-

The decline in the share of "cured" delinquent loans is a potential signal for increased securitization losses in the months to come.

August 13 -

Lighter seasoning compared to American Credit Acceptance's last loan portfolio issuance is the primary reason, say ratings agencies.

August 8 -

“Buy here, pay here” auto lender Byrider’s improvements in recent ABS collateral performance and operational servicing changes are gaining favor with ratings analysts.

August 2 -

Kroll this week withdrew ratings on the defunct subprime auto lender's loan securitization, which had undergone multiple downgrades.

June 19 -

Foursight's first deal of 2019 has a rising 36.6% share of subprime borrowers from its lower-tier loan programs.

June 13 -

A decline in average FICO and recent loss levels in AmeriCredit's securitizations prompts Moody's to project slightly higher credit losses in the new transaction compared to previous rated deals.

May 31 -

S&P Global Ratings reports that cumulative loss levels on collateralized portfolios of subprime auto loans fell to 7.11% in March, compared to 8.67% in February. That figure was also down from 7.61% in March 2018, and the lowest since 2016.

May 28 -

A Davis & Gilbert poll of market participants showed more expect delinquencies over the next one to two years, likely requiring credit enhancement in future deals.

May 22 -

S&P Global Ratings forecasts lower losses in subprime lender American Credit Acceptance's next auto-loan securitization, citing the inclusion of performing loans transferred from a recently called deal.

May 16 -

Santander Drive Auto Receivables Trust 2019-2 has a lower average FICO (600) and lighter seasoning (two months) compared to SDART 2019-1.

May 8 -

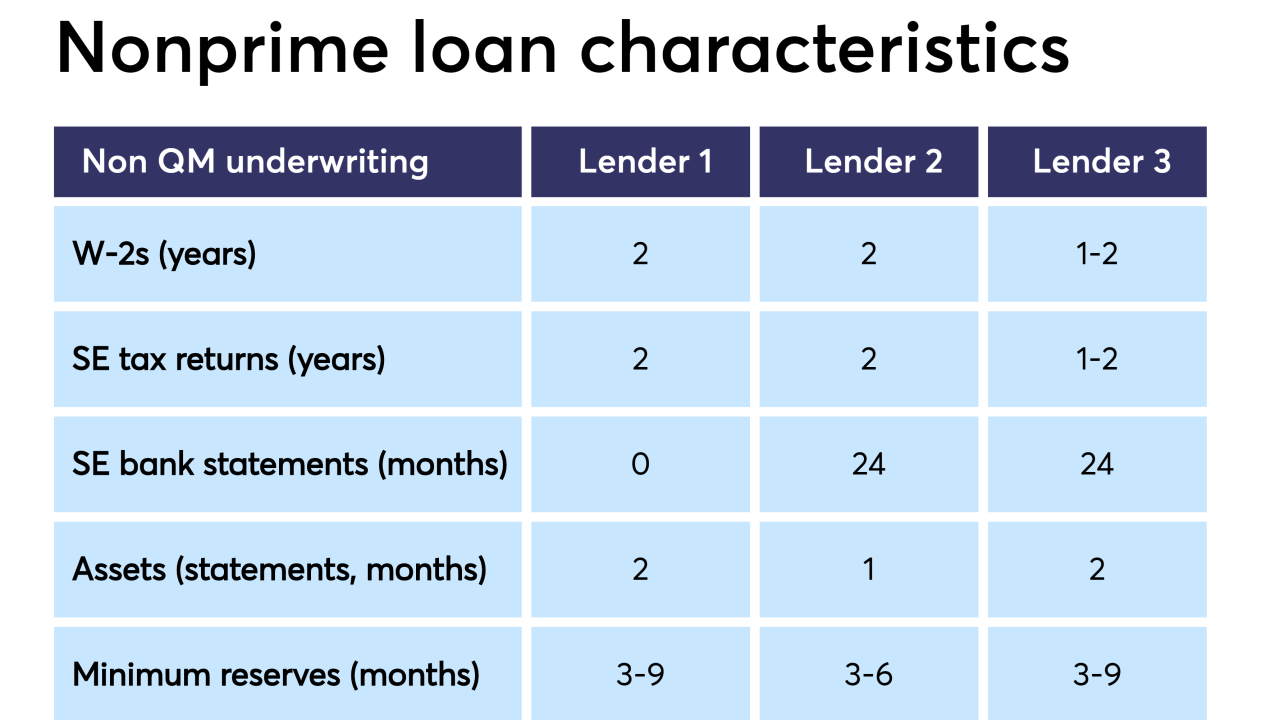

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

DT Auto Owner Trust 2019-2 will issue five classes of notes, collateralized by $550 million in auto loans issued through company-owned "buy here-pay here" dealerships.

May 2 -

Kroll has again downgraded the subordinate note classes for Honor Automobile Trust Securitization 2016-1, with total losses expected to build to $7 million to $8 million.

April 29 -

The $350 million GLS Auto Receivables Trust 2019-2 transaction is being issued on the heels of the lender's record $453.2M 1Q volume in originations.

April 24 -

For the first time, the marketplace lender d/b/a Best Egg is securitizing loans from High Yield Prime borrowers who don't qualify for its prime loan products.

April 22 -

The Federal Trade Commission accused the online lender of numerous violations in connection with its loan servicing practices. In one example, Avant allegedly informed customers that they could make payments by credit card or debit card but then refused to accept such payments.

April 15 -

Two deals Exeter completed in 2018 are performing worse than Moody's expected so its looking for additional losses on this deal; S&P sees losses in the same range as four prior deals.

April 12 -

Losses on Conn’s consumer loans are stabilizing, and the electronics and appliance store chain sees an opportunity to reduce the level of credit enhancement for its latest securitization.

April 11 -

The regional direct lender caters to very risky and highly leveraged borrowers (507 FICO, 163.95% LTV), but is offering relatively little credit enhancement compared to its peers.

April 5 -

Unusually, all of the loans in the $374 million transaction were purchased from a single originator, Impac Mortgage.

March 20