-

As financial institutions look closer at the increasingly detailed consumer credit data available, they are learning consumers are more apt to pay off personal loans before mortgages, auto loans and credit cards

May 17 -

S&P and DBRS have diverged on rating the senior notes in a $175.26 million securitization of private student-loan refinancings from Earnest Operations. Also, Comenity Bank has a new private-label card transaction through its World Financial master trust.

May 15 - Europe

A Dutch mortgage lender is planning a second green securitization of 400.7 million in home loans for properties meeting certain energy efficiency and low-carbon footprint guidelines.

May 15 -

Federal Housing Finance Agency Director Mel Watt appears poised for a showdown with Congress over how to handle Fannie Mae and Freddie Macs dwindling capital buffers.

May 11 -

Fannie Mae and Freddie Mac issued proposals Monday to create pilot programs for loans on mobile homes, part of an ambitious federal effort to find creative solutions for underserved and rural housing markets.

May 9 -

While proposed corporate tax cuts by the Trump administration would largely be good for Fannie Mae and Freddie Mac, they would be required to make an initial adjustment that could force a draw from their line of credit with the Treasury Department.

May 5 -

After more than two days of debate, the House Financial Services Committee on Thursday approved its sweeping Dodd-Frank Act rollback bill.

May 4 -

In an attempt to show it went all out to help struggling homeowners, the embattled mortgage servicer Ocwen Financial provided an unusual level of detail about foreclosures that regulators have deemed "inappropriate."

May 3 -

Fannie Mae and Freddie Mac will continue to pursue opportunities for the government-sponsored enterprises to provide liquidity to the single-family rental market, despite opposition from mortgage and real estate industry group

May 2 -

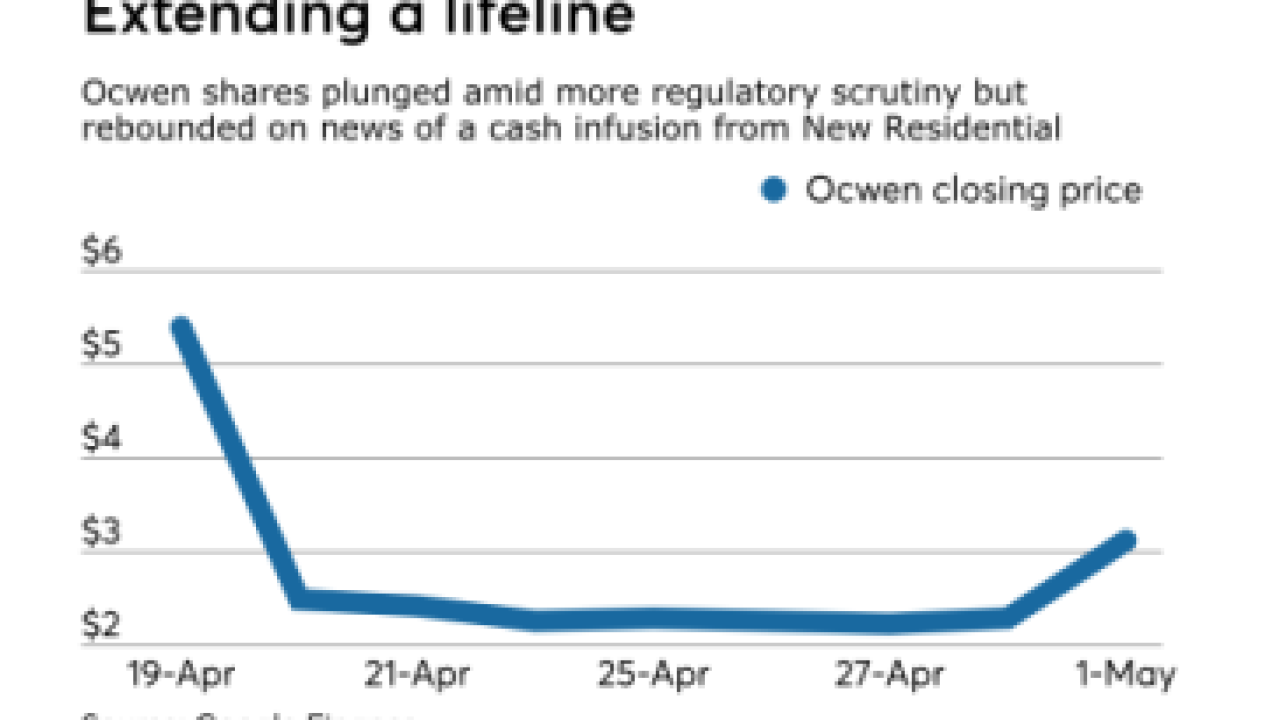

Ocwen Financial Corp. is in talks to sell a nearly 5% stake to its biggest client, New Residential Investment Corp., as part of a deal that would finalize a long-expected sale of mortgage servicing rights.

May 1