-

Industry observers will be closely monitoring Mark Calabria's testimony before the Senate Banking Committee on Thursday for hints about how the Trump administration plans to proceed on mortgage finance reform.

February 13 -

A lapse in rental-assistance funding, an understaffed FHA and other effects of the government shutdown are causing real harm to families, said the chair of the House Financial Services Committee.

January 11 -

Freddie Mac issued its first non-low-income housing tax credit forward commitment, providing financing for an affordable housing development in Minnesota.

December 28 -

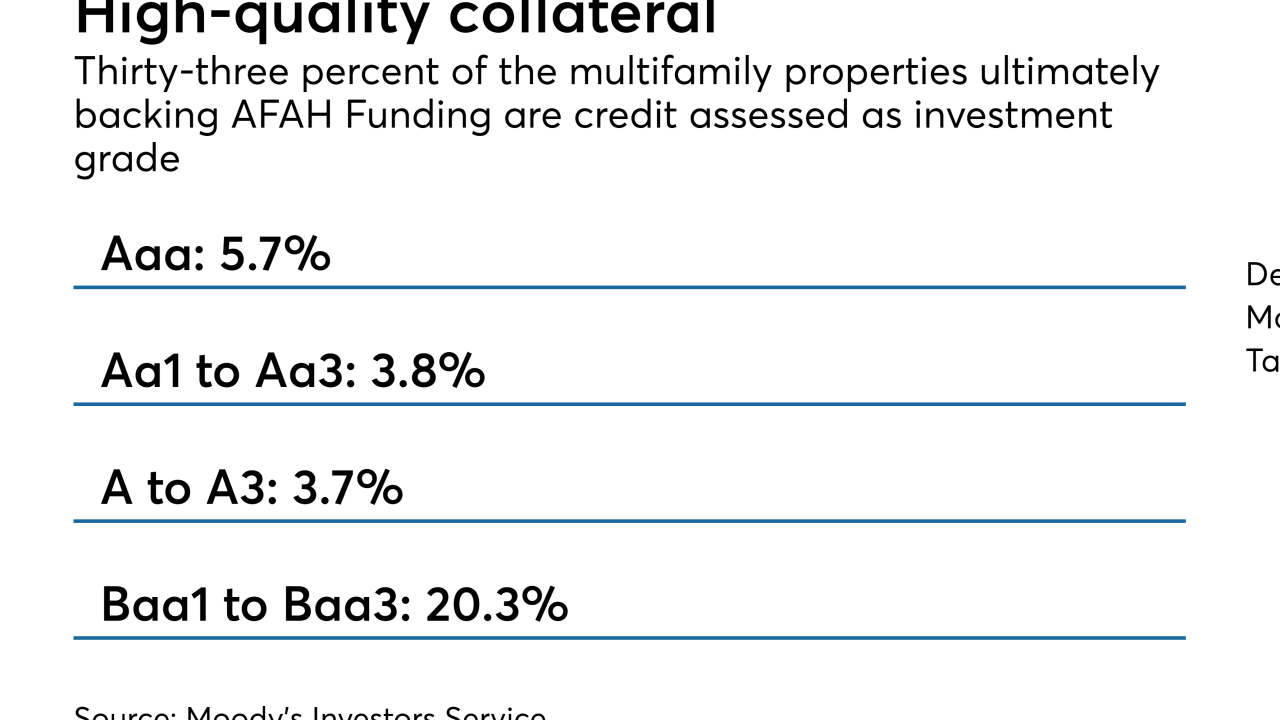

AFAH Funding is not your typical CRE CLO: It is backed by entirely by long-dated mezzanine interests in multifamily properties that are eligible for low-income housing tax credits.

December 24 -

The House Financial Services Committee held a hearing to examine the outgoing committee chairman's bipartisan GSE reform bill, but lawmakers were already looking ahead.

December 21 -

The Democrat, who will likely head the Financial Services Committee, has signaled she'll make expanded housing opportunities for lower-income consumers a top priority.

December 3 -

The Federal Housing Administration's risk-sharing program with the Federal Financing Bank began as a temporary fix, but the agency is exploring how to make it more permanent.

November 27 -

Donald Layton, who has run the mortgage giant since 2012, discussed the busy agenda leading up to his departure and says Freddie can serve as a "technical adviser" in GSE reform talks.

