-

Shawbrook's debut securitization of "buy-to-let" mortgages issued to UK landlords will pay coupons based on the sterling-based overnight index average benchmark, rather than Libor.

May 14 -

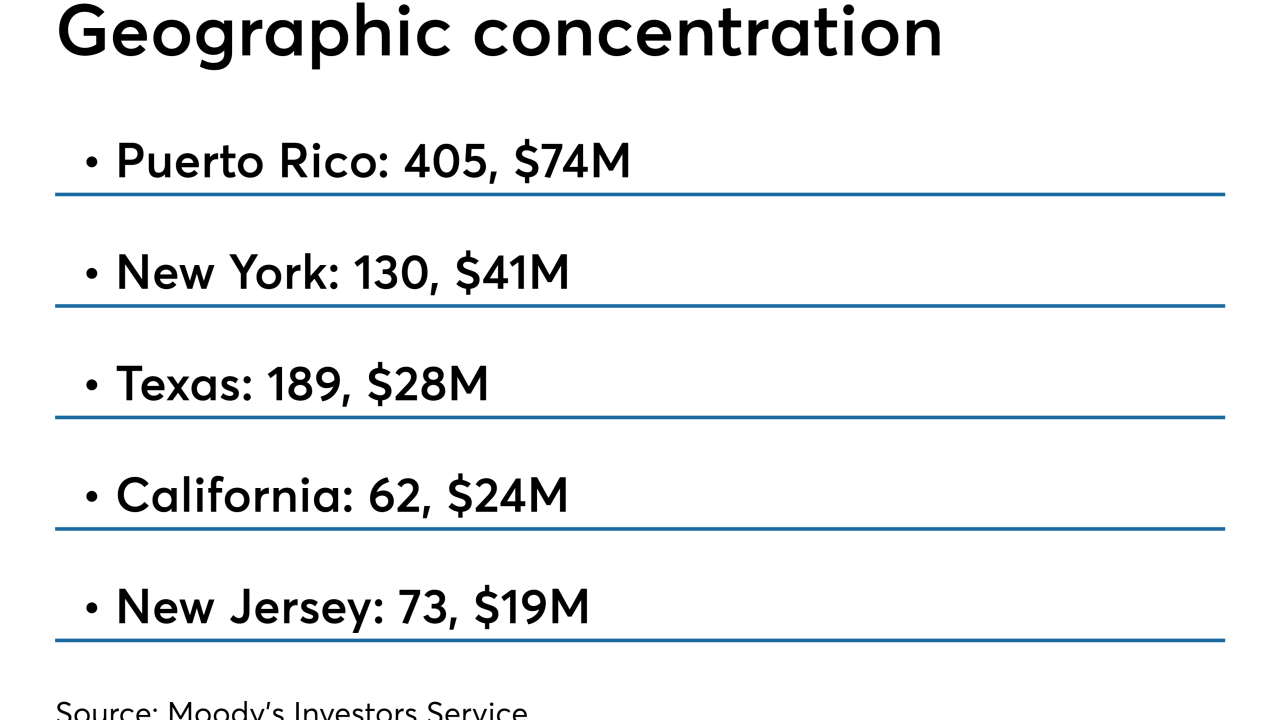

After issuing five RMBS deals of prime jumbo loans in 2019, JPMorgan has gathered a pool of 919 investor-only properties for its next mortgage securitization.

