Update: After this story was originally published, Fitch Ratings

Fitch Ratings on Tuesday downgraded several series of notes backed by commercial passenger aircraft lease transactions sponsored by Carlyle Aviation Partners and Avolon Aerospace – reflecting ongoing stress on fleet operators amid delayed lessee payments and a crushing loss of demand from struggling airlines.

The ratings agency issued one-notch downgrades to five classes of notes within two Carlyle deals, while lowering ratings on a pair of subordinate tranches in two recent Avolon deals. The Class C notes in Avalon’s 2018-vintage securitization, the $768.4 million Sapphire Aviation Finance, are being downgraded for the second time since June.

While Fitch maintained current ratings on seven classes of notes in the Carlyle deals and four from Avolon’s, the downgrades within both issuers’ deals “reflect ongoing deterioration” in airline credit profiles afflicted by the global coronavirus pandemic that has curtailed business and leisure passenger traffic, and curbed many regional and international routes.

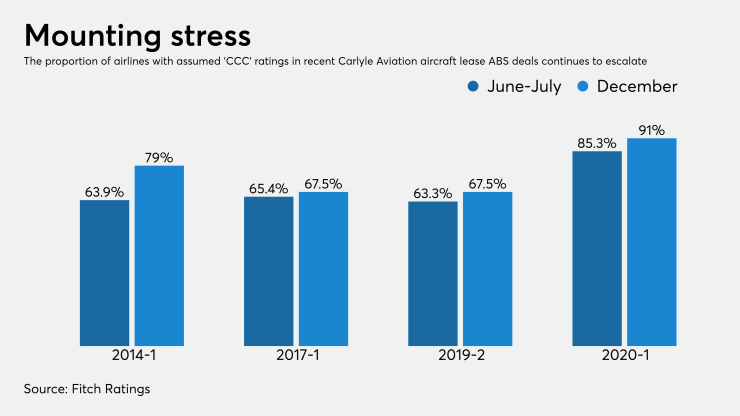

Across Carlyle Aviation’s pools issued via its AASET trust platform, for example, the proportion of airline lessees with highly speculative, near-default ‘CCC’ ratings has grown to between 67.5% to more than 91% for each particular transaction.

Also impacting lessors are the falling value of aircraft assets that provide a portion of the backing of the bonds sold to investors, according to Fitch.

Since March at the onset of the coronavirus pandemic, Fitch has downgraded 47 different tranches of notes on various aircraft lease securitizations (which include passenger aircraft and engine-only deals).

Nearly all 31 aircraft lease ABS transactions rated by Fitch (totaling approximately $12.6 billion) from 13 different lessors currently carry a negative outlook, with Fitch expecting a “wave of airline lease deferrals” to arrive in 2021 that will further stress cash flows into aviation securitization transactions.

“The air travel sector hit a low in the spring and early summer months, but the slower winter period will challenge travel volumes and, thus, the health of airlines,” Fitch noted in an October report. “Looking ahead, Fitch Ratings expects continued high pressure on ABS, including deal cash flow and ratings in 2H20 into 2021.”