-

The £571.6 million Elvet Mortgages 2018-1 is the first mortgage bond offering rated by Moody's Investors Service to include loans that were originated using a mobile phone application.

September 27 -

Fannie Mae and Freddie Mac’s involvement in the single-family rental market may have been short-lived, but it still had a positive effective, according to Beth O’Brien, CEO of CoreVest.

September 25 -

Corevest CEO Beth O'Brien says that Fannie and Freddie's involvement in the single-family rental market both generated buzz and produced standardized documentation.

September 25 -

Approximately 81.5% of the borrowers in the latest deal have more than one mortgaged property; those with three or more mortgages (with a maximum of 10) represent 45.5% of the pool and generally show considerable income and liquid reserve.

September 19 -

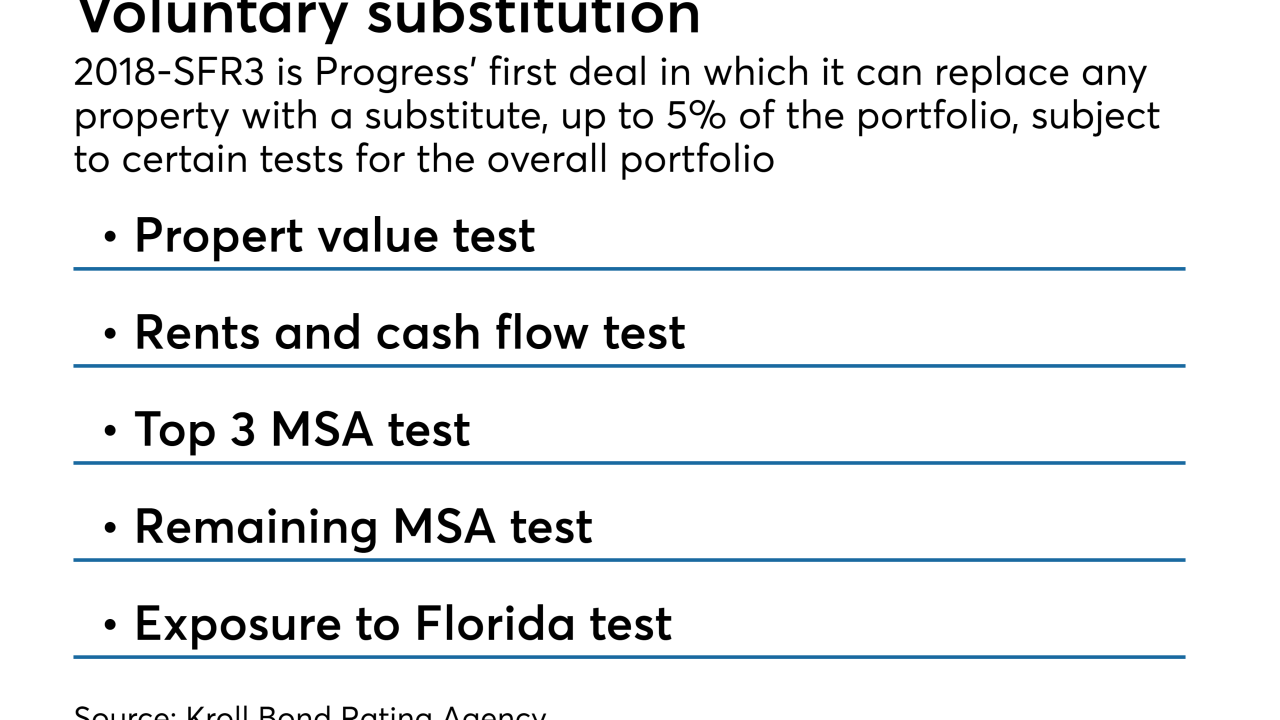

Progress 2018-SFR3 is backed by 3,459 single-family homes, of which 3,418 homes (98.8% by broker price opinion) were previously securitized in 2016. And 1,492 of those properties (44.4%) were first securitized in 2014.

September 18 -

Caliber Home Loans’ next offering of subprime mortgage bonds includes a new product offered to borrowers with a stronger credit profile than its other programs – but also less equity in their homes.

September 10 -

Brass No. 7 is Accord's ninth overall securitization of prime mortgages for owner-occupied homes and the second to feature a revolving period.

September 5 -

The sponsor has increased the credit enhancement on the senior support class of notes on offer in order to offset the slightly higher risk to investors.

August 31 -

Only 9.6% of €1.08 billion of collateral meets the criteria for responsible lending and borrowing set by the National Institute for Family Finance in the Netherlands, down from 22.9% for the prior deal.

August 30 -

The initial collateral for Tower Bridge Funding No. 3 consists of 1,737 loans totaling £375.5 million, and there will be a £125 million prefunding account that can be used to acquire additional collateral before the first interest payment date.

August 29