-

The rating agency is now considering lowering its BBB rating on the class B notes. The rating agency also downgraded the class C notes issued in the deal, for a second time, to CC from CCC+.

November 20 -

Flagship, Santander Consumer USA and AmeriCredit are printing $2.3 billion in new notes backed by subprime auto-loan originations.

November 8 -

The deal comes a year after the captive finance company began excluding low-FICO loans from its primary auto loan ABS platform.

October 31 -

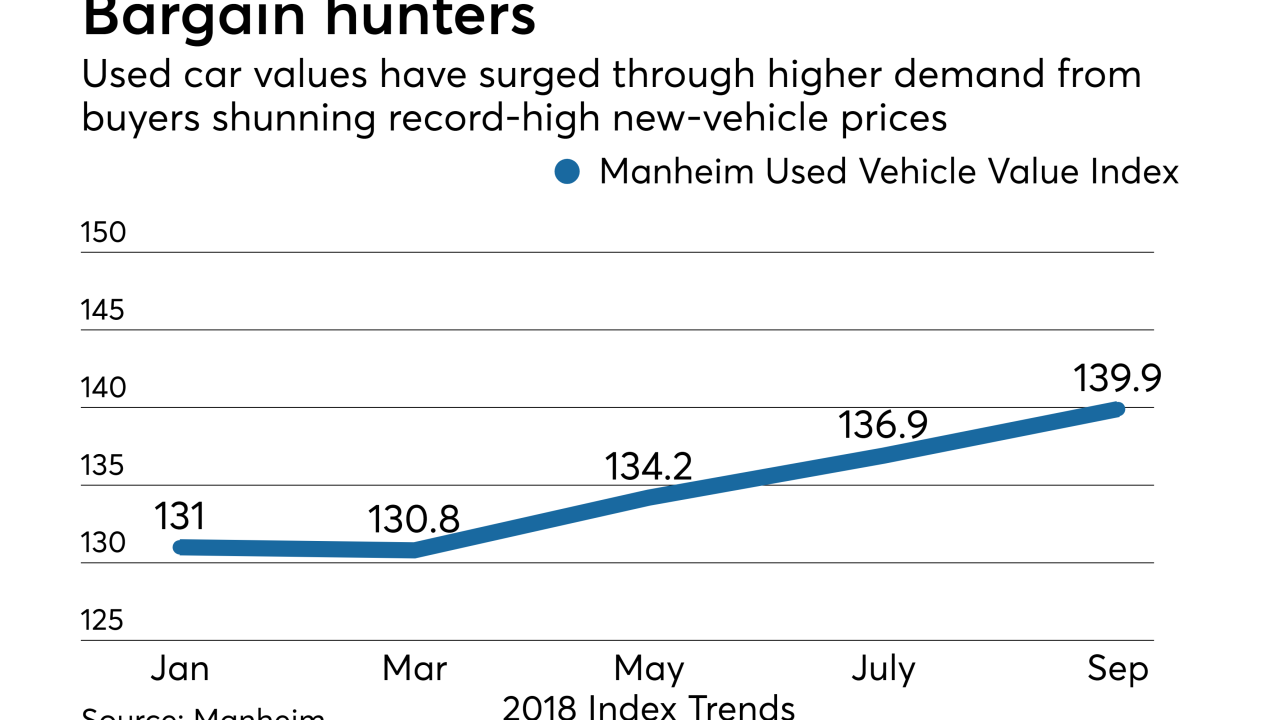

Sales of older vehicles are on the rise and prices are headed back up, so there's more collateral available and it is also performing better.

October 29 -

Turbo Finance 8 is a £375.5M static transaction that includes both hire purchase loan contracts and personal contract purchase, lease-like arrangements.

October 24 -

The credit quality of loans backing the Cailfornia-based lender's $183 million securitization is better than that of its inaugural deal, which was only rated 'A' by Kroll.

October 18 -

The fifth SDART deal of the year benefits from the same improvement in credit quality as other recent transactions from the platform.

October 11 -

Consumer Portfolio Services' fourth auto-loan securitization of the year has a 3.97% share of loans previously assigned to CPS asset-backed portfolios, compared to an 11.97% share in its last transaction.

October 4 -

DriveTime is making less-risky loans under a $750 million contract purchase agreement with Ally Financial; it appears that the sponsor is also funding some of this lending through its own securitization platform.

October 4 -

Auto loan securitization has been in overdrive this year, even if the global tussle over import tariffs is injecting a note of caution.

September 24