May 14 -

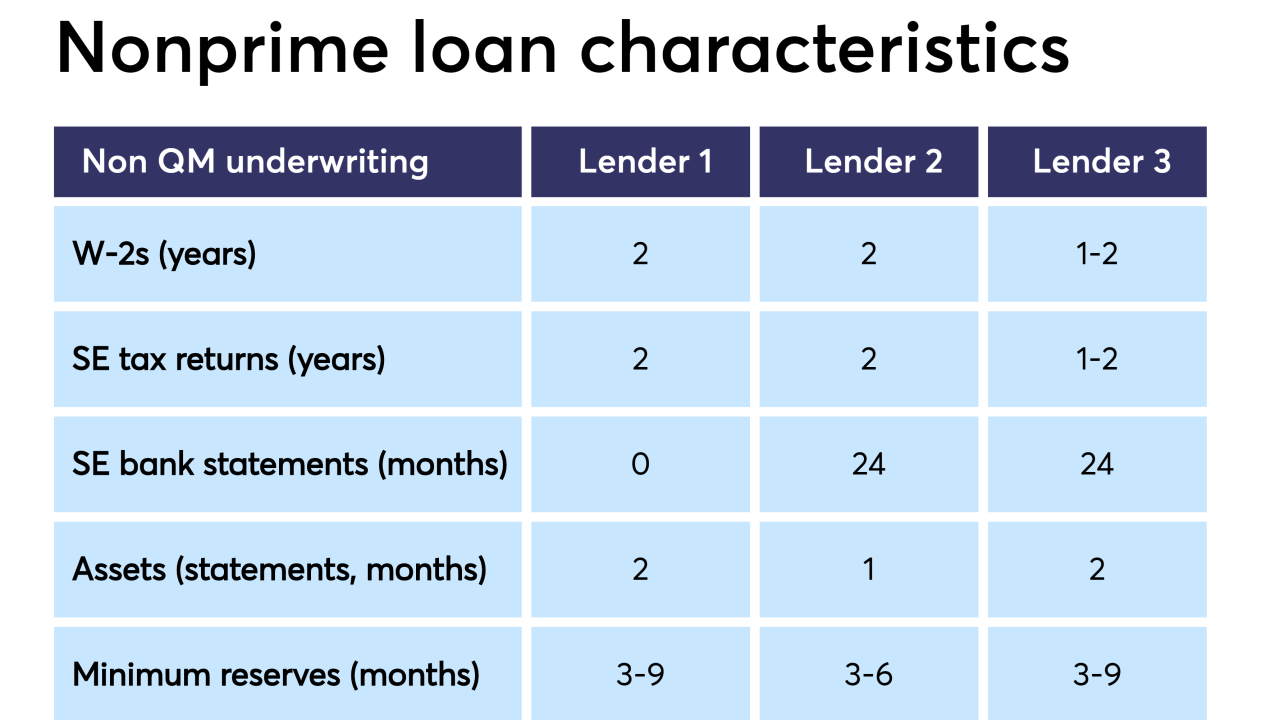

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

Citigroup Mortgage Loan Trust 2019-RP1 is a pool of 1,330 first-lien mortgage loans with a remaining balance of $262.8 million. Nearly 89% of the loans were previously modified.

April 26 -

An industry working group might seek legislation to eliminate the need for investor consent in the shift to a new benchmark interest rate. But any legislative fix is almost certain to be challenged because choosing an alternative to Libor will inevitably favor one party in a transaction over another.

April 21 -

Nearly 67% of the loans in the $309 million loans and repossessed properties backing FASST 2019-HB1 were obtained from a 2017 deal that was recently collapsed.

April 18 -

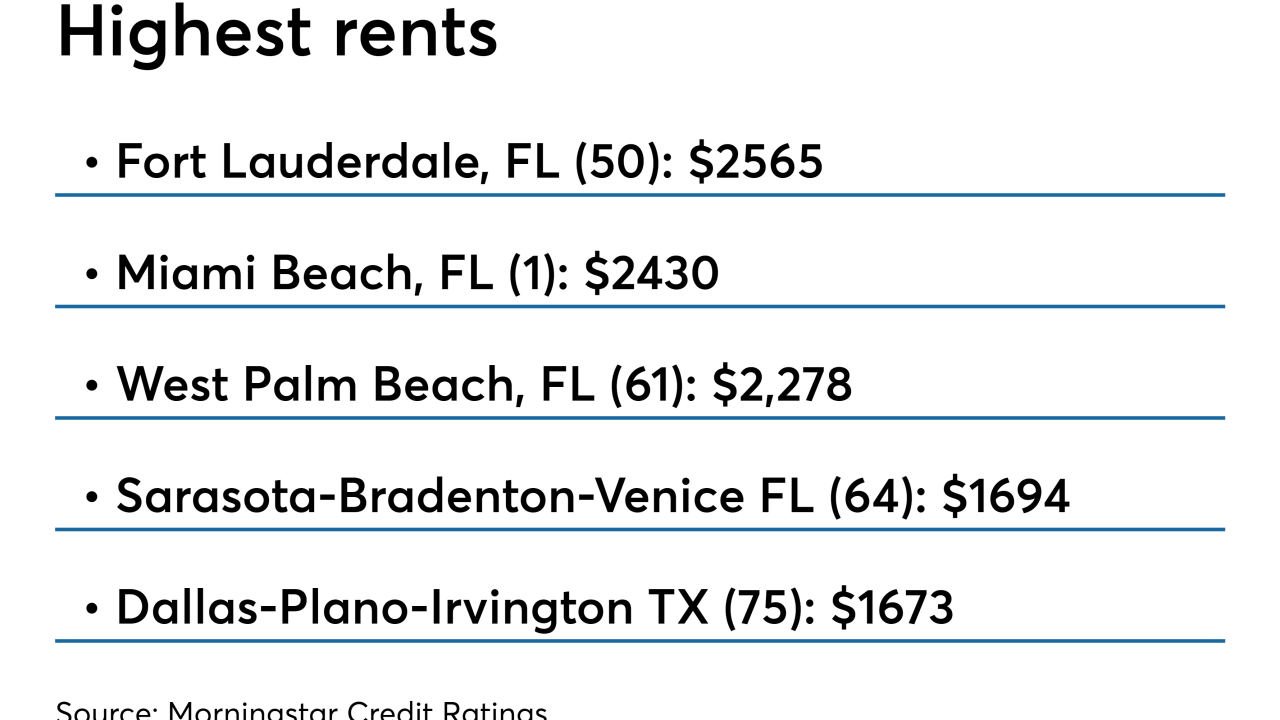

The $479 million Progress Residential 2019-SFR2 Trust is backed by 2,459 single-family residences, 2,452 of which were previously securitized in Progress 2016-SFR2.

April 9 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

The bank agreed to modify loans to struggling U.S. borrowers as part of a 2017 settlement. Instead, it’s receiving credit for financing new mortgages that likely would have been made anyway.

April 8