-

For the fifth time since early 2016, American Honda Finance is hedging on oversubscribed demand for its prime-loan receivables-backed notes with a potential upsizing.

February 15 -

Westmont Hospitality Group has secured a $360 million first mortgage and $40 million mezzanine loan from Barclays and Morgan Stanley that is secured by a portfolio of 89 Red Roof locations in 25 states.

February 6 -

Lease contracts from the newly acquired business account for 5% of collateral for the $305.7 million transaction; the remainder is leases on construction and transportation equipment.

January 29 -

The credit quality of the collateral appears to have improved, but investor protections have also decreased; as a result, Kroll is only assigning an 'A' to the senior tranche of notes.

January 26 -

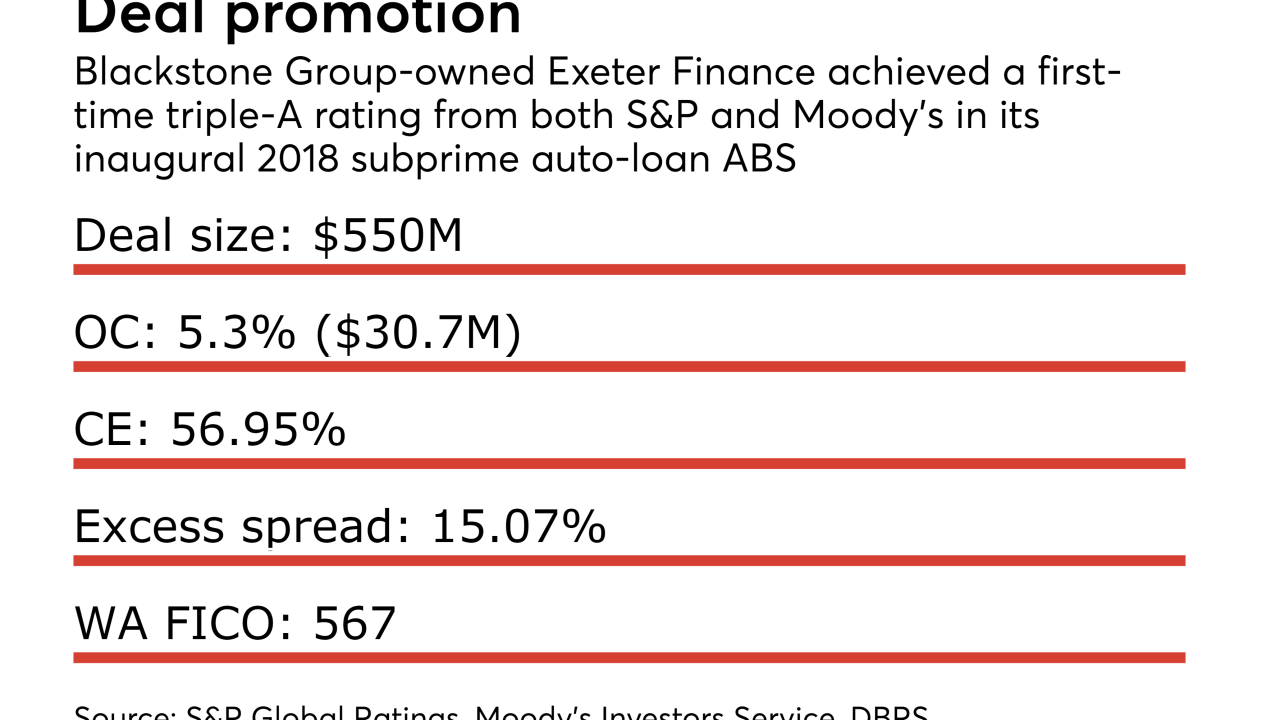

The Irving, Tex.-based specialty lender boosted senior-note credit enhancement levels and has stabilized portfolio losses to break the AA ratings cap on its deals, according to S&P Global Ratings.

January 19 -

The New York-based alternative asset manager is first out of the gate with a new-issue deal amidst a flurry of early reset/refinancing activity totaling $3.4 billion.

January 19 -

The first prime auto-loan securitizations for Ally Bank and captive-finance lenders for Toyota and Ford total $3.5-$4B, according to rating agency presale reports.

January 18 -

Initial expectations for cumulative net losses on the $1.15 billion transaction are higher than those of the sponsor's three prior deals, according to credit rating agency reports.

January 12 -

BMW Financial Services is launching its first U.S. auto-loan securitization in two years, while Daimler AG's U.S. captive finance arm is proposing a $1.3 billion to $2 billion pooling of luxury auto leases.

January 11 -

The lender's first deal of the year is sized at $750 million, in line with its two prior offerings, but the amount of collateral has been significantly increased, to over $1 billion.

January 11 -

The first subprime auto ABS deal for 2018 is the 30th overall for Consumer Portfolio Services, with caters to deep subprime borrower pools.

January 5 -

AXA Investment Advisors' two primary-issue CLOs in 2017 were each priced within the past month.

December 29 -

The collateralized loan obligation market is ending the year at nearly full throttle with nearly $18 billion in new deal/refi volume month-to-date, with more on the way.

December 20 -

Despite boosting credit enhancement, the sponsor was only able to earn an 'A' from S&P Global Ratings, which cited heightened competition and adverse borrower selection.

December 1 -

The bonds, which are backed by royalty payments and franchise fees, are expected to close in January; proceeds will be used in part to refinance a 2015 transaction.

November 29 -

Carlyle Euro CLO 2017-3 is the latest under its new shelf managed by affiliate CELF Advisors, with a AAA coupon of just 75 basis points over three-month Euribor.

November 28 -

The deal will relaunch with a weighted average spread (4.22%) and excess spread (2.86%) well above the three-month industry average for issued U.S. CLOs.

November 22 -

The largest loan is for the first phase of State Farm’s two-year-old Park Center Phase 1 office tower complex that the firm constructed in Dunwoody, Ga.

November 14 -

Nearly one-third of the vehicles in CIG Financial's $172 million transaction have mileage above 100,000; the highest-mileage car financed has 197,387.

November 13 -

The aerospace components manufacturer, one of the largest-held obligors in U.S. CLOs, is consolidating loans and tightening coupon spreads from 300 to 275 basis points over Libor.

November 10