-

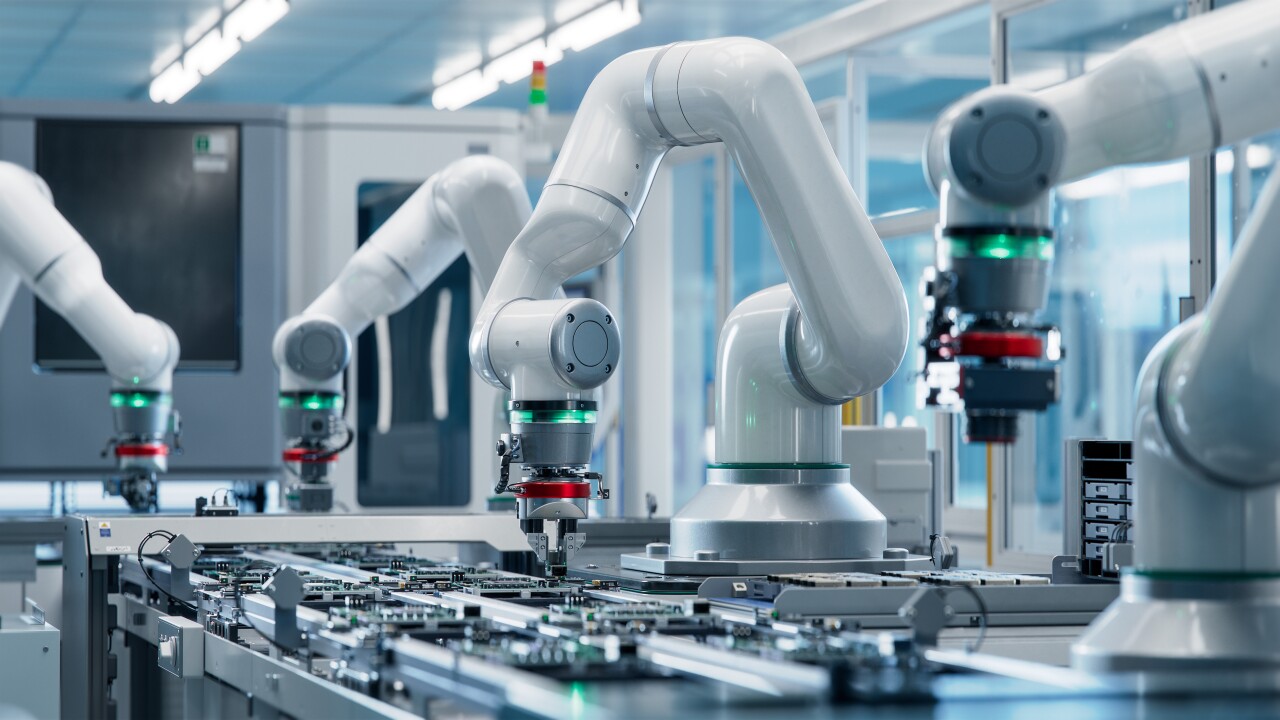

DEXT is very diversified by equipment type. Enterprise technology, medical technology and surgical equipment account for the top three concentrations, representing 22%, 16% and 10% of the portfolio.

November 15 -

Slightly more than half of the borrowers in the collateral pool, 54.74%, have a FICO score that is higher than 740, and just 3.06% of the borrowers have a score below 661.

November 14 -

Both tranches have the same legal final maturity of Oct. 20, 2033, an initial (OC) of 26.00%, and an initial reserve of 0.50%.

October 20 -

The deal has the smallest pool balance from the ACHV program this year, with an aggregate current principal balance of $177.8 million. The collateral pool contains 14,141 loans, with an average current loan size of $12,577.

October 19 -

Lam, who oversees the firm's structured credit investment strategies, managed CLOs, separate accounts and commingled accounts. Lam succeeds Andrew Gordon, who will assume the role of executive chair of the board of managers.

October 18 -

Donlen and LPUSA's involvement as a servicer is considered a credit strength, because its managed portfolio, which performed well even throughout the 2007-2008 recession, chalked up consistently low historical rates of delinquencies and net losses.

October 16 -

US 30-year yields dropped seven basis points to 4.79%, unwinding part of Thursday's surge that was driven by a somewhat disappointing inflation reading and a weak bond auction.

October 13 -

While securitization performance improved over last year on a quarterly basis, the year-to-date measure dipped compared with 2022, following expectations.

October 12 -

The three class A notes have initial hard credit enhancement that amounts to 36%, and consists of over-collateralization, the reserve account (with an initial coverage amount of 1%) and subordination of all notes, except class G.

October 12 -

These firms are seeing an uptick in demand for niche capital relief trades, according to David Snyderman, Managing Partner and Global Head of Alternative Credit and Fixed Income at alternative investment manager Magnetar Capital.

October 11 -

Notes will repay investors on a sequential basis, S&P said. One of S&P's rationales for assigning its ratings is the available credit support, including excess spread of 49.0%, 44.7%, 37.3% and 31.5% on classes A, B, C and D notes.

October 4 -

A deal to avoid a government shutdown resolves one immediate risk. But a major auto strike, the resumption of student-loan repayments, and a shutdown that may yet come back after the stop-gap spending deal lapses, could easily shave a percentage point off GDP growth in Q4.

October 2 -

Just one class of variable funding notes (VFN), which have an anticipated repayment date of July 2026, will be issued to investors.

September 29 -

On average the receivables have a balance of $971, a WA average percentage rate of 32.88%, and a WA age of 24 months. Also, cardholders might pay an annual membership of up to $75.

September 28 -

The deal will be secured by payments on subprime auto loans and comes shortly after officer Jill Rockwood joined as chief financial officer.

September 28 -

Equify ABS 2023-1 is expected to close on October 11 and will issue three classes of notes secured by revenue from mid- to large-ticket equipment contracts and related assets.

September 27 -

The deal is the eleventh this year for Pagaya AI Debt Selection Trust, and is slated to close by September 29.

September 27 -

Total hard credit enhancement of 37.45% shore up the class A notes, according to Moody's. In the rest of the deal the classes B, C and D notes benefit from total hard credit enhancement of 33.1%, 23.7% and 13.7%, respectively.

September 22 -

Revenue from agricultural and construction equipment will secure the notes, which get a boost from a spread account and overcollateralization.

September 21 -

Credit enhancement to the class A notes includes a non-declining overcollateralization of 4.75% of the initial adjusted pool balance, and a non-declining reserve fund of 0.25% of the initial adjusted pool balance.

September 20