-

The Japanese lender will back $526 million in U.S. dollar-denominated notes with receivables of domestic new- and used-car loans from domestic borrowers.

February 10 -

The eight-year-old finance company closed on its fourth overall securitization, in what was its largest ABS bond issuance to date.

February 9 -

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.29-Feb. 4

February 4 -

The ratings agency says the pool of prime motorcycle loans is slightly weaker than the lender's previous securitization, plus uncertainties remain over how the pandemic might still impact riders' monthly payment performance.

February 4 -

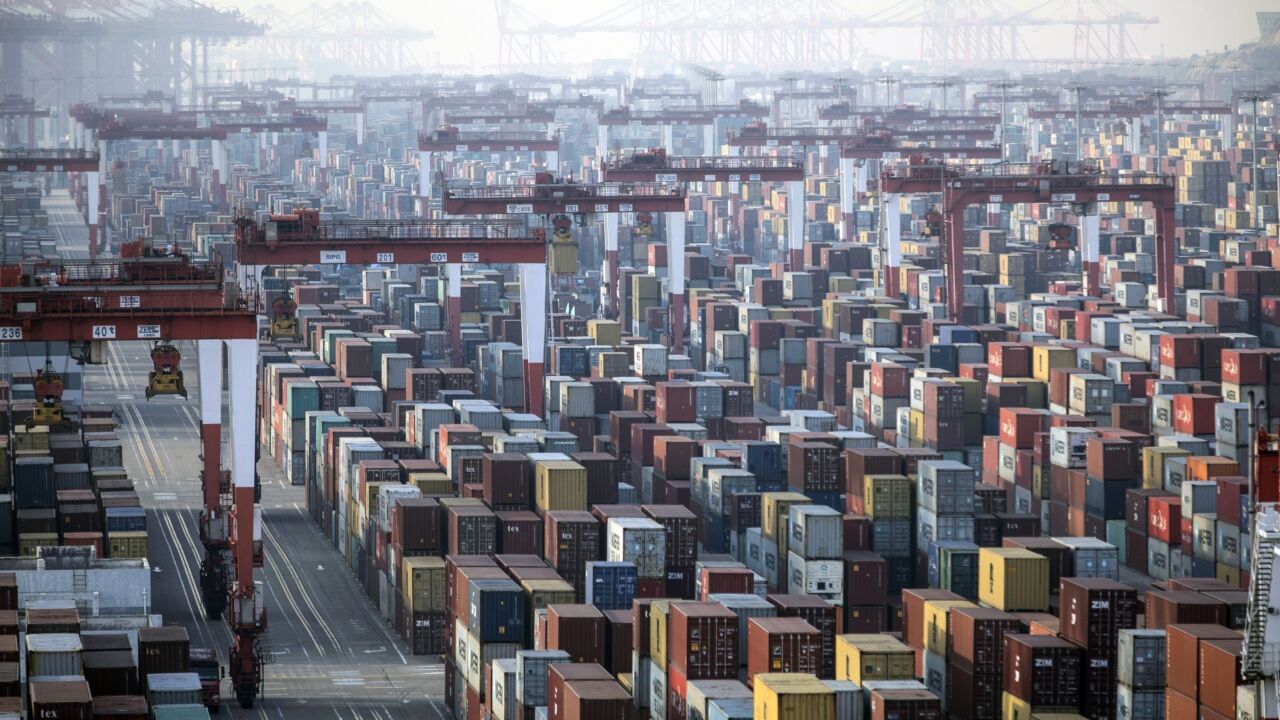

The new transaction priced inside of the coupons Textainer achieved in its prior 2020 container-lease securitization, as investors continue to clamor for the lengthier terms of the asset class' bonds.

February 3 -

Moody's Investors Service says forbearance levels were a factor in assigning a higher expected net loss figure for Navient's new FFELP securitization.

February 3 -

Environmental, social and governance issues topped the list of risk managers’ concerns in a Deloitte poll .

February 2 -

The startup firm, backed by hedge fund capital, is pooling more than half of its managed railcar portfolio for the single-A rated transaction.

February 2 -

A pool of more than 1,600 contracts to small- and middle-market companies include financing for tractors, excavation equipment and dump trucks for firms in transportation, construction and waste services industries.

February 1 -

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.22-28

January 28 -

The receivables will flow from payments on UK monoline credit-card accounts for nonprime borrowers.

January 25 -

The online lender is looking to price its second securitization deal of 2021, following last week's closing of a pass-through notes offering via its master trust.

January 25 -

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.15-21

January 22 -

Deals, trends and research in structured finance and asset-backed securities for the week of Jan.7-14

January 15 -

The railcar equipment notes are secured by a portfolio of 5,770 units which are almost all being utilized through full-service leases.

January 14 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 31-Jan.7

January 7 -

The agency cited improving used-car prices that have elevated resale values of off-lease vehicles that drivers are turning back into dealerships.

December 31 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 11-17

December 18 -

Downgrades applied to deals sponsored by Carlyle Aviation and Avolon Aerospace reflect the continued deterioration of airline credit quality and aircraft values afflicting nearly all issuers, the ratings agency reported.

December 16 -

Deals, trends and research in structured finance and asset-backed securities for the week of Dec. 4-10

December 11