-

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

The deal for the Salt Lake City-based home improvement lender, which Home Depot tried to acquire more than a decade ago, is part of a larger effort by Regions Financial to diversify its home lending business.

June 8 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

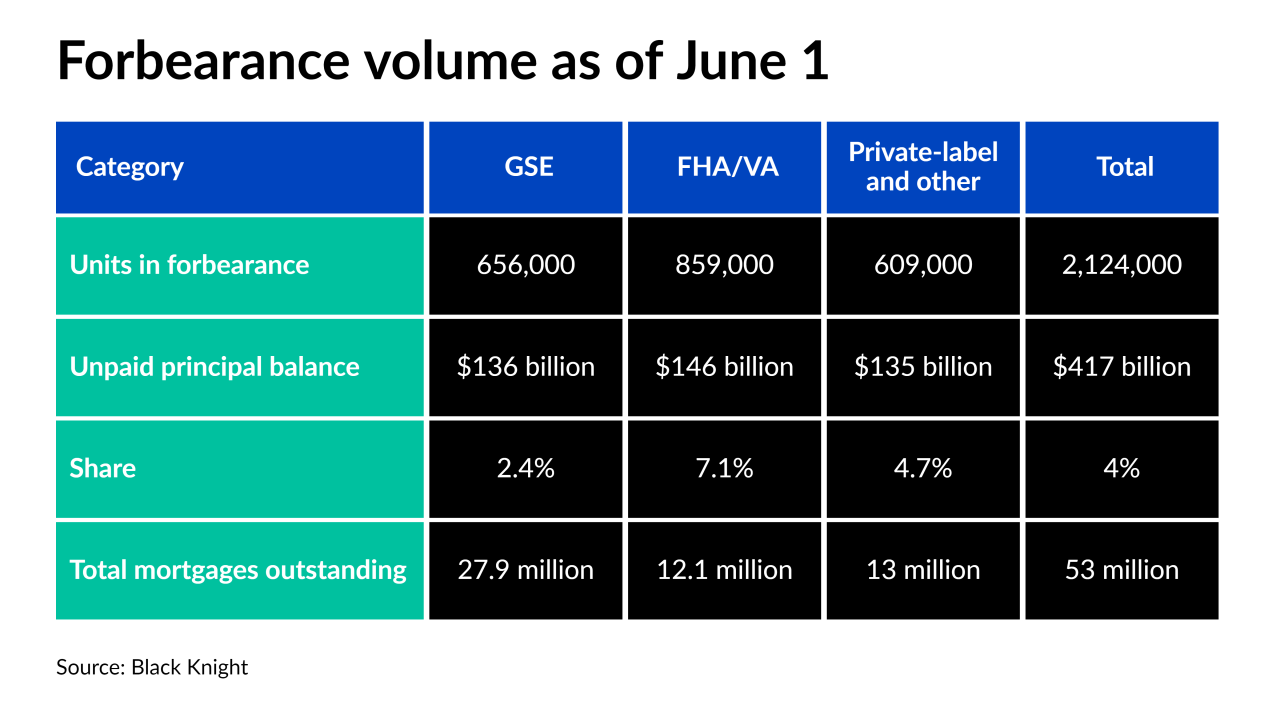

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

A pool of subprime auto loans, new and used, and approved with a heavily automated, technology driven and multi-step process underpin a $559 million deal.

June 3 -

After a colossally “brutal” period in the beginning of the COVID-19 outbreak last year, a recent report from Kroll Bond Rating Agency noted that business development corporations mostly rebounded by year-end 2020 to bring a sense of renewed optimism into the alternative-lending space.

May 25 -

Investment Management Corp. of Ontario is investing $400 million to a customized portfolio, with the goal of capitalizing on Are’s all-weather approach, taking advantage of opportunistic dislocations and market inefficiencies. The remaining $100 million will be allocated to the flagship Ares Pathfinder fund.

May 21 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Carvana Auto Receivables Trust 2021-N2 is the used-car retailer's ninth securitization since 2019, and the third to include a pool exclusively made of non-prime loans.

May 19 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19 -

The $1 billion bond, which follows similar issuances by Citigroup, JPMorgan Chase, Bank of America and Truist Financial, gives a big role to broker-dealers owned by minorities, women and disabled veterans.

May 19 -

DMB Financial, a debt-settlement firm near Boston that operates in 24 states, agreed to pay $5.4 million in restitution to consumers for allegedly charging upfront fees before providing any service, the CFPB said.

May 17 -

Avant Loans Funding Trust 2021-REV1 is a $200 million note offering backed by loans underwritten through its Avant platform. The $500 million OneMain Financial Issuance Trust 2021-1 is the first deal of the year for OneMain, which has previously issued 23 consumer loan securitizations and five auto-loan ABS deals.

May 17 -

This week, Moody’s Investors Service projected elevated credit-loss expectations for a new subprime auto-loan securitization from Veros Credit, even though the new deal has several improved credit metrics compared to the company’s prior ABS offering in March 2020.

May 14 -

The legislation, which the chamber passed Thursday, would ban collectors from making threatening statements to military service members and prevent credit bureaus from including debt arising from certain medical procedures.

May 13 -

Raising the capital gains tax and code changes could have more of an impact on the public debt market than rising interest rates, according to a panelist at the Urban Land Institute's Spring event.

May 13 -

Some worry the Senate’s rejection of the OCC rule hampers efforts to clarify legal standards for banks selling loans to fintechs.

May 12 -

If the lender's trust opts to upsize its second bond offering of 2021, the $2 billion-plus transaction would be Santander's biggest in the post-crisis era.

May 12 -

The total number of loans in this category dropped 11 basis points from week to week according to the Mortgage Bankers Association. Meanwhile, the amount of unpaid balance in forbearance dropped almost 23% since the start of the year, a separate report from Black Knight found.

May 10 -

The bonds backed by the primarily non-prime unsecured receivables have preliminary ratings of BBB (low) from DBRS Morningstar and BBB- from Kroll Bond Rating Agency.

May 10