DDR, a publicly traded real estate investment trust that specializes in shopping malls, is tapping the commercial bond market to help finance the spinout of part of its portfolio into a new REIT called Retail Value Inc, or RIV. DDR announced plans to spin RVI off in December 2017; the new REIT is expected to hold an initial public offering of its stock in July of this year.

In February, RVI obtained a $1.35 billion mortgage that was co-originated by Column Financial (60%), JPMorgan Chase (20%), and Wells Fargo (20%) ; proceeds were used to pay off $900 million of unsecured subordinate debt securities held by parent DDR, refinance approximately $350 million of existing debt, fund reserves, and pay closing costs, according to Kroll Bond Rating Agency.

The new loan is secured 38 retail properties in the U.S. and a pledge of cash flows and insurance proceeds from 12 Puerto Rico retail properties, as well as a pledge of the equity interests in the owners of the Puerto Rico portfolio borrowers.

The loan, which pays interest of one-month Libor plus 3.30%, and no principal, for its entire extended term of up to five years, is being used as collateral for a mortgage bond offering called RETL 2018-RVP.

Kroll considers that transaction to be highly leveraged; it puts the loan-to-value ratio of the debt held in the securitization trust at 98.5%, though this is based on a conservative valuation of the properties that it roughly half their appraised values. By comparison, the 19 single-borrower securitizations rated by KBRA over the last 12 months had LTVs ranging from 61.9% to 117.9%.

On the other hand, 98.5% is below the average LTV of the retail properties securitized in the 35 conduits rated by Kroll over the past 12 months of 102.8%.

And, unlike many recent single-borrower securitizations, there is no additional debt in place and no future debt is permitted. This is a plus, since higher leverage can increase the probability of default, and additional debt can introduce new classes of creditors that could complicate a workout.

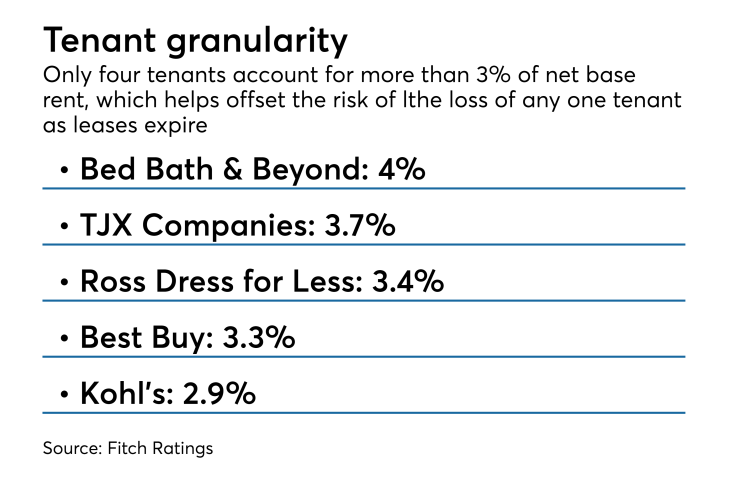

Another risk is the fact that leases representing 62.1% of base rent are scheduled to expire over the fully extended five-year loan term. There are two years, 2021 (15.7%) and 2022 (16.8%), where leases accounting for more than 15.0% of base rent roll. However, Kroll believes that this risk is somewhat mitigated by the granularity of the tenant base of approximately 945 tenants, only three of which account for more than 3% of the portfolio’s total base rent: Bed Bath & Beyond (4.1%), Best Buy (3.5%) and Ross Dress for Less (3.4%).

About those properties in Puerto Rico.

Kroll’s presale notes, dryly, that the U.S. territory, where many still lack power five months after a hurricane trampled the power grid, is “struggling economically.” Indeed, all of the properties in the Puerto Rico sustained hurricane damage.

What’s more, the representations and warranties in the loan agreement pertaining to the Puerto Rico properties have carve-outs and qualifications that “significantly impair” their value. They are subject to “the present and actual knowledge of the CFO of the borrower as of the origination date without any duty of inquiry or duty to investigate or update,” for one. The reps and warranties also carve out prior hurricane damage and any subsequent restoration of the Puerto Rico properties.

On the plus side, Kroll notes that eight (24.5%) of the 12 properties are “anchored or shadow anchored by a needs-based tenant such as a grocery store or a pharmacy."