Credit quality can only go downhill from here.

Speaking at an industry conference Thursday, the heads of several big banks — including JPMorgan Chase, Bank of America and U.S. Bancorp — warned of looming deterioration in their loan books.

In the years following the crisis, asset quality has been on an upswing. Chargeoff rates have declined steadily as banks have worked through bad mortgages and consumers have gotten back on solid ground.

But don't expect the good times to last, executives said. On both the consumer and commercial sides of the business, a range of economic factors — from rising interest rates to rapid growth in niche lending categories — will likely lead to an increase in problem loans over the long term.

"Energy was your first peek at it all," said Richard Davis, the chairman and chief executive of U.S. Bancorp. "All of a sudden one portfolio goes quickly. …It will be something else later."

Credit concerns will emerge as a "meaningful issue" for banks once rates rise and consumers and businesses begin to run into problems repaying their loans, Davis said.

"It's not going to get bad — it's just going to get worse," said Jamie Dimon, the chairman and CEO of JPMorgan Chase, noting that he expects a cyclical uptick in losses in credit cards and commercial loans. "In the middle market, we haven't had losses for years," Dimon said.

The comments come amid signs of credit issues across the industry.

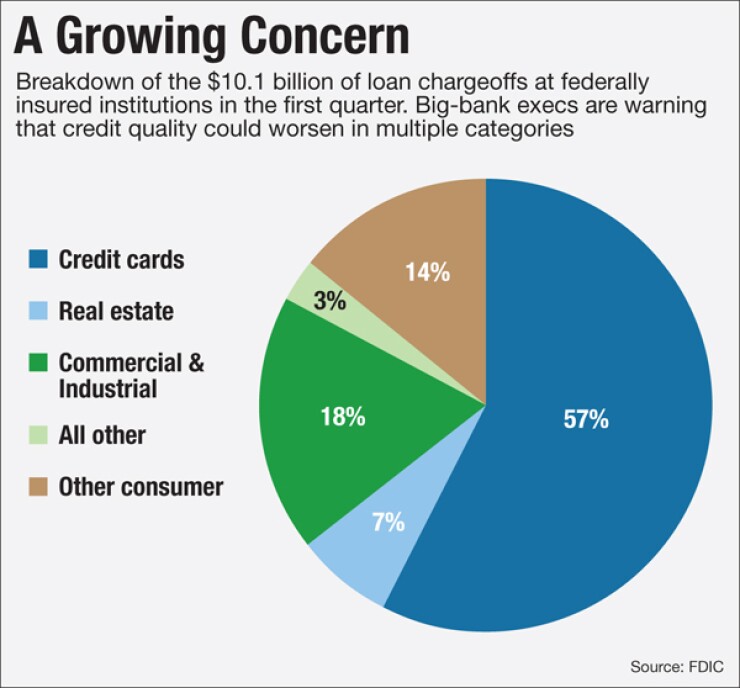

The Federal Deposit Corp. said Wednesday that problem loans are on the rise, as net chargeoffs rose 12.3% in the first quarter from a year earlier to $10.1 billion. That marked the second consecutive quarter that chargeoffs rose, the agency said.

More than half of the chargeoffs came from credit cards, while commercial and industrial loans accounted for 18% of total chargeoffs, the agency said in its quarterly banking profile.

Still most of the industry's current headaches are coming from energy. During the quarter banks reported an uptick in noncurrent loans as companies struggled with lower energy prices, according to the FDIC.

Big-bank executives acknowledged Thursday that their recent energy woes have continued into the second quarter.

JPMorgan, for instance, expects to report higher reserves on oil loans in the second quarter as a handful of large oil borrowers are still reeling from the market crash.

"You're still going to see bankruptcies," Dimon said, though he noted the company's increase in oil reserves would not be "material."

During JPMorgan's

Other executives said the impact of low oil prices has stabilized across the industry. "It is what it is right now," said Brian Moynihan, the chairman and CEO of Bank of America.

In addition to oil, auto loans were another source of concern, as bank executives criticized what they described as excessive risk-taking in the subprime auto market. Competition has heated up as several nonbank players have begun adjusting loan-to-value ratios, Dimon said.

"Someone is going to get hurt," he said.

Growth in the commercial real estate market was another source of worry. Over the past year, for instance, the $428 billion-asset U.S. Bancorp has scaled back CRE lending amid concerns that several major markets cannot support the current pace of construction.

During the first quarter the Minneapolis company cut its CRE portfolio by nearly 1%, to just over $42 billion. That book will likely remain "flattish" in the near future, Davis said.

He added that other bankers should take caution even though the current market for CRE loans remains solid.

"You're going to regret it later if things don't stay where they are," Davis said.