Small-business financing is getting a boost — as OnDeck Asset Securitization Trust III comes to market for its fifth term securitization with $300 million in notes.

Under the master trust structure, the fixed-rate, asset-backed notes in the 2021-1 series will revolve on a three-year term. After April 30, 2024, the principal on the notes will pay down sequentially, beginning with the Class A notes, according to Morningstar | DBRS, which rated the Class A senior notes ‘AAA.’

In terms of credit strengths, DBRS noted the deal’s over collateralization, subordination, excess spread, and a cash reserve account.

The cash reserve account plays a dynamic role in credit enhancement. Non-declining and fully funded at closing, the account is equal to 0.75% of the series’ required asset amount. The reserve account will be available to pay principal on the series 2021-1 notes if an amortization event occurs.

Also, the required asset amount will step up to the sum of the series 2021-1 aggregate excess concentration amount; 8% of the adjusted investment amount in classes A, B, C and D; and the adjusted investment amount in classes A, B, C, and D following the end of the revolving period.

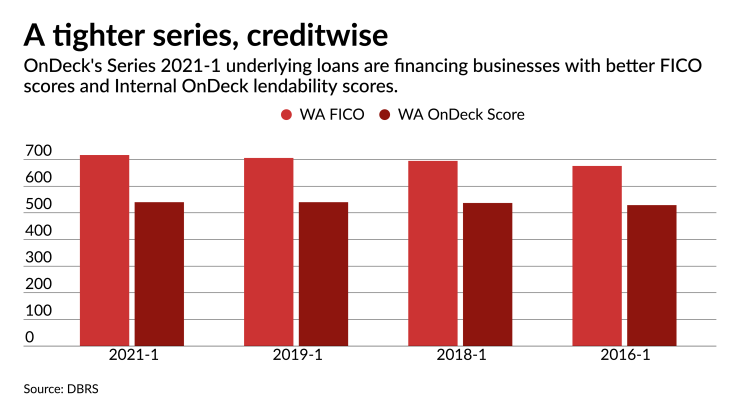

The underlying pool’s credit quality was also a big consideration. The pooled loans are relatively short term, with a weighted-average original term of about 12.8 months. They also generate a weighted-average yield of 47.39%, giving significant first-loss protection through excess spread.

DBRS rated the on the $49.4 million class B notes ‘A;’ the $29.2 million class C notes ‘BBB;’ and the $20.5 million class D notes ‘BB.’

OnDeck Capital, headquartered in New York City, focuses on lending to small businesses that have been historically underserved by traditional financial institutions, according to the company’s website.

Through term loans and lines of credit, OnDeck provides financing to small businesses across more than 700 industries in amounts ranging from $5,000 to $500,000, according to DBRS, and as of December 31, 2020, the entities OnDeck and ODK had originated more than 209,664 term loans with an aggregate original principal amount of about $11.3 billion.