Fannie Mae has made three selling guide changes aimed at helping the growing number of borrowers with student debt qualify for home loans, and may begin testing other similar proposals related to this goal.

"Student debt is around $30,000 on average for a graduate, depending on what population you look at, and it just continues to grow year after year," Jonathan Lawless, a vice president at Fannie Mae, said in an interview.

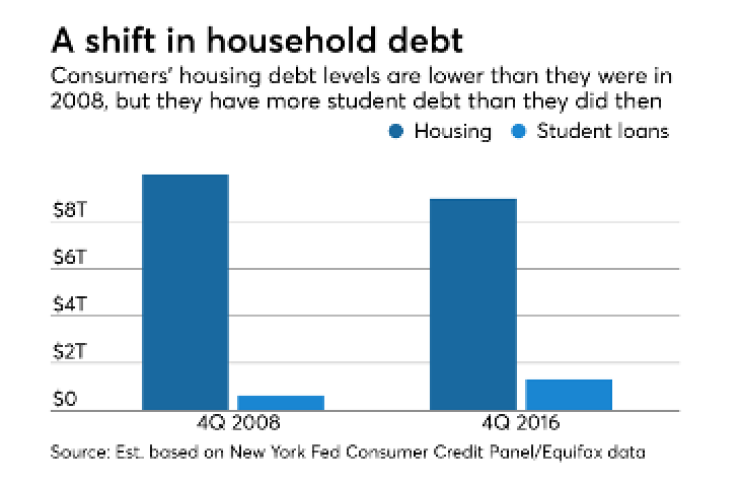

U.S. consumers held more than $1.3 trillion in outstanding student debt at the end of 2016, up 205% from $635 billion in 2008, according to a recent

To address this, the government-sponsored enterprise has expanded a cash-out refinance pilot for certain consumers with student loans. It also has changed the way it calculates student debt payments and will be providing an allowance to borrowers who have others pay their debt.

Under the first change, the cash-out refi loan Fannie had been

The second change allows mortgage lenders to accept student loan payment information from credit reports and use it for calculations they use to assess income-based payments on federal student loans. A more conservative and complicated calculation previously was used to override that payment information.

Under the third selling guide change, lenders will be able to exclude borrowed amounts paid by others from nonmortgage debt-to-income calculations used in underwriting.

The changes were announced Tuesday and take immediate effect.

"There are often situations where you see student debt paid by others. Previously, that would be completely ignored, and the student debt would count against your debt-to-income ratio," said Lawless.

In addition to these national policy changes, Fannie has been working a handful of lenders to develop new pilot proposals related to expanding lending to borrowers with student debt. Lawless declined to provide details, but said Fannie has been considering which of these proposals may be worth testing.