-

Treasury Secretary Steven Mnuchin on Monday reiterated his goal of tackling housing finance reform within the next year, an aggressive plan for resolving a matter that has long flummoxed Congress.

May 1 -

First Key preps its second reperforming RMBS of the year; April CLO count reaches $29.8 billion; Toyota, Nissan file plans for notes backed by auto loans and dealer inventory financing.

May 1 -

Ocwen Financial's recent regulatory troubles may open the door for New Residential Investment Corp. to transfer its massive subservicing portfolio to an affiliate, Nationstar Mortgage Holdings; that could either slow or speed up repayment of bonds backed by its advance receivables.

April 30 -

Firms that offer loans to small-time landlords have been slow to tap the securitization market. So far there has only been one transaction with a public credit rating, in December 2016. Yet bundling these loans into collateral for bonds provides attractive financing.

April 28 -

Bayview Asset Management is marketing its third package of re-performing mortgages acquired last year from former subprime HELOC lender CitiFinancial Credit Corp. in a $182.98 million transaction.

April 26 -

Freddie Mac is preparing a second transaction designed to transfer credit risk on mortgages that have been modified in order to avoid default.

April 25 -

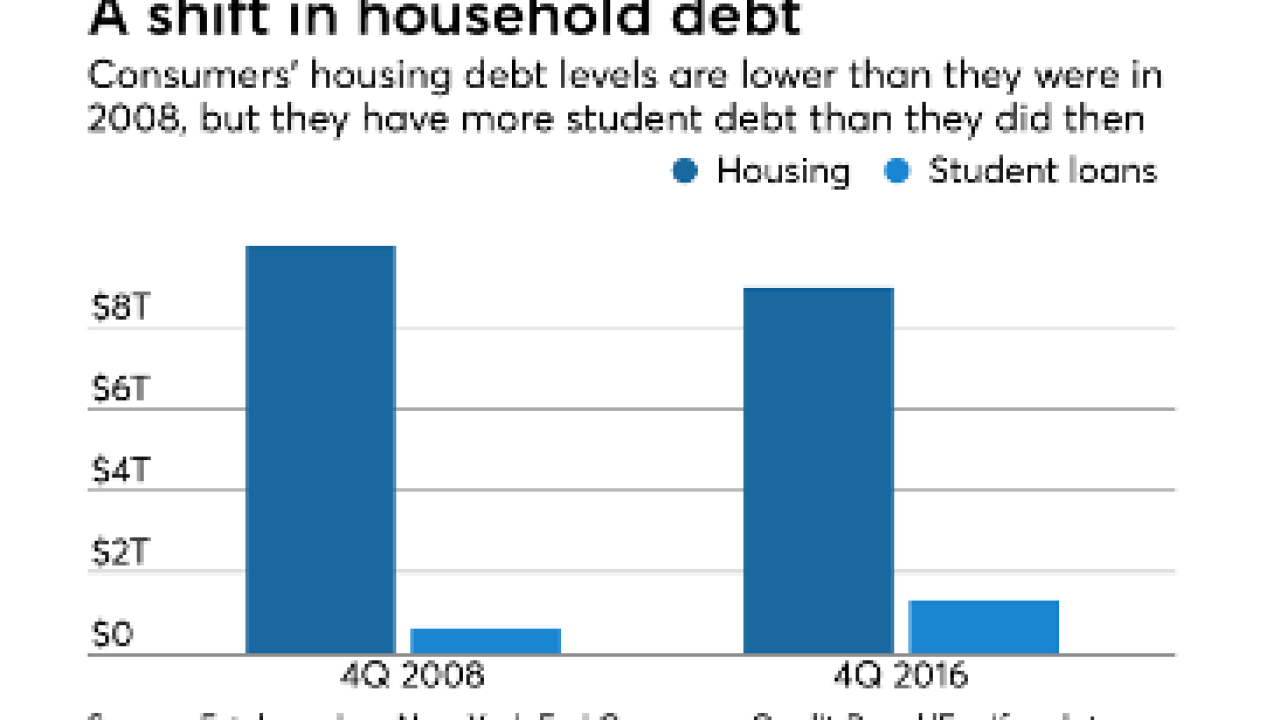

Fannie Mae has made three selling guide changes aimed at helping the growing number of borrowers with student debt qualify for home loans, and may begin testing other similar proposals related to this goal.

April 25 -

President Trump and Consumer Financial Protection Bureau Director Richard Cordray appear locked in a game of chicken over his continued leadership of the agency

April 24 -

Renovate America launches $268 million of bonds backed by Property Clean Energy Assessements; Calibur Home Loans returns with non-prime RMBS, and three more collateralized loan obligations refinance.

April 24 -

Ocwen Financial and its subsidiaries faced a slew of accusations from federal and state regulators on Thursday, which raised questions about whether the firm could survive.

April 20