-

Mortgage performance in November was improving, coming close to crossing a key threshold for pandemic-era recovery, but Omicron raises questions about whether that trend will continue.

January 3 -

The Alabama bank is buying Clearsight Advisors to add to its booming capital markets division.

December 17 -

Under the Federal Housing Finance Agency rule, the GSEs would need to lay out how levels will change under a variety of stress tests, including required ratios separately proposed for amendment.

December 16 -

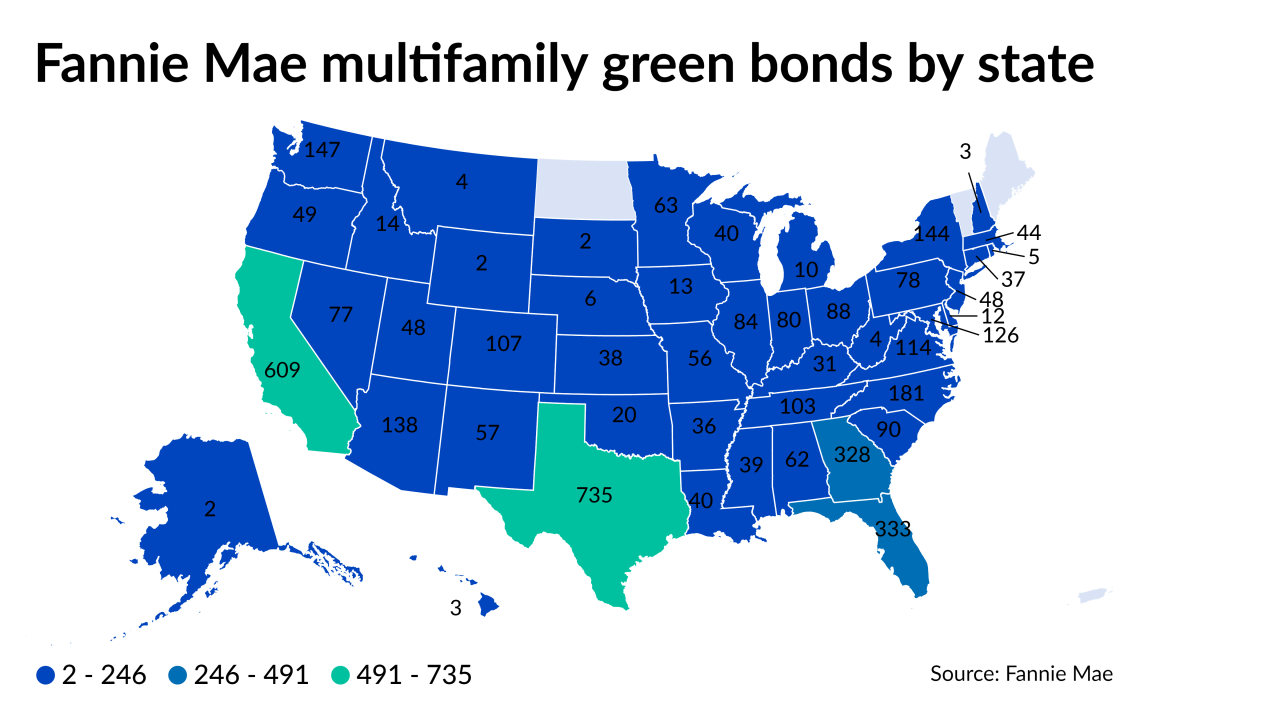

New securitizations of mortgages on energy-efficient rental housing totalled $12.7 billion during the first 11 months of this year, suggesting 2021’s total will come close to matching 2020’s $13 billion.

December 8 -

Acting Federal Housing Finance Agency Director Sandra Thompson and the Housing Policy Council say the new amounts are not good for affordable housing.

November 30 -

However, capacity issues, the suspension of the government-sponsored enterprise purchase caps and higher conforming limits all could affect activity, KBRA said.

November 22 -

However, it remains 30% tighter than pre-pandemic levels, according to the Mortgage Bankers Association.

November 9 -

Acting FHFA Director Sandra Thompson's decision to act immediately rather than taking the time to examine the impact likely harmed private-label securitizations in the short term, but issuance is still on course for a record year.

November 9 -

The company also locked a record $4.7 billion in jumbo loans and significantly increased its business purpose lending from a year ago as its revenue mix shifted toward its taxable subsidiary.

October 28 -

Button Finance intends to use the capital to develop its underwriting platform and increase hiring.

October 25