-

LPPT 2022-ST1 has a gross excess spread, of about 18.2%, based on an average contract rate of 21.7%, minus 1% servicing fee, and an assumed WA coupon of 2.5%.

January 11 -

Commercial mortgage bond sales are heating up again, signaling another strong year ahead after issuance of the securities hit a post-crisis record in 2021.

January 11 -

Potters, who has headed CMBS businesses at SocGen and Merrill Lynch, will focus on digital and automated commercial real estate loan securitizations.

January 10 -

The main risk to the repayment of notes is that Hertz will not be able to recoup enough funds, through used vehicle sales, to fund the payments to bondholders.

January 10 -

The bond selloff that pushed 10-year Treasury yields to their highest in two years may not lead to a full-on taper tantrum, according to one of the biggest Treasury options market makers.

January 10 -

The rapid wage growth underscored the case for a more aggressive tightening by the Fed and capped a punishing week in the bond market.

January 7 -

Neighborly Issuer’s transaction structure incorporates several features to benefit the notes should payments fall below established debt service coverage ratio (DSCR) thresholds.

January 7 -

The municipal market has a history of outperforming during periods when the Fed hikes rates, because as yields rise, the tax-free interest that munis pay makes them more attractive.

January 6 -

While the mix of vehicle types in GMF originations is shifting, Chevrolet remains the top vehicle make in the 2022-1 deal, comprising about 57.5% of the pool.

January 6 -

Boulmetis will deliver MUFG’s capital markets capabilities to investment-grade debt issuers, and lead coverage of its roster of financial institutions clients.

January 6 -

The selloff worsened after minutes from the Federal Reserve’s latest meeting showed officials considering earlier and faster interest-rate increases than expected.

January 5 -

The Reserve Bank of Dallas data in housing prices hints at a so-called ‘episode of exuberance,’ but the central bank is a long way from sounding the alarm.

January 5 -

First-lien, agency-eligible mortgages secure the notes in the deal, which will issue notes through a senior-subordinate and shifting interest structure.

January 5 -

Treasury yields rose a second day amid increasing conviction that the Federal Reserve will raise rates at least three times beginning in May.

January 4 -

The platform enables structuring of the entire transaction, including covenant tests and trigger levels, and the distribution of interest and principal cash flows, but professionals need more time to become comfortable with DLT.

January 4 -

ABS issuance performance is largely neutral, with exceptions for stepped up volume, including auto. Inflation and COVID-related risks could overhang the industry.

January 3 -

Even among the non-QM loans in the reference pool, pegged to the SOFR, most of their characteristics fall in line with what is considered prime.

January 3 -

Fitch Ratings affirmed classes on five transactions, and upgraded class B notes on one deal, citing strong performances, plus upgraded B notes on a 2004 transaction.

December 22 -

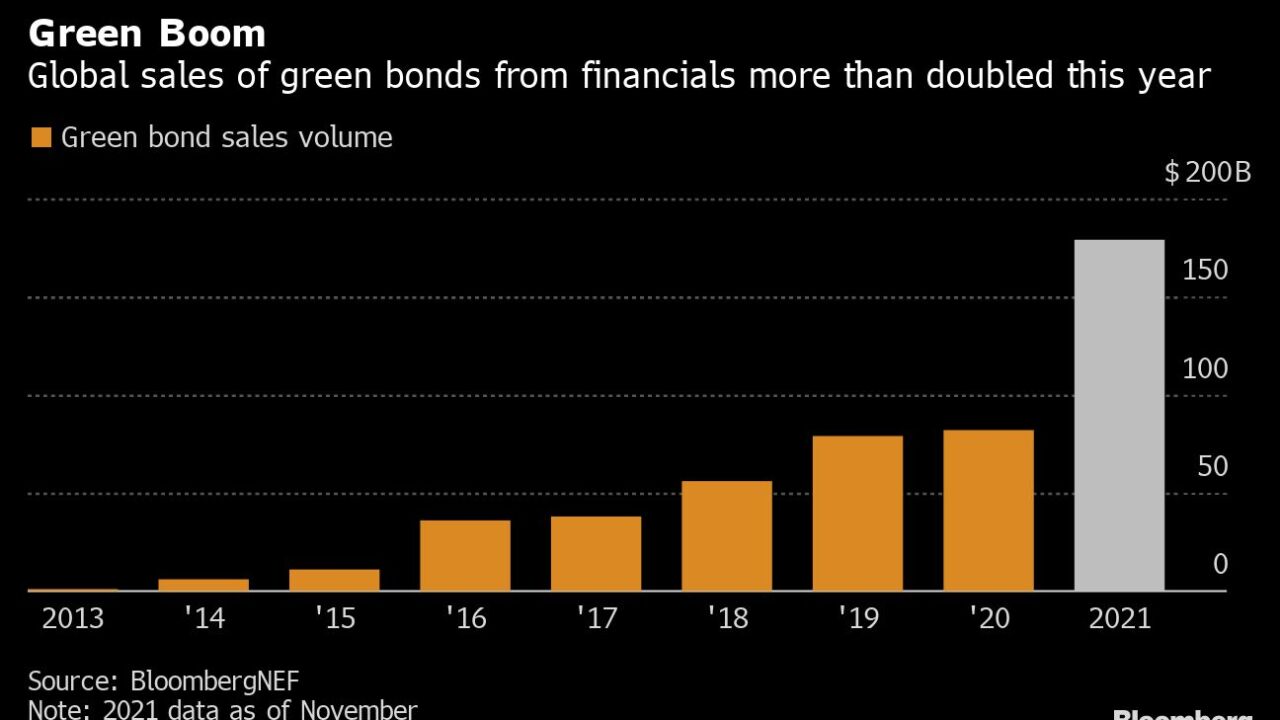

A growing chorus of auditors, researchers and climate activists warn that the numbers provided by bankers offer an exaggerated picture of their role in fighting climate change.

December 22 -

ABS experts discussed new avenues for growth, and hindrances to innovation at the IMN ABS East conference in Miami.

December 22