-

Credit enhancement on the senior tranches of notes to be issued is unchanged from the prior six deals, at 24.38%; monthly payment rates by dealers continues to trend upward at 40.5%.

March 8 -

The performance of outstanding transactions issued via the Capital Auto Receivables Trust platform is weakening, so rating agencies are demanding additional investor protections.

March 8 -

Discover's master trust is issuing $800 million in its first deal since October; Scotiabank has priced US$600 million in card receivables in its first cardholder account securitization in two years.

March 8 -

DriveTime's improving loss performance in recent securitizations allowed it to relax the enhancement levels on its first securitization of the year.

March 2 -

The transaction is the second this year involving Santander's Chrysler Capital preferred-lender unit; in January Santander sold bonds on its first-ever deal backed by Fiat Chrysler leases.

March 1 -

Avoca CLO V was issued only the second default rating of a subordinate global CLO in the last four years, the result of an unpaid subordinate tranche in an early deal liquidation by manager KKR.

February 28 -

Verizon Wireless' sixth overall securitization of device-payment plans includes more subprime borrowers, but delinquencies remain low in its managed portfolio.

February 27 -

Despite the bankruptcy of its second-largest retail client, Comenity Bank is upsizing the first private-label card securitization of the year to $591 million.

February 22 -

The $410 million Ares XXXVIII CLO was the first U.S. collateralized loan obligation to reset, reprice or be issued since Angelo Gordon completed its Northwoods Capital XVI transaction on Feb. 15.

February 21 -

The No. 5 global shipping container lessor is marketing $250M in bonds backed by $573.2M in marine cargo ship containers. The portfolio has an unusually high concentration of dry containers.

February 20 -

For the fifth time since early 2016, American Honda Finance is hedging on oversubscribed demand for its prime-loan receivables-backed notes with a potential upsizing.

February 15 -

Westmont Hospitality Group has secured a $360 million first mortgage and $40 million mezzanine loan from Barclays and Morgan Stanley that is secured by a portfolio of 89 Red Roof locations in 25 states.

February 6 -

Lease contracts from the newly acquired business account for 5% of collateral for the $305.7 million transaction; the remainder is leases on construction and transportation equipment.

January 29 -

The credit quality of the collateral appears to have improved, but investor protections have also decreased; as a result, Kroll is only assigning an 'A' to the senior tranche of notes.

January 26 -

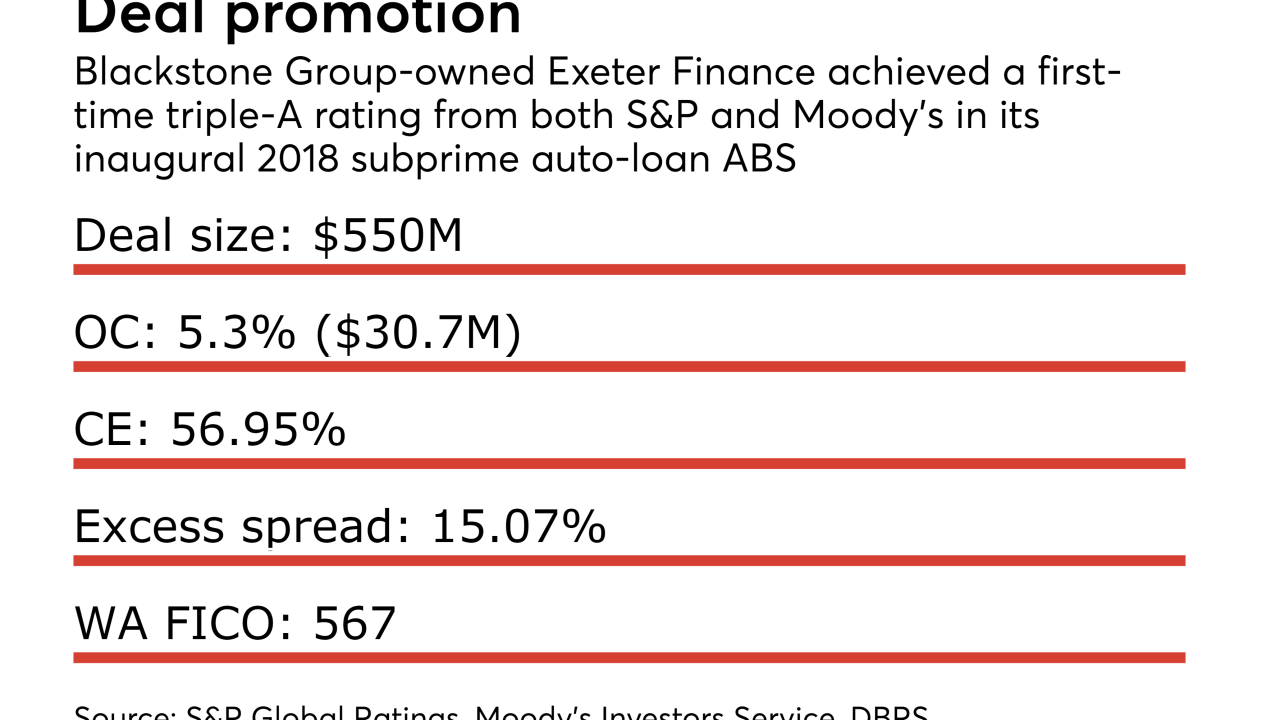

The Irving, Tex.-based specialty lender boosted senior-note credit enhancement levels and has stabilized portfolio losses to break the AA ratings cap on its deals, according to S&P Global Ratings.

January 19 -

The New York-based alternative asset manager is first out of the gate with a new-issue deal amidst a flurry of early reset/refinancing activity totaling $3.4 billion.

January 19 -

The first prime auto-loan securitizations for Ally Bank and captive-finance lenders for Toyota and Ford total $3.5-$4B, according to rating agency presale reports.

January 18 -

Initial expectations for cumulative net losses on the $1.15 billion transaction are higher than those of the sponsor's three prior deals, according to credit rating agency reports.

January 12 -

BMW Financial Services is launching its first U.S. auto-loan securitization in two years, while Daimler AG's U.S. captive finance arm is proposing a $1.3 billion to $2 billion pooling of luxury auto leases.

January 11 -

The lender's first deal of the year is sized at $750 million, in line with its two prior offerings, but the amount of collateral has been significantly increased, to over $1 billion.

January 11