-

European banks are snapping up large pieces of their own collateralized loan obligations, keeping the market for CLOs afloat in the absence of the U.S. and Japanese banks.

December 5 -

Rule 15c2-11's public disclosure requirements could inhibit Rule 144A issuers unless addressed.

December 2 -

Florida is pulling about $2 billion from BlackRock, the largest anti-ESG withdrawal announced by a U.S. state, as Republicans ramp up their ESG fight.

December 2 -

Securitization production for 2022 is expected to experience a 13% decrease compared with 2021, and the declining trend is expected to continue for 2023.

December 1 -

Members of the Brazos Electric Power Cooperative seek to recoup cost outlays from the fallout of Winter Storm Uri in 2021 the latest Texas utility to do so.

December 1 -

Jerome Powell signaled a slowdown in the pace of tightening as early as December, while indicating more hikes to fight inflation. Bond yields slumped with the dollar.

November 30 -

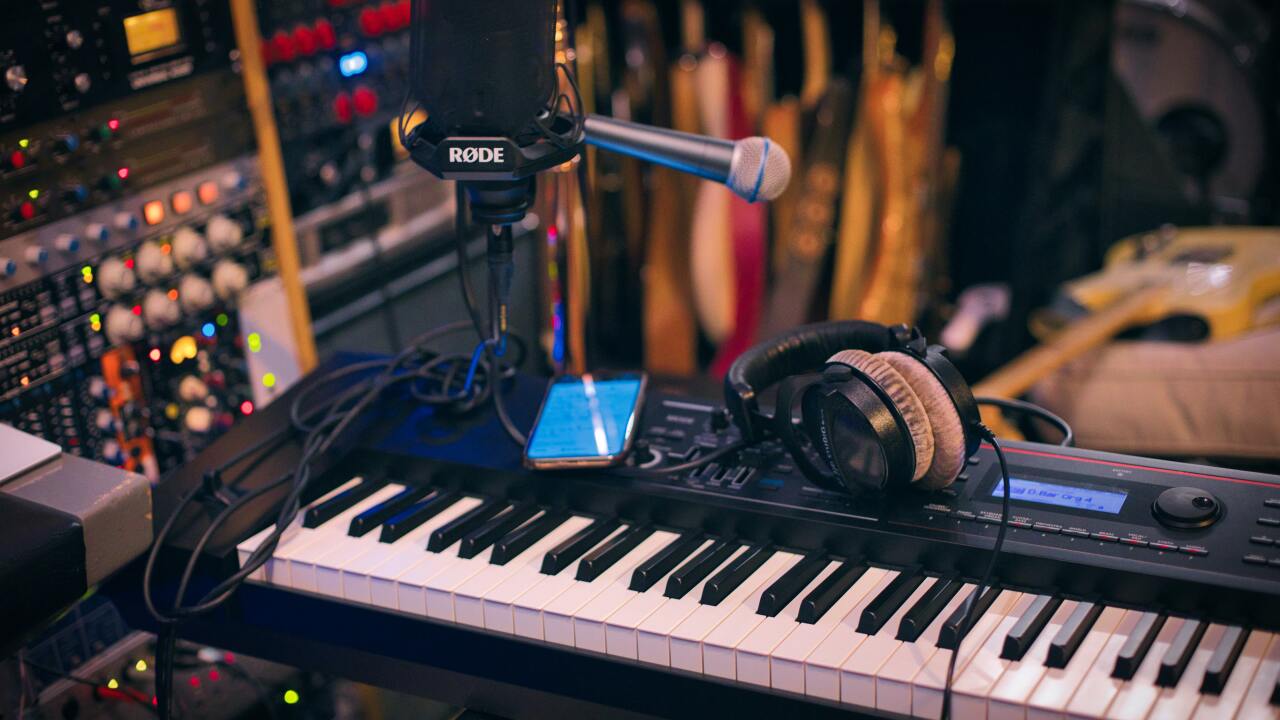

The catalog itself is valued at $4.1 billion, easily the largest portfolio value among the securitization industry's recent music royalty transactions.

November 30 -

The right to collect a tariff from some 650,000 retail electricity service customers in the Dallas-Fort Worth area will secure the ratepayer backed bonds.

November 29 -

For hotel mortgage-backed securities, Fitch expects a better outlook, with the 2023 delinquency rate not expected to return to its pandemic peak of 18.4%.

November 29 -

Stabilization in the leveraged loan and high yield bond markets has led to an opening for deals as banks try to reduce debt on their balance sheets before the holidays.

November 29 -

Should Exeter Finance fail to uphold its obligations as servicer, then Citibank will step in as the deal's backup servicer.

November 28 -

After its foray into entity, framework and instrument ESG ratings, Fitch will offer ratings on a range of structured notes including solar ABS, RMBS and CMBS.

November 28 -

Corporate borrowers will consider tapping bond and loan markets in the coming week as lending costs drop and investors snap up debt ahead of 2022's close.

November 28 -

Kapitus will issue expandable term notes, where at any time during the revolving period it has the ability to issue additional notes, up to $500 million.

November 23 -

US mortgage rates retreated sharply for a second week, hitting a two-month low and providing a bit of traction for the beleaguered housing market.

November 23 -

The uptick in cash balances might indicate the challenges issuers are facing originating new loans for reinvestment in commercial real estate CLOs.

November 22 -

There's no convincing evidence that central banks' purchases of trillions of dollars of bonds and other financial assets helped any economy.

November 22 -

Over time, the receivables that have FICO scores greater than 720 have continued to rise steadily, while receivables with scores of less than 660 have declined.

November 21 -

Apollo Global Management Inc. raised its first long-only fund to make investments in multiple credit asset classes, including some of the $43 billion in buyout loans on bank balance sheets.

November 21 - Imperial Fund Mortgage looks to raise $322.8 million, on a diverse portfolio of fixed-rate mortgages

Most of the loans in the pool, 56.4%, are not subject to the Consumer Finance Protection Bureau's (CFPB) Ability to Repay Rule, and virtually all are fixed-rate.

November 18