-

A decline in average FICO and recent loss levels in AmeriCredit's securitizations prompts Moody's to project slightly higher credit losses in the new transaction compared to previous rated deals.

May 31 -

S&P Global Ratings reports that cumulative loss levels on collateralized portfolios of subprime auto loans fell to 7.11% in March, compared to 8.67% in February. That figure was also down from 7.61% in March 2018, and the lowest since 2016.

May 28 -

A Davis & Gilbert poll of market participants showed more expect delinquencies over the next one to two years, likely requiring credit enhancement in future deals.

May 22 -

S&P Global Ratings forecasts lower losses in subprime lender American Credit Acceptance's next auto-loan securitization, citing the inclusion of performing loans transferred from a recently called deal.

May 16 -

Santander Drive Auto Receivables Trust 2019-2 has a lower average FICO (600) and lighter seasoning (two months) compared to SDART 2019-1.

May 8 -

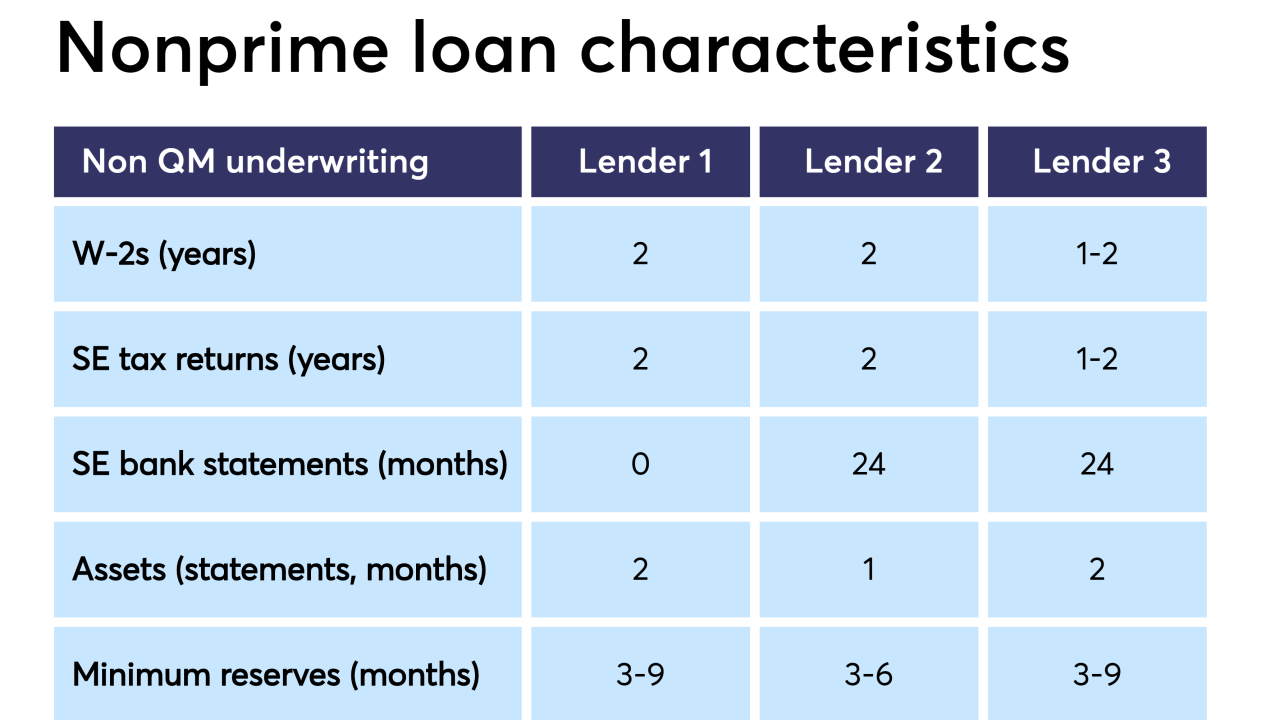

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

DT Auto Owner Trust 2019-2 will issue five classes of notes, collateralized by $550 million in auto loans issued through company-owned "buy here-pay here" dealerships.

May 2 -

Kroll has again downgraded the subordinate note classes for Honor Automobile Trust Securitization 2016-1, with total losses expected to build to $7 million to $8 million.

April 29 -

The $350 million GLS Auto Receivables Trust 2019-2 transaction is being issued on the heels of the lender's record $453.2M 1Q volume in originations.

April 24 -

For the first time, the marketplace lender d/b/a Best Egg is securitizing loans from High Yield Prime borrowers who don't qualify for its prime loan products.

April 22