-

A congressional resolution that invalidates the regulation issued last fall by the Office of the Comptroller of the Currency would help regulators crack down on so-called rent-a-bank schemes that promote predatory lending, the president said before signing the measure.

July 1 -

Kikoff, whose investors include Golden State Warriors' star Stephen Curry, provides applicants with a no-fee $500 revolving line of credit they can use to purchase personal finance books and courses from its online store. The company then reports this payment activity to some credit bureaus.

June 30 -

Goldman Sachs Group hunts for a new office campus in Dallas that could become the Wall Street bank’s largest U.S. presence outside of Manhattan headquarters.

June 29 -

Democrats are pushing for a public-sector alternative to the three main credit bureaus, but Republicans argue that the government is ill-equipped to safely handle consumer data and produce accurate reports.

June 29 -

Growing CRE mortgage volumes raised the bar for the coming year despite lingering concerns, according to the CRE Finance Council.

June 23 -

The fintech specializes in lending to dentists, veterinarians and other solo providers looking to grow or establish their own practice.

June 22 -

Cannabis, though still illegal at the federal level, continues to inch into the financial mainstream. Small credit unions and lenders as large as Valley National and East West have moved beyond just taking deposits from marijuana companies.

June 21 -

A growing number of companies like Klarna, Sezzle and Circle let consumers split large purchases into smaller transactions paid over time. But they say they need to offer more than one product to set themselves apart and build customer loyalty.

June 18 -

Executives at Citizens Financial and Regions Financial said they plan to make policy changes that will reduce their reliance on the controversial but already dwindling charges.

June 15 -

Fears of widespread credit losses have largely subsided, but demand for new commercial real estate loans remains lackluster because many companies are sitting on so much cash they don’t need to borrow. Meanwhile, competition from private equity groups and other nonbank lenders is escalating.

June 14 -

Meanwhile, National MI has been increasing its new insurance written by slightly widening its credit standards.

June 11 -

The deal for the Salt Lake City-based home improvement lender, which Home Depot tried to acquire more than a decade ago, is part of a larger effort by Regions Financial to diversify its home lending business.

June 8 -

But March's overall late payment rate was 1.3 percentage points higher than one year ago, while the 90-day-plus rate was 2.3 percentage points higher.

June 8 -

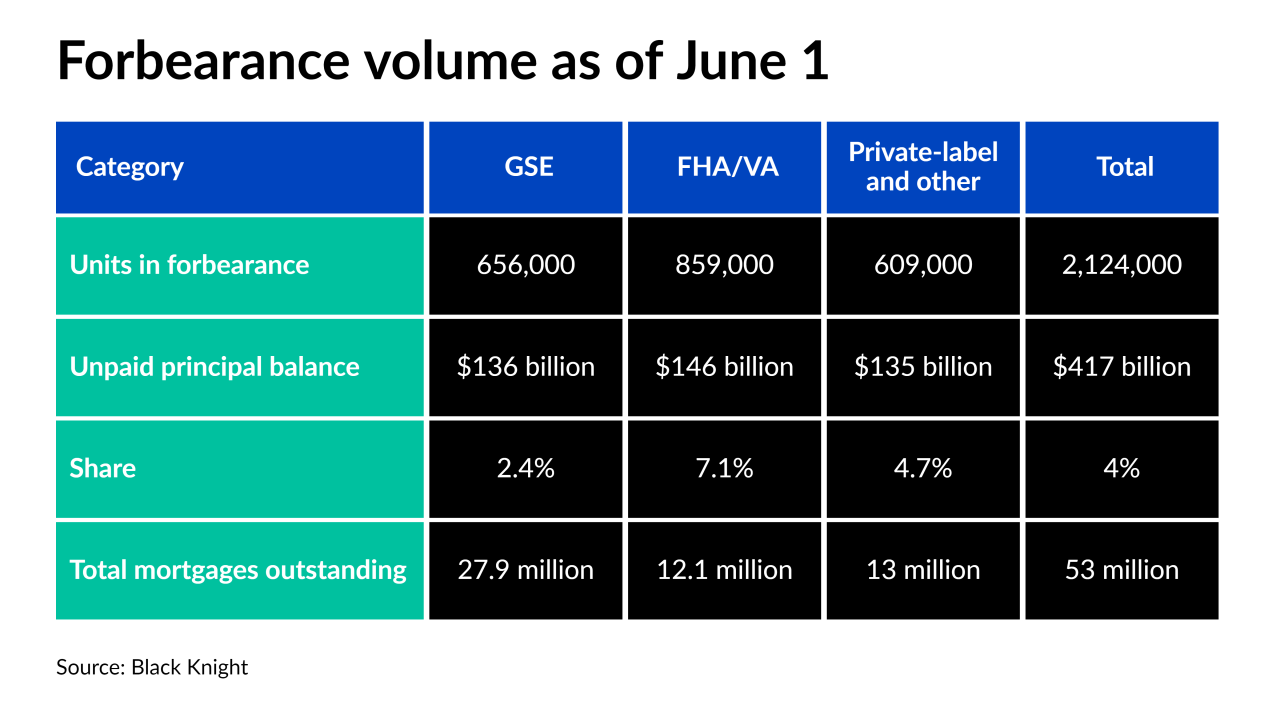

The four-week high in forbearance exits also helped drive the considerable drop in plans, according to Black Knight.

June 4 -

A pool of subprime auto loans, new and used, and approved with a heavily automated, technology driven and multi-step process underpin a $559 million deal.

June 3 -

After a colossally “brutal” period in the beginning of the COVID-19 outbreak last year, a recent report from Kroll Bond Rating Agency noted that business development corporations mostly rebounded by year-end 2020 to bring a sense of renewed optimism into the alternative-lending space.

May 25 -

Investment Management Corp. of Ontario is investing $400 million to a customized portfolio, with the goal of capitalizing on Are’s all-weather approach, taking advantage of opportunistic dislocations and market inefficiencies. The remaining $100 million will be allocated to the flagship Ares Pathfinder fund.

May 21 -

For the first time since the pandemic began, the share of borrowers who are 30 days or more late on their payment is below 5%, Black Knight found.

May 20 -

Carvana Auto Receivables Trust 2021-N2 is the used-car retailer's ninth securitization since 2019, and the third to include a pool exclusively made of non-prime loans.

May 19 -

Only 0.9% of mortgage borrowers are currently at least 90 days delinquent. That figure could rise as high as 3.8% once pandemic-related deferrals lapse — still well below the 6% mark reached after the Great Recession, according to research by the New York Fed.

May 19