-

The U.S. CLO manager breaks the ice with its first euro-denominated deal, which priced Friday and will close in May when it is about 75% ramped up.

March 27 -

Just over 20% of the balance are hotel loans, including the second-largest loan in the collateral pool, a $59.9 million portion of a $132.9 million loan used in a cashout refinancing of the Hilton Clearwater.

March 23 -

The money manager is preparing to refinance a $400 million deal originally printed in March 2016 that is currently grandfathered from risk retention rules - without bringing the deal into compliance.

March 21 -

Moody’s expects net losses over the life of NAVSL 2018-2 to be about 0.95%; that's up slightly from 0.9% for Navient's prevous deal, NAVSL 2018-1 due to the longer remaining terms of the collateral.

March 15 -

CBAM, the leading CLO issuer by volume in 2017, had a shorter non-call for its senior-note stack; Apex has split the AAA paper into three variable-priced tranches.

March 15 -

The €413 million transaction will issue exchangeable notes for the five senior tranches, allowing regulated U.S. banks the opportunity to invest, even though the portfolio includes bonds.

March 13 -

The transaction fills out the original available $7 billion capacity of the Sprint Spectrum trust program, which markets notes backed by the sale-leaseback receivables from Sprint's portfolio of spectrum licenses.

March 12 -

Discover's master trust is issuing $800 million in its first deal since October; Scotiabank has priced US$600 million in card receivables in its first cardholder account securitization in two years.

March 8 -

Citigroup and Goldman Sachs are securitizing a $405 million first mortgage taken out to help finance the private equity-led acquisition of the WoodSpring Suites low-priced extended-stay hotel chain.

March 5 -

Credit support on the senior tranche of the $800 million transaction is 19.25%, up 250 basis points on the comparable tranche of the sponsor's previous deal to offset the impact of falling used car prices.

February 27 -

Lender and servicers are increasingly using nontraditional methods such as "hybrid" appraisals and broker price opinions in an attempt to cut costs, but some are more reliable than others.

February 21 -

Nissan’s deal is backed by loans and will be sized at $1 billion or $1.3 billion, depending on demand. Hyundai Capital’s $1 billion transaction is backed by leases ranging from 24 to 48 months.

February 16 -

The all-senior note structure is backed by $812 million in loans, and supported by low 3.5% credit enhancement based on low historical loss rates of John Deere securitizations.

February 15 -

For the fifth time since early 2016, American Honda Finance is hedging on oversubscribed demand for its prime-loan receivables-backed notes with a potential upsizing.

February 15 -

It will use proceeds from the issuance of $640 million of bonds backed by wireless tower leases to help repay two deals totaling $755 million that were issued in 2013.

February 13 -

Over 94% of the collateral pool consists of diesel-engine vehicles, even though diesel cars have had waning interest among French drivers in the past decade.

February 1 -

The pooling of loans and leases for Volvo- and Mack-brand trucking and construction equipment is modeled largely on the credit and portfolio characteristics of seven prior securitizations by Volvo's VFS subsidiary.

February 1 -

While tightening down on cov-lite and subordinate loans, Marathon CLO XI's rules give the asset manager more room to trade in lower-credit and DIP loans.

January 31 -

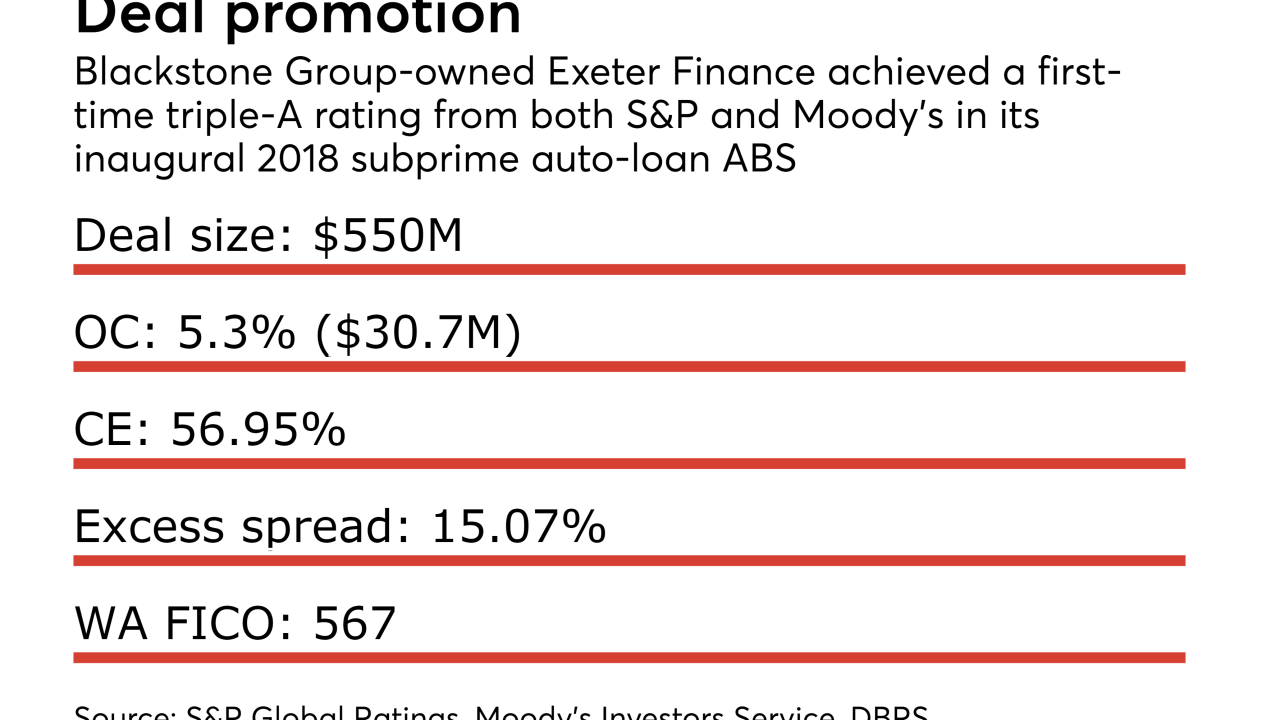

The Irving, Tex.-based specialty lender boosted senior-note credit enhancement levels and has stabilized portfolio losses to break the AA ratings cap on its deals, according to S&P Global Ratings.

January 19 -

The New York-based alternative asset manager is first out of the gate with a new-issue deal amidst a flurry of early reset/refinancing activity totaling $3.4 billion.

January 19