class.

April 13 -

With no more concerns about triggering risk retention on its large pile of older deals, Blackstone is dusting off CLO portfolios that have long been eligible for a refi makeover.

April 11 -

The LSTA has declared the era of risk retention for open-market CLOs is over, pending an unlikely U.S. Supreme Court intervention. "We believe we can exhale," the trade group said in a statement.

April 6 -

The $31.7 billion in collateralized loan obligation deals priced year-to-date is the most in a first quarter in the post-crisis era.

April 4 -

Fortress Investment Group's $702.8 portfolio of SME loans is the first since Softbank Group acquired Fortress in December.

April 3 -

Managers are regaining the ability to amend older deals that they previously locked down to maintain risk-retention exemptions.

April 2 -

The U.S. CLO manager breaks the ice with its first euro-denominated deal, which priced Friday and will close in May when it is about 75% ramped up.

March 27 -

The deadline to seek an en banc hearing has now passed, and skin-in-the-game rules for collateralized loan obligations could be off the books by April 2.

March 27 -

The deadline to appeal the rollback of risk-retention requirements for CLO managers expired at midnight last night, but Voya Alternative Asset Management is not taking advantage.

March 26 -

An affiliate of the private-equity firm Angel Oak is packaging bank-issued sub debt to minimize risk for bondholders. It recently completed its first securitization and has plans to issue two deals a year.

March 26 -

The money manager is preparing to refinance a $400 million deal originally printed in March 2016 that is currently grandfathered from risk retention rules - without bringing the deal into compliance.

March 21 -

The €413.5 million BlackRock European CLO V is the fourth euro-denominated CLO to launch this month, and asset manager's first since BlackRock Euro CLO IV priced in November.

March 20