Collateralized loan obligations comprise less than 1% of all banks' securities, but these minor bank holdings received temporary fame recently when investors used

We disagree with the central point in the article that indicates the U.S. banking system has a near-term issue with CLOs.

Just 137 out of 5,276 institutions insured by the Federal Deposit Insurance Corp. hold CLOs, which are technically called “structured financial products” on call reports.

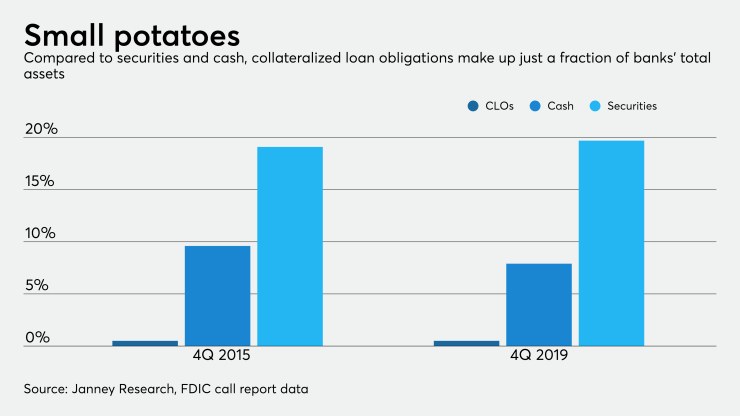

Overall banks’ securities totalled $4.3 trillion as of the first quarter, according to FDIC data. In addition, there was cash of $2.4 trillion held on all banks’ balance sheets.

CLOs amounted to $104 billion at all FDIC-insured banks in the U.S. as of March 31.

Moreover, aggregate securities and cash have increased by more $3 trillion from the fourth quarter of 2010 to the first quarter this year (overwhelming the modest $72 billion growth in CLOs at all FDIC banks). We see risk to CLOs as immaterial to regulated banks given the limited size outlined

It’s true that

Also, most banks that hold CLOs tend

The pricing on CLOs faced temporary illiquidity during the March swoon in global financial markets, which led to weak prices for mark-to-market purposes at March 31.

However, in the past 10 weeks CLO prices have improved significantly. Banks

Editor's note: This article originally appeared, in slightly different form, in an analyst note to Janney Montgomery Scott clients.