-

Despite a steep drop in average FICO and increase in extended-term loans, DriveTime is shaving overcollateralization levels thanks in part to improved performance from its outstanding securitization portfolios.

June 1 -

Fiat Chrysler is expected to announce Friday that it will establish its own captive finance unit in the U.S. The move could be bad news for its lending partners.

May 30 -

The Dallas-based lender, a unit of the global banking giant Banco Santander, was able to lower credit enhancement on the senior notes to 63.55% from 65.25% on the previous deal in February.

May 10 -

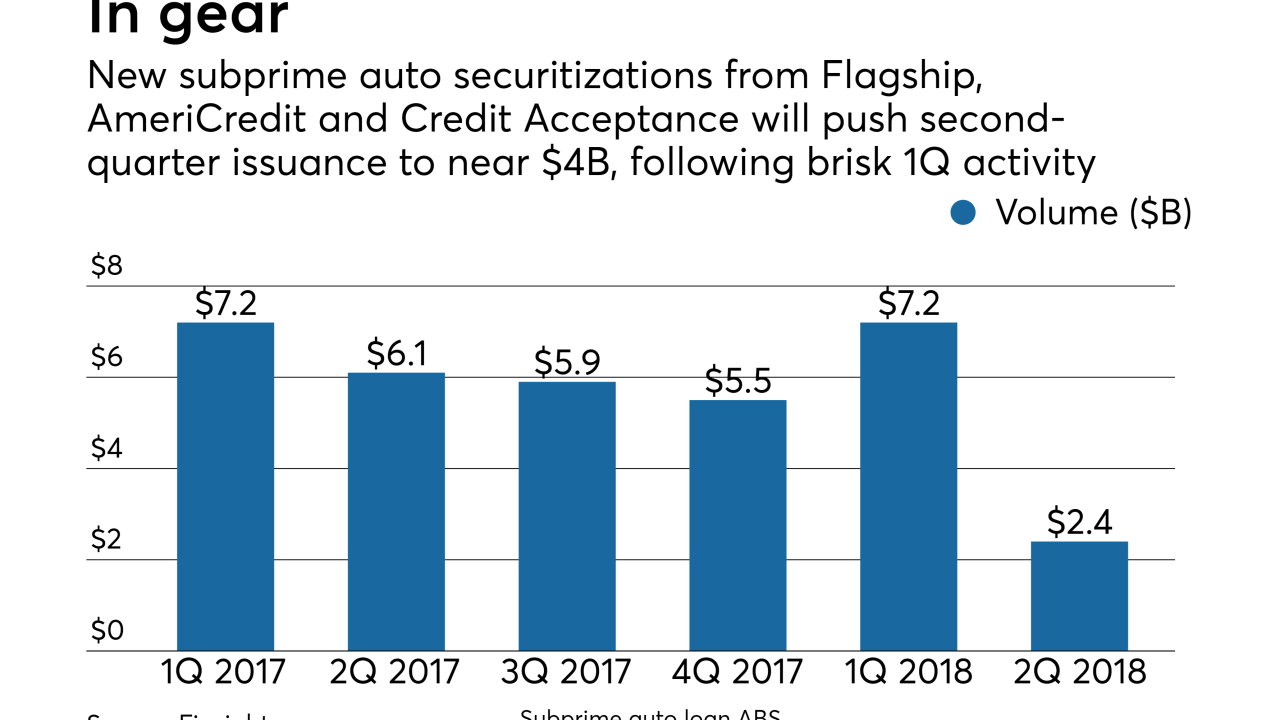

AmeriCredit returns to securitization for the first time since November with a $1.1 billion deal, while Flagship's $223 million deal, its second of 2018, takes a step back in collateral quality.

May 9 -

The senior tranche of Credit Acceptance Auto Loan Trust 2018-2 benefits from initial credit enhancement of 51.61%, up from 49.93% in a February deal; it comes from additional subordination.

May 9 -

RAC King (d/b/a American Car Center) has expanded rapidly since being acquired in a 2016 leveraged buyout; now it's bundling most of its portfolio into collateral for bonds.

April 25 -

The $185 million transaction features a higher exposure to borrowers entering bankruptcy than the sponsor's 2016 deal; it's also more seasoned, since it recycles 2014 collateral.

April 19 -

Higher LTVs and fewer low-risk, new-car loans trumped the recent decline in managed-portfolio delinquencies and improved ABS performance since 2015.

April 16 -

The sponsor is pooling what a majority of customers are buying these days, but future gas-price shocks could depressed used-vehicle prices on the lower MPG models.

April 12 -

The transaction is backed by 6,857 loans with a total balance of $835 million, or roughly 13% of the $6.4 billion of commercial vehicle and equipment loans in Mercedes-Benz Financial Services USA.

March 16 -

The performance of outstanding transactions issued via the Capital Auto Receivables Trust platform is weakening, so rating agencies are demanding additional investor protections.

March 8 -

Credit enhancement on the senior notes has risen to 36.25% from 28.7% to account for higher expected losses on the collateral; Kroll's base-case range is for 6.75% to 8.75% over the life of the deal.

March 8 -

DriveTime's improving loss performance in recent securitizations allowed it to relax the enhancement levels on its first securitization of the year.

March 2 -

The transaction is the second this year involving Santander's Chrysler Capital preferred-lender unit; in January Santander sold bonds on its first-ever deal backed by Fiat Chrysler leases.

March 1 -

Despite riskier terms, rising delinquencies and falling used car values, investors keep buying bonds backed by prime and subprime auto loans and leases.

February 28 -

Credit support on the senior tranche of the $800 million transaction is 19.25%, up 250 basis points on the comparable tranche of the sponsor's previous deal to offset the impact of falling used car prices.

February 27 -

It's deep and liquid, and spreads are tight. To many, a deal with a few idiosyncratic risks — not to mention cool factor — just offers a chance to pick up a little extra yield.

February 2 -

Over 94% of the collateral pool consists of diesel-engine vehicles, even though diesel cars have had waning interest among French drivers in the past decade.

February 1 -

The Detroit company recorded an 11% increase in car loans and leases originated during the fourth quarter, as well as a jump in yields. Ally appears to be benefiting from Wells Fargo's substantial retrenchment in auto lending.

January 30 -

The single-B rated company is facing a large cash requirement as it ramps up production of its Model 3; but leases backed by electric vehicles pose additional risks for investors in asset-backeds.

January 26