October 18 -

A former Federal Home Loan bank president argues that the system should limit its exposure to risky nonbanks.

September 19 Flushing Bank

Flushing Bank -

Instead of shrinking the GSEs, the housing regulator is letting them expand into a host of new products and programs.

June 28 American Enterprise Institute

American Enterprise Institute -

The groups applauded a proposal to establish minimum GSE capital requirements, but called for more immediate steps to release the companies from conservatorship.

June 19 -

Despite a legislative push by some senators and other stakeholders to jump-start housing finance reform, efforts to form consensus over a bill once again are stuck in neutral.

February 15 -

Freddie Mac is broadening its capital markets vehicles with its first offering of participation certificate securities backed by multifamily tax exempt loans.

December 13 -

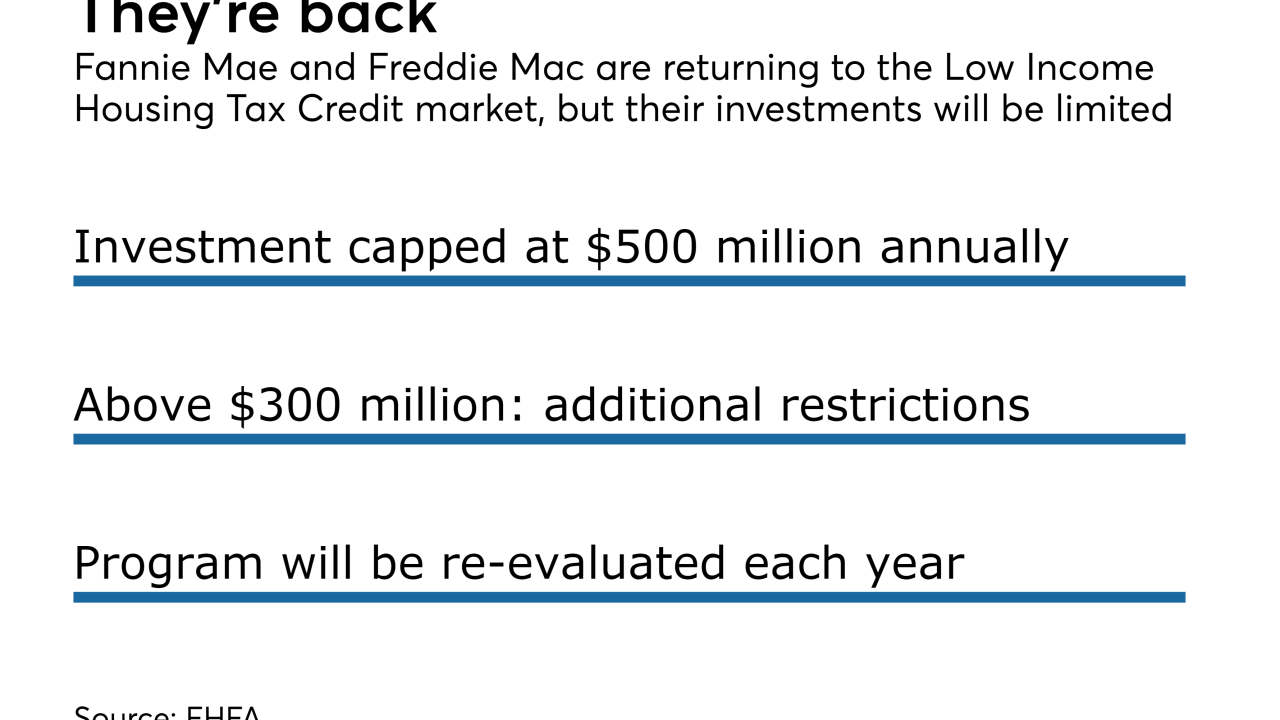

The FHFA is allowing Fannie Mae and Freddie Mac to invest in the credits for the first time since they entered conservatorship. Its purpose is to promote affordable housing in underserved markets.

November 16 -

Rather than working with large-scale investors, Freddie Mac said it will focus on assisting community organizations and local institutions to fund single-family properties for renters with special needs.

July 24 -

The Federal Housing Finance Agency made just incremental changes to two of the seven affordable housing benchmarks.

June 29 -

Freddie Mac has priced its first credit-risk transfer securities backed in part by tax-exempt loans used to finance affordable multifamily rental properties.

June 15