-

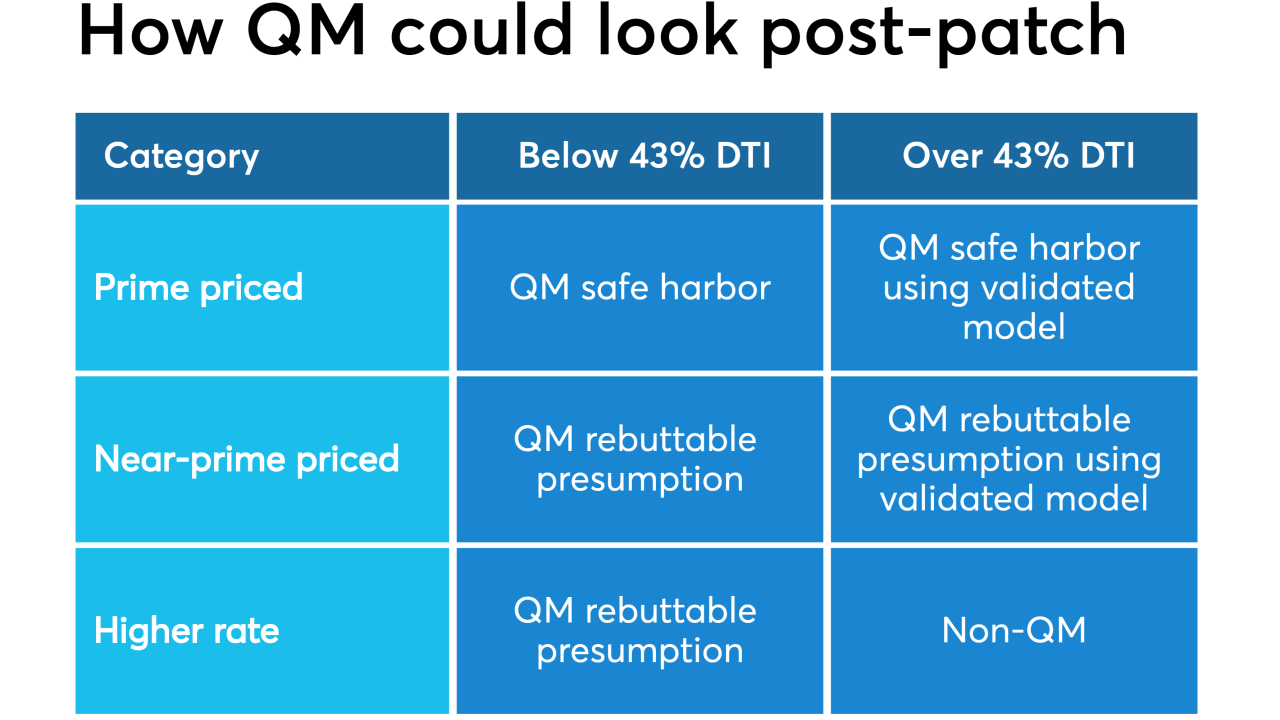

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

The unrated notes being issued by the FREMF 2019-KG01 Mortgage Trust are backed entirely by workforce housing loans for green-friendly upgrades of older apartment buildings that fulfill affordable housing needs in communities.

June 21 -

Freddie Mac is now offering to buy a new form of manufactured housing loan with terms similar to that of conventional mortgages from all eligible lenders, following a test run last year.

May 2 -

The Trump administration is cracking down on national affordable housing programs because of concern over growing risk to the government's almost $1.3 trillion portfolio of federally insured mortgages.

April 22 -

The administration official will serve a five-year term as Fannie Mae and Freddie Mac's chief regulator.

April 4 -

The Federal Housing Finance Agency in recent years has required Fannie Mae and Freddie Mac to contribute to the funds every March, but has yet to make a 2019 request. Housing groups see the delay as a troubling sign.

March 25 -

David Brickman will take the helm of the mortgage giant at a time of transformation in the mortgage market and housing finance policy.

March 21 -

There’s bipartisan consensus that the conservatorships of Fannie Mae and Freddie Mac are unsustainable, but that may not be enough for lawmakers to upend the current system.

March 19 -

The secretary of housing and urban development plans to "finish out this term" but wants to return to "the private sector because I think you have just as much influence, maybe more."

March 5 -

Industry observers will be closely monitoring Mark Calabria's testimony before the Senate Banking Committee on Thursday for hints about how the Trump administration plans to proceed on mortgage finance reform.

February 13