-

Lender and servicers are increasingly using nontraditional methods such as "hybrid" appraisals and broker price opinions in an attempt to cut costs, but some are more reliable than others.

February 21 -

Nissan’s deal is backed by loans and will be sized at $1 billion or $1.3 billion, depending on demand. Hyundai Capital’s $1 billion transaction is backed by leases ranging from 24 to 48 months.

February 16 -

The all-senior note structure is backed by $812 million in loans, and supported by low 3.5% credit enhancement based on low historical loss rates of John Deere securitizations.

February 15 -

For the fifth time since early 2016, American Honda Finance is hedging on oversubscribed demand for its prime-loan receivables-backed notes with a potential upsizing.

February 15 -

It will use proceeds from the issuance of $640 million of bonds backed by wireless tower leases to help repay two deals totaling $755 million that were issued in 2013.

February 13 -

Over 94% of the collateral pool consists of diesel-engine vehicles, even though diesel cars have had waning interest among French drivers in the past decade.

February 1 -

The pooling of loans and leases for Volvo- and Mack-brand trucking and construction equipment is modeled largely on the credit and portfolio characteristics of seven prior securitizations by Volvo's VFS subsidiary.

February 1 -

While tightening down on cov-lite and subordinate loans, Marathon CLO XI's rules give the asset manager more room to trade in lower-credit and DIP loans.

January 31 -

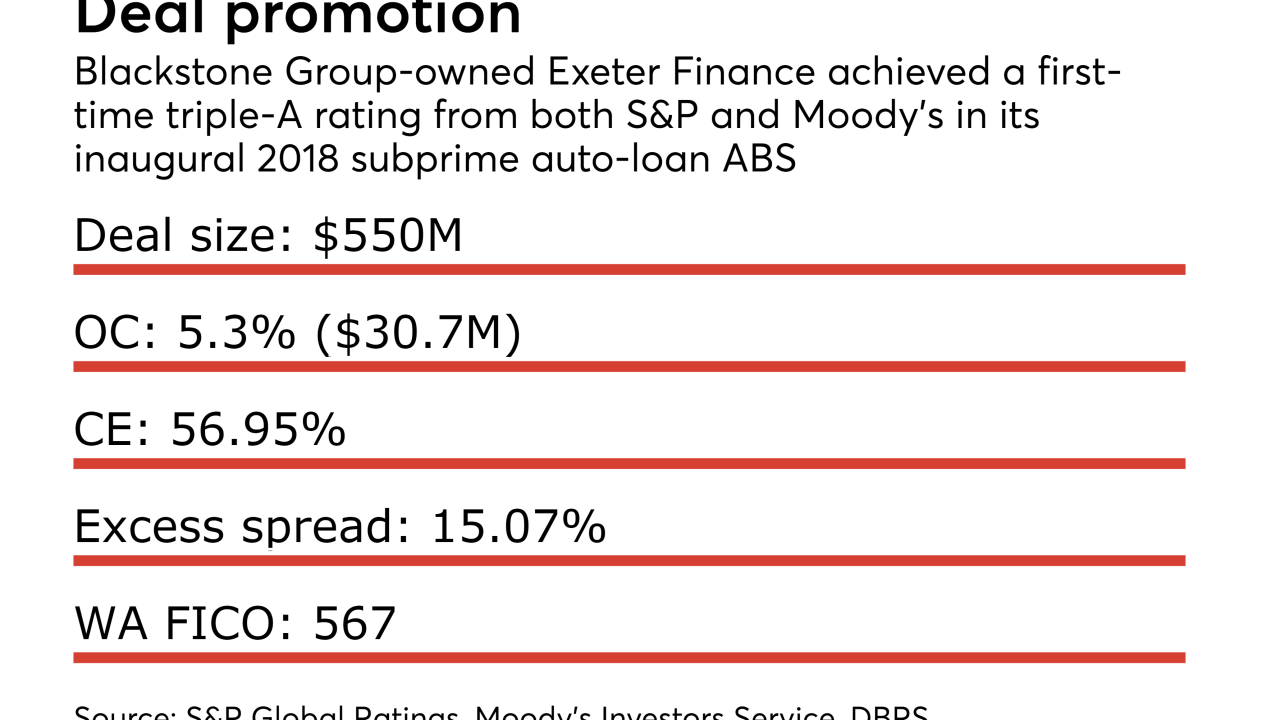

The Irving, Tex.-based specialty lender boosted senior-note credit enhancement levels and has stabilized portfolio losses to break the AA ratings cap on its deals, according to S&P Global Ratings.

January 19 -

The New York-based alternative asset manager is first out of the gate with a new-issue deal amidst a flurry of early reset/refinancing activity totaling $3.4 billion.

January 19 -

The first prime auto-loan securitizations for Ally Bank and captive-finance lenders for Toyota and Ford total $3.5-$4B, according to rating agency presale reports.

January 18 -

Improved underwriting allowed the lender to secure AAA ratings despite offering the lowest credit enhancement on senior SDART notes in three years.

January 11 -

Obvion, a €31.1B-asset lender with a 3.2% market share in the Netherlands, is placing more seasoned loans into its latest five-year revolving pool of prime loans.

January 10 -

AXA Investment Advisors' two primary-issue CLOs in 2017 were each priced within the past month.

December 29 -

Only 2.6% of speculative-grade rated firms with public financials carry Moody's weakest liquidity rating, a drastic reduction since March 2016, helped by a recovery in the oil and gas sector.

December 20 -

Junk-rated firms pay little tax, and so won't benefit much from a lower corporate rate. And this benefit could be offset by a limit on the interest deduction.

December 4 -

In its third securitization of cash-out auto loans, OneMain will for the first time include originations from the 1,000 legacy offices acquired from CitiFinancial.

November 30 -

CHT 2017-CSMO will issue six classes of notes in the $1.38 billion transaction, which will refinance a 2016 mortgage securitization and provide funds for renovation.

November 30 -

The bonds, which are backed by royalty payments and franchise fees, are expected to close in January; proceeds will be used in part to refinance a 2015 transaction.

November 29 -

Carlyle Euro CLO 2017-3 is the latest under its new shelf managed by affiliate CELF Advisors, with a AAA coupon of just 75 basis points over three-month Euribor.

November 28