-

According to ratings agency presale reports, the $398.7 million Flagship Credit Auto Trust 2019-4 includes a 23% share of collateral loans originated through the company’s growing dCarFinance.com direct financing channel.

November 6 -

A growing percentage of Santander Consumer USA Holdings Inc.’s subprime auto loans are turning out to be clunkers soon after the cars are driven off the lot.

October 25 -

Subprime auto finance company Global Lending Services brought $300 million in notes to the asset-backed securities market GLS Auto Receivables Issuer Trust 2019-4.

October 25 -

The $450 million DT Auto Owner Trust 2019-4 has a pool balance of $519.7 million, an average balance of $17,125 per account and an 84.21% share of loans with terms over 60 months.

October 20 -

According to presale reports, the fixed-rate loan collateral in Angel Oak Mortgage Trust 2019-5 makes up 77.8% of the new collateral, compared to just 35.5% in Angel Oak’s previous deal that priced in July.

October 16 -

The transaction is the first securitization sponsored by the auto finance company since S&P Global downgraded four classes of subordinate notes in prior transactions due to higher-than-expected losses.

October 4 -

Arivo Acceptance, a two-year-old specialty-finance auto lender, is launching its debut securitization of subprime and non-prime loans for new and used cars, trucks and SUVs.

October 3 -

About 10% of the collateral pool consists of prime loans with extended term loans of 78 months excluded from World Omni's prime securitization platform.

October 2 -

The LendingPoint 2019-1 trust will market $169.4 million in notes backed by 18,760 loans with a collective balance of $178.3 million.

August 20 -

The decline in the share of "cured" delinquent loans is a potential signal for increased securitization losses in the months to come.

August 13 -

Lighter seasoning compared to American Credit Acceptance's last loan portfolio issuance is the primary reason, say ratings agencies.

August 8 -

“Buy here, pay here” auto lender Byrider’s improvements in recent ABS collateral performance and operational servicing changes are gaining favor with ratings analysts.

August 2 -

Kroll this week withdrew ratings on the defunct subprime auto lender's loan securitization, which had undergone multiple downgrades.

June 19 -

Foursight's first deal of 2019 has a rising 36.6% share of subprime borrowers from its lower-tier loan programs.

June 13 -

A decline in average FICO and recent loss levels in AmeriCredit's securitizations prompts Moody's to project slightly higher credit losses in the new transaction compared to previous rated deals.

May 31 -

S&P Global Ratings reports that cumulative loss levels on collateralized portfolios of subprime auto loans fell to 7.11% in March, compared to 8.67% in February. That figure was also down from 7.61% in March 2018, and the lowest since 2016.

May 28 -

A Davis & Gilbert poll of market participants showed more expect delinquencies over the next one to two years, likely requiring credit enhancement in future deals.

May 22 -

S&P Global Ratings forecasts lower losses in subprime lender American Credit Acceptance's next auto-loan securitization, citing the inclusion of performing loans transferred from a recently called deal.

May 16 -

Santander Drive Auto Receivables Trust 2019-2 has a lower average FICO (600) and lighter seasoning (two months) compared to SDART 2019-1.

May 8 -

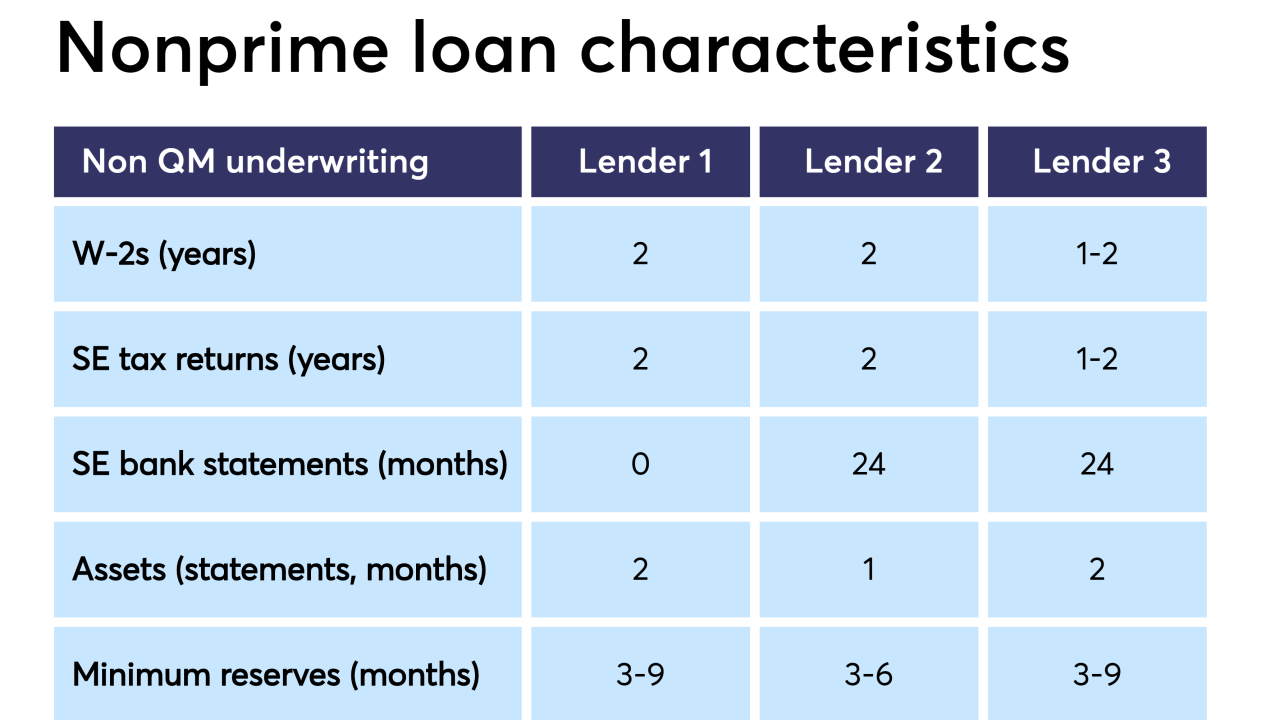

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6