Bank of America

Bank of America

Bank of America Corp is one of the largest financial institutions in the United States, with more than $2.5 trillion in assets. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets.

-

TALNT 2025-1's notes benefit from initial hard credit enhancement that totals 6.33% of the note balance.

June 9 -

The vehicles comprise the overcollateralization (OC), because of a highly liquid secondary market for them. That OC rate will shift according to the fleet mix.

June 5 -

1988 Asset Management has priced and closed $2.5 billion in CLOs in the U.S., and the partnership expects to issue CLOs regularly in Europe.

May 29 -

The US 10-year term premium — or the extra return investors demand to own longer-term debt instead of a series of shorter ones — has climbed to near 1%, a level last seen in 2014.

May 23 -

BAAT Auto Trust series 2025-1, has a super-prime underlying borrower base, as FICO scores exceeding 800 made up 55.2% of the pool.

May 20 -

The WA original term is about 68 months for all three pools. That is shorter than the term on the previous series, but within the range of terms on recent deals.

May 16 -

Industry diversification and strong borrower financials bode well for CLO prospects in uncertain times.

May 12 -

The transaction's senior, interest-only tranches, which are also initially exchangeable, pay a coupon of 0.50%.

May 6 -

Among its structural strengths, DEFT 2025-1 includes a non-declining reserve account representing 1.0% of the pool balance.

April 28 -

The structure includes credit enhancement from overcollateralization representing 16.4% of the pool balance.

April 16 -

The notes will be issued through series 2025-3 and 2025-4, and aside from slightly different maturity dates, they have similar initial overcollateralization and reserves.

April 1 -

Almost the entire pool of mortgages will fund primary residences and were underwritten using full documentation.

March 19 -

Fitch notes that 74.8% of the collateral pool, made up entirely of 3,103 loans, is backed by trucking—or transportation—equipment.

March 5 -

Total delinquencies as a percentage of John Deere's managed portfolio was 3.06%, an increase since 2022. That aligns with the decline in corn and soy prices in the same period.

March 3 -

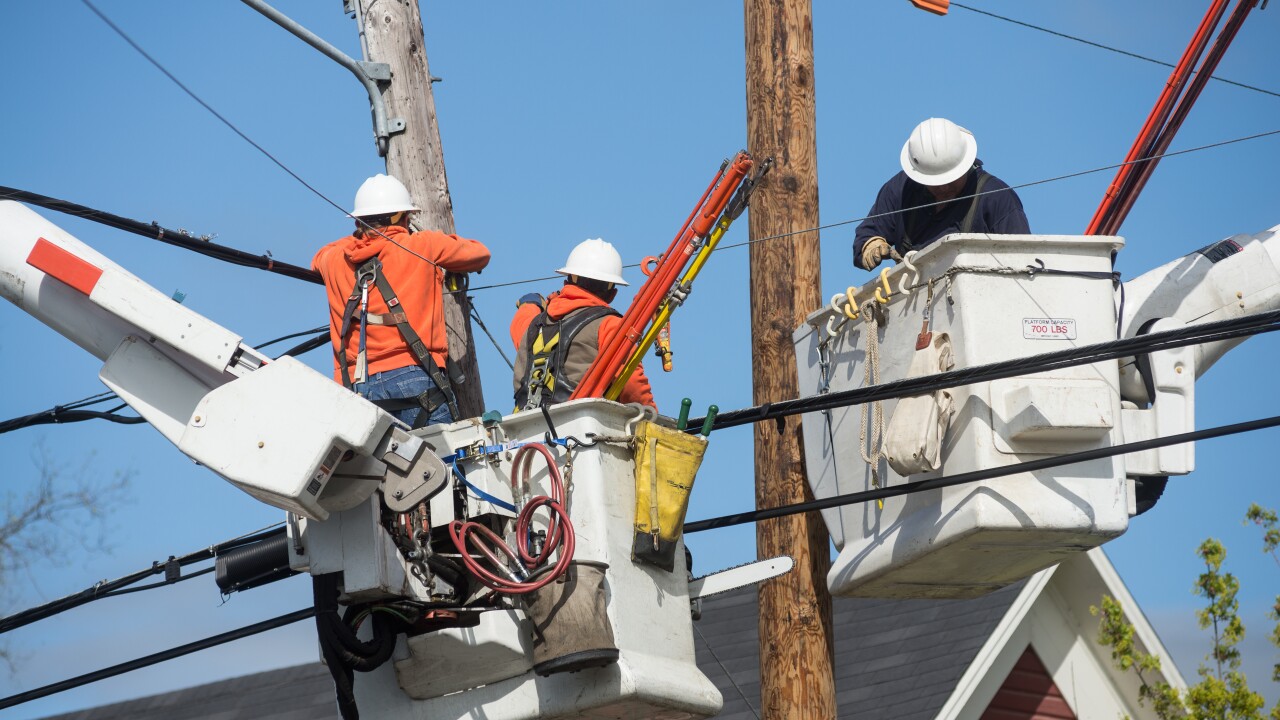

Residential customers made up 70.1% of NYSEG's sales revenue, while commercial and industrial customers account for the other 30% of sales. The latter is a relatively high exposure for such deals.

February 4 -

Obligors are slightly more concentrated but the percentage of obligors in higher credit quality grades—2 through 5—increased to 56.9%, from 41.3% from the previous deal.

January 21 -

The issuance marks the first time a multilateral climate fund is turning to the capital markets, as cash-strapped developed nations balk at providing the funds needed to cut greenhouse gas emissions.

January 15 -

Bank of America, Citigroup, Wells Fargo and Goldman Sachs have also withdrawn from the Net-Zero Banking Alliance in the past month, as President-elect Donald Trump prepares to take office.

January 2 -

Borrowers had an original FICO score of 774. A little over a quarter of the borrowers, 25.1%, are self-employed.

December 27 -

Moody's says its cumulative net loss expectation for the PFAST 2024-1 pool is 0.70%, and puts its losses on the Aaa stress level at 4.75%.

December 3