-

Digital-first lenders more than doubled their market share in the last four years, according to a report by Experian.

September 25 -

Social Finance is supplying lower levels of credit enhancement to its third consumer-loan securitization of 2019.

May 16 -

Figure, the startup headed by Mike Cagney, uses blockchain technology to provide home equity loans in as little as five days. It intends to use the newly raised funds to offer other services, including wealth management.

February 27 -

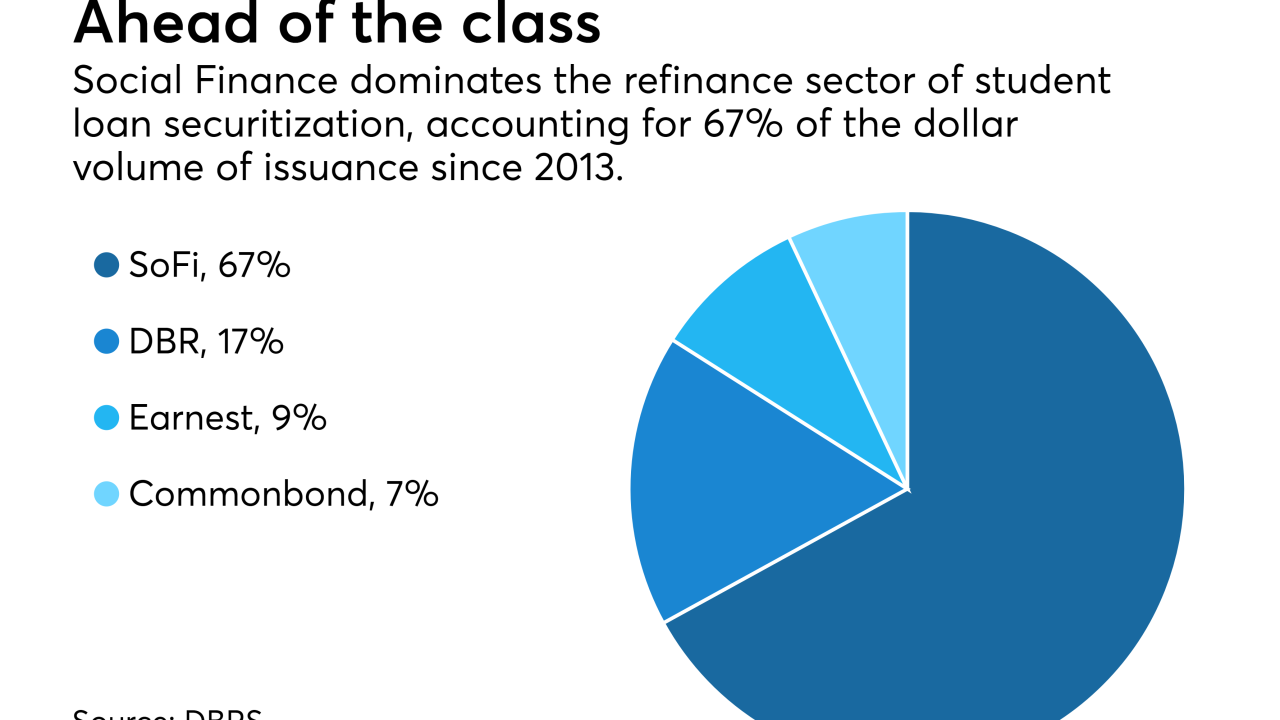

Many banks remain wary of student loans given the government's dominance in the market, but some fintechs see untapped potential.

December 6 -

Social Finance, the lending and refinancing startup valued at more than $4 billion, is cutting about 7% of its staff, according to a person familiar with the matter.

December 3 -

The Federal Trade Commission, which issued a formal complaint against SoFi, is urging other lenders to review their advertisements for false claims about the benefits of refinancing.

October 29 -

Mike Cagney’s current venture, Figure Technologies, is offering consumers the ability to apply online for home equity loans and get funding in as little as five days.

October 10 -

As upstart companies mature, they face pressure to develop deeper relationships with their customers. That is leading some to offer to a wider range of products, including deposit accounts.

April 12 -

Gill, who spent 14 years at Goldman, will fill a role that has been vacant since last summer at SoFi.

April 9 -

The percentage of 84-month loans has been shaved to 37.5% of the pool in SoFi's consumer loan program 2018-2 issuance, down from 45.4% in its prior transaction in January.

April 8 -

Medical residents are considered to be good credits but have less free cash flow than fully practicing doctors; the loans did not have a big impact on overall credit metrics of the $900 million deal.

March 19 -

Social Finance has acquired the engineering and product teams of mortgage startup Clara Lending, bolstering the financial technology company's offerings beyond student-loan refinancing, according to people familiar with the matter.

January 26 -

Stepping in after co-founder Mike Cagney's resignation, Twitter's Anthony Noto needs to overhaul the firm's corporate culture, lay the groundwork for an IPO and determine whether to renew SoFi's pursuit of a bank charter.

January 23 -

Introducing limits on federally guaranteed loans to graduate students, instead of letting them borrow whatever schools charge, would create a multibillion-dollar opportunity for private lenders.

November 30 -

The British banking giant has been testing its new online lending platform with a handful of its U.S. customers and plans to roll it out in full force next year. It's all part of a broader effort to expand its U.S. consumer business beyond credit cards.

November 21 -

Student loan platform Social Finance has withdrawn its application for deposit insurance, a month after former CEO Mike Cagney retired in the wake of sexual harassment allegations.

October 13 -

Navient and Social Finance are kicking off what’s expected to be a busy second half for student loan securitization with two deals totaling nearly $1.5 billion.

July 17 -

Over 45% of the borrowers the collateral pool have FICO scores above 760, compared with just 36.42% in the marketplace lender's most recent transaction, completed in May.

June 22 -

The online lender, which focuses on high-earning millennials, is offering assurances that it will also serve Americans who make less money. But the company has not convinced critics, who say the plans are inadequate.

June 15