-

That's unprecedented; previous series from Ford Motor Credit's master trust financing dealer inventories limited non-amortizing schedules to three to seven years.

December 14 -

It’s a trend that bears watching, particularly for holders of the riskiest securities issued in subprime auto securitizations, according to S&P Global Ratings.

December 3 -

The rating agency is now considering lowering its BBB rating on the class B notes. The rating agency also downgraded the class C notes issued in the deal, for a second time, to CC from CCC+.

November 20 -

Flagship, Santander Consumer USA and AmeriCredit are printing $2.3 billion in new notes backed by subprime auto-loan originations.

November 8 -

The deal comes a year after the captive finance company began excluding low-FICO loans from its primary auto loan ABS platform.

October 31 -

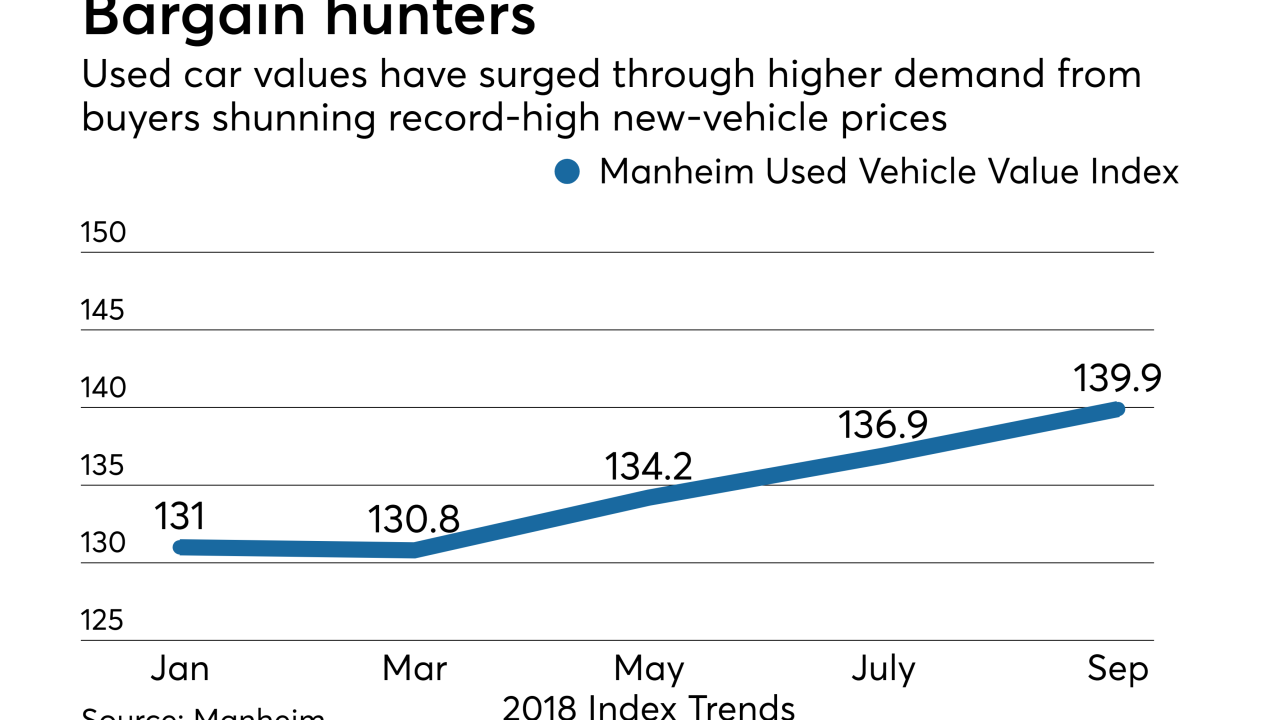

Sales of older vehicles are on the rise and prices are headed back up, so there's more collateral available and it is also performing better.

October 29 -

Turbo Finance 8 is a £375.5M static transaction that includes both hire purchase loan contracts and personal contract purchase, lease-like arrangements.

October 24 -

The credit quality of loans backing the Cailfornia-based lender's $183 million securitization is better than that of its inaugural deal, which was only rated 'A' by Kroll.

October 18 -

The fifth SDART deal of the year benefits from the same improvement in credit quality as other recent transactions from the platform.

October 11 -

Consumer Portfolio Services' fourth auto-loan securitization of the year has a 3.97% share of loans previously assigned to CPS asset-backed portfolios, compared to an 11.97% share in its last transaction.

October 4 -

DriveTime is making less-risky loans under a $750 million contract purchase agreement with Ally Financial; it appears that the sponsor is also funding some of this lending through its own securitization platform.

October 4 -

Auto loan securitization has been in overdrive this year, even if the global tussle over import tariffs is injecting a note of caution.

September 24 -

Moody’s expects losses on Drive Auto Receivables Trust 2018-4 to reach 25% of the original balance over the life of the deal, down from 26% for its prior deal.

September 7 -

Investor appetite for deeply subordinated debt is increasing even as the industry starts to consolidate; problems at Honor Finance demonstrate the limits of relying on overcollateralization to offset losses.

September 6 -

About 8.5% of loans backing the $256.2 million transaction were reassigned from a 2015 deal; this boosted the weighted average seasoning to seven months from one month for ACA's prior deal.

September 5 -

S&P says extended term loans and "liberal" collection policies are pushing losses and amortization toward the tail end of some lenders' securitizations — making cross-comparing performance between lenders and an issuer's own outstanding vintage deals more difficult.

August 26 -

Westlake increased the size of all eight classes of notes by at least 37% as investor demand surges for subprime ABS paper

August 13 -

Westlake's $800 million offering features increased exposure to loans sourced through a relationship with Ally Bank; CAC's $398 million deal is notable for having less seasoned collateral.

August 9 -

Loans backing the $1.2 billion AmeriCredit Automobile Receivables Trust 2018-2 have the highest weighted average FICO score in the history of the platform.

August 2 -

The credit quality of the initial collateral pool is similar to that of United Auto Credit Corp.'s previous transaction, but the performance of the lender's managed portfolio of subprime loans is improving.

July 26