-

CarMax, BMW, Santander and Credit Acceptance Corp. all launched deals Thursday; they add to the $35 billion in prime auto, $12.31 billion in prime lease, and $19.4 billion in subprime auto loan ABS so far this year.

October 12 -

Over 80% of the cars are diesel-engine vehicles, bringing potential volatility to the portfolio cash flows given the public debate over potential panning such cars in several European urban centers.

October 11 -

A report released Friday calls risk retention "an imprecise mechanism" for encouraging the alignment of interest between sponsors and investors. It recommends creating loan-specific requirements under which managers would receive relief.

October 6 -

The proportion of collateral that will be acquired after the CPS Auto Receivables Trust 2017-D closes is 33.3%, or $66 million, from the 29.7% level from the sponsor's prior deal in July.

October 6 -

The French specialty lender, owned by a consortium of mutual insurers, is pooling over 54,000 loans it originated and services for clients of its shareholders.

October 4 -

BMO is part of a trend-setting 2017 parade of Canadian auto lenders pooling their loan, lease and dealer floorplan receivables to the U.S. investor market.

October 3 -

Nissan's second U.S. lease-securitization of 2017 pools more than 71,000 contracts with $1.5 billion outstanding on cars, SUVs and cross-overs. Delinquencies remain low, but residual values are growing volatile.

October 2 -

Ford Motor Credit's second master trust issuance funding its dealer inventory financing has pushed floorplan ABS industry-wide past $8.5 billion, the busiest year for the asset class since 2014.

October 1 -

GM Financial is following similar actions by American Honda, Santander, Fifth Third and USAA to limit Texas exposure in securitizations, but the captive-finance lender has extended the exclusion to Florida loans as well.

September 28 -

Bank of Nova Scota's third overall deal in its brief auto-loan securitization history will feature $500m in U.S.-dollar denominated bonds.

September 25 -

The loans have an average balance of €18.5k (US$22.1k) and went to 39,698 borrowers; they are secured by a pool of new (46.8%) and used (53.2%) cars, according to Moody's Investors Service.

September 24 -

Credit enhancement for the senior, triple-A-rated notes is in line with recent Honda transactions, but the pool of collateral is concentrated (12%) in Texas and Florida, making it vulnerable to economic disruption from hurricanes.

September 21 -

HELOCs make up approximately 11.51% of the collateral; 22.5% of the HELOC borrowers are currently eligible to make draws up to their credit limit.

September 21 -

The San Francisco-based bank's first prime auto loan securitization in two years includes a sizable portion of loans (60% of the pool) with terms exceeding six years.

September 20 -

The €684.8 million transaction is backed primarily by new-car leases to German prime borrowers. It's the 21st German securitization by FCE Bank, Ford's UK-based captive finance arm.

September 13 -

The rental car giant is more dependent than ever on asset-backed financing after being downgraded in May, making high yield bond issuance prohibitively expensive.

September 12 -

The federal savings institution is pooling more than 33,000 well-seasoned auto loans to its armed services-linked membership base.

September 10 -

The credit quality of the collateral is lower, by several metrics, than that of Exeter's prior deal; however, S&P Global expects cumulative net losses to be in the same range, from 20.1%-21.1%.

September 7 -

Ford Motor Credit, GM Financial and Fifth Third Bancorp are marketing a combined $3.4 billion in prime auto loan and lease asset-backed securities, according to presale reports published Thursday.

September 7 -

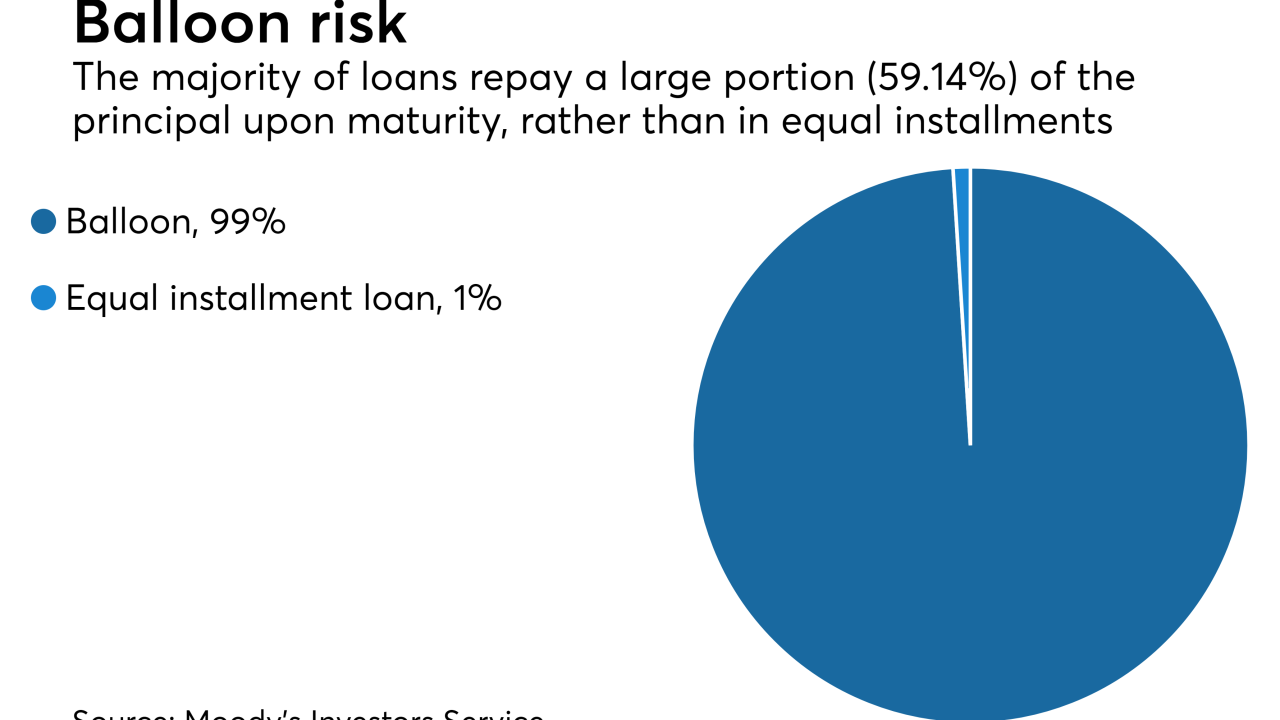

S&P says exclusion of the value of "personal contract purchase" balloon payments from Santander's Motor 2017-2 transaction will benefit the deal through excess spread and recoveries from contract defaults.

September 4