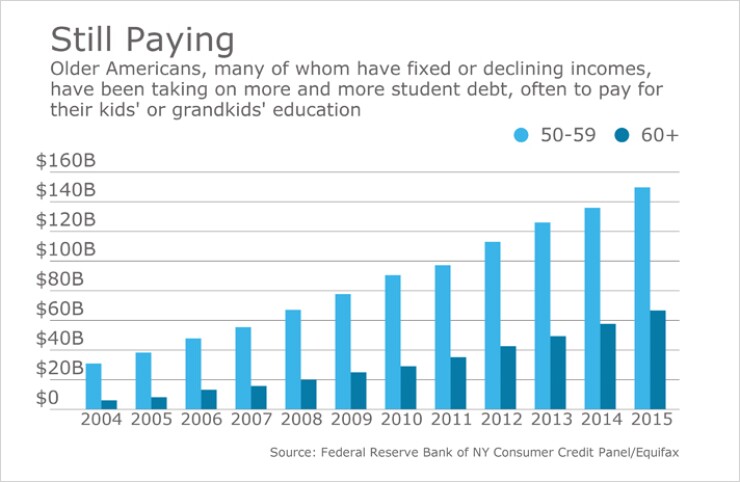

The face of U.S. student loan debt is usually an underemployed twentysomething. But increasingly, the burden of paying for higher education is falling on older Americans.

In a new

Perhaps most worrying is that these older borrowers are having much more difficulty making their payments than younger borrowers are. The report finds that 37% of federal student loan borrowers who are 65 or older are in default, compared with 17% of borrowers under the age of 50.

What's more, the proportion of delinquent student loan debt that is held by borrowers ages 60 and above rose from 7.4% in 2005 to 12.5% in 2012. Americans ages 60 and older owe roughly 5.4% of all student loan debt, up from just 1.8% about a decade earlier.

"Older student loan borrowers are often ignored," lamented Persis Yu, director of the student loan borrower assistance project at the National Consumer Law Center.

The CFPB report, which compiles the findings of other researchers, carries important implications for both the federal student loan program and for banks that make private student loans. Both face the risk of rising defaults as older Americans stretch thinner to pay for higher education.

As college tuitions have climbed, parents and grandparents of students have been shouldering a larger share of the cost. Often they borrow through a federal program called Parent Plus. The program allows parents to borrow in amounts up to the full cost of tuition, without regard for their ability to repay the loan.

That recipe can be problematic, especially when the borrowers are past their peak earning years.

"You can get a Parent Plus loan if you're poor. You can get a Parent Plus loan if you're poor and in your 60s," said Jason Delisle, a resident fellow at the American Enterprise Institute, a right-leaning think tank.

The CFPB expressed concern that student debt is preventing some older Americans from paying for basic needs in their lives. The agency cited survey data from 2014, which found that 39% of consumers ages 60 and older with a student loan said that they skipped necessary health care needs, compared with 25% of older consumers who do not have student debt.

But Delisle is skeptical of the conclusion that the high delinquency rates mean graying borrowers are all in dire financial straits.

He said that some older consumers — including many who already own a house, and are not terribly concerned about hurting their credit scores — may be making a rational decision not to make payments on student loans.

"It may not be entirely a picture of people struggling or overwhelmed by debt, as the CFPB would have it," he said.

Delisle is a critic of the Parent Plus program, but he doubts that Congress will reform it anytime soon, given the political sway of middle-class families that use the program.

If the program were to be scaled back, the beneficiaries would likely include banks that make private loans, since more students and parents would need to look beyond the federal government to finance higher education.

The CFPB report also offers a note of caution regarding the private market, which represents roughly 7.5% of all outstanding U.S. student debt. Since the financial crisis, private lenders have increasingly required borrowers to get a co-signer, in order to increase the likelihood that the debt will be repaid.

The CFPB estimates that 57% of all co-signers are 55 or older, and raises questions about their ability to meet their financial obligations.

"Unlike their younger counterparts, who generally are expected to experience income growth over their lives, older consumers typically experience a decrease in income as they age," the report states.

A lot of co-signers on student loans may fail to comprehend that they are on the hook if the student fails to repay the debt, said Dan Feshbach, president of MeasureOne, a data analytics firm for private student lenders.

"I think the key to this is that co-signers need to understand the responsibility that comes along with co-signing a loan," Feshbach said.