-

Loans with FICO scores less than 680 make up a smaller percentage of the pool, at 13.0%, compared with 18.2% for the Mosaic 2022-2.

December 9 -

US producer prices rose in November by more than forecast, driven by services and underscoring the stickiness of inflationary pressures that supports Federal Reserve interest-rate increases into 2023.

December 9 -

Regulators look set to reserve their harshest interventions for firms caught making misleading statements about climate strategies, according to JPMorgan Chase.

December 8 -

Early amortization triggers and the use of cross-currency swaps will support the timely repayment of notes on the hybrid private and rule 144a deal.

December 8 -

More recent OMFIT securitizations have experienced increasing 30+ delinquencies as well as annualized net loss rates.

December 7 -

The pact binds them to act together in negotiations with the company, a move meant to prevent the kind of nasty creditor fights that have complicated other debt restructurings in recent years.

December 7 -

The notes also face a credit challenge because there is no mandatory repurchase of modified loans.

December 6 -

Proceeds from the sale of the bonds will be used to replenish and fund Entergy New Orleans' storm recovery reserves that had been depleted after Hurricane's Zeta and Ida.

December 6 -

Investors brace for more FTX-like blowouts in the private equity industry and expect a good year for investment grade credit, survey shows.

December 6 -

The deal also differs from other bank-sponsored, CLN transactions in that the rating agency will not limit the ratings to SBNA's long-term counterparty risk rating.

December 5 -

European banks are snapping up large pieces of their own collateralized loan obligations, keeping the market for CLOs afloat in the absence of the U.S. and Japanese banks.

December 5 -

Rule 15c2-11's public disclosure requirements could inhibit Rule 144A issuers unless addressed.

December 2 -

Florida is pulling about $2 billion from BlackRock, the largest anti-ESG withdrawal announced by a U.S. state, as Republicans ramp up their ESG fight.

December 2 -

Securitization production for 2022 is expected to experience a 13% decrease compared with 2021, and the declining trend is expected to continue for 2023.

December 1 -

Members of the Brazos Electric Power Cooperative seek to recoup cost outlays from the fallout of Winter Storm Uri in 2021 the latest Texas utility to do so.

December 1 -

Jerome Powell signaled a slowdown in the pace of tightening as early as December, while indicating more hikes to fight inflation. Bond yields slumped with the dollar.

November 30 -

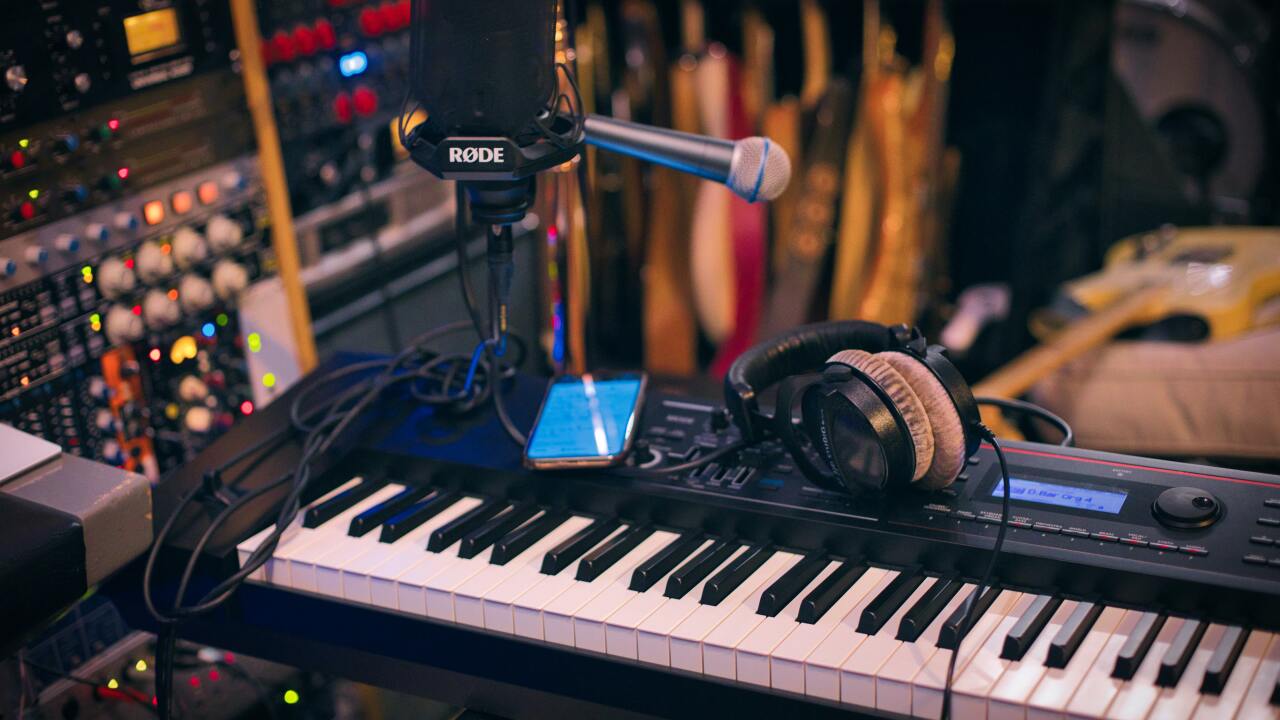

The catalog itself is valued at $4.1 billion, easily the largest portfolio value among the securitization industry's recent music royalty transactions.

November 30 -

The right to collect a tariff from some 650,000 retail electricity service customers in the Dallas-Fort Worth area will secure the ratepayer backed bonds.

November 29 -

For hotel mortgage-backed securities, Fitch expects a better outlook, with the 2023 delinquency rate not expected to return to its pandemic peak of 18.4%.

November 29 -

Stabilization in the leveraged loan and high yield bond markets has led to an opening for deals as banks try to reduce debt on their balance sheets before the holidays.

November 29