Another subprime auto lender appears to be closing up shop as more of its loans go bad; it remains to be seen whether investors in a $135 million securitization it completed in 2016 are sufficiently insulated from losses.

Sierra Auto Finance ceased originations in August 2018, when Wells Fargo withdrew its warehouse line of credit. At the time, the lender said it would continue to service its loans. Despite have lost several senior managers earlier in the year, it also held out the possibility that it might restart originating when capital markets conditions warrant.

That may no longer be in the cards.

On March 14, Kroll Bond Rating Agency said it had received notice that Sierra had transferred servicing to First Investors Servicing Corp. as of March 4. Kroll is not taking any action at this time; however the rating agency will continue to monitor the developments of the servicing transition and the performance of the auto asset-backeds.

Kroll did not provide an update on the performance of Sierra’s loan portfolio. But as of December, losses were running ahead of its expectations.

The Class A notes issued by Sierra Auto Receivables Securitization Trust 2016-1 (SARST 2016-1), which were rated A by both Kroll and S&P Global Ratings, paid off in November 2018, so those investors are in the clear.

Both Kroll and S&P had previously affirmed their BBB ratings on the Class B notes, despite the higher-than-expected losses. As of December, the credit enhancement on these notes had actually increased, to 67.37% from 25.19% at issuance (per Kroll), as proceeds from interest and principal payments on the collateral were used to pay down principal on the notes, boosting overcollateralization.

Kroll also affirmed its BB rating on the class C notes, citing an increase in the overcollateralization to 26.08% from 15% at issuance. But S&P put its BB rating under review for a possible downgrade, citing its expectations that cumulative net losses on the collateral could reach 25% of the original principal balance, five percentage points higher than it had originally expected.

On March 28, S&P issued a statement saying it was keeping the the Class C notes under review for another 90 days to gauge the impact of the servicing transfer. "We expect the pace of delinquencies, and possibly losses, to increase initially for the first few months, and then stabilize thereafter," the rating agency said. "At this time, although the transaction is currently just below its target O/C of 20% (currently 19.65%), the hard credit enhancement for class C continues to grow (26.62% for the March distribution date)." It attributed the slight decline in overcollateralization to the increase in gross charge-offs as the company manages down its repossession inventory.

While hiring a subservicer is a necessary step for a lender winding down its operations, this kind of transaction comes with its own risk: a potential disruption in payment collections. Kroll did not discuss this risk in its statement, but it has raised the concern in a similar situation, when Honor Finance

Both S&P and Kroll have since downgraded the most subordinate tranche of notes issued by Honor in a 2016 securitization.

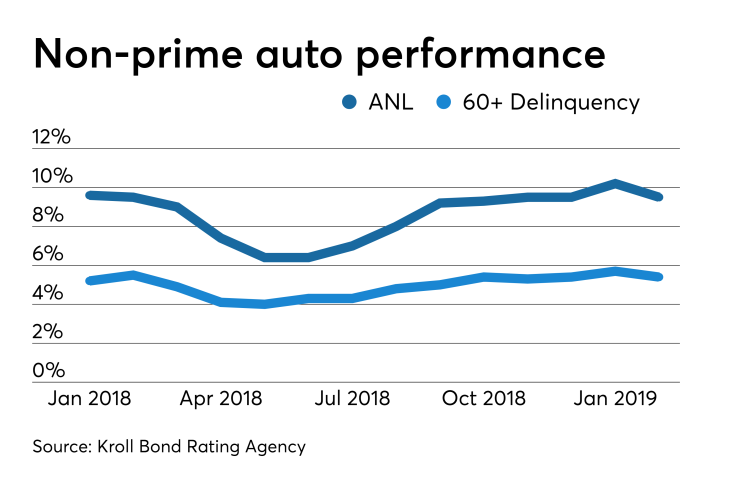

Honor and Sierra, which is controlled by Emerald Development Managers, a venture capital firm, still appear to be outliers, however. On March 13, Kroll published data indicating that credit performance improved across most securitized auto loan pools it tracks in February. The rating agency's Non-Prime Auto Loan Index posted annualized net losses of 9.45%, which was down 80 basis points on the month and two basis points on the year. Delinquency rates also improved, declining 26 basis point month-on-month and 11 basis points year-on-year to 5.44%.

The strong non-prime collateral performance was mostly driven by lower losses and delinquencies in the DriveTime and Santander ABS shelves, per Kroll.

The rating agency expects delinquency and loss rates to continue to improve in March as borrowers continue to receive tax refunds, providing an additional source of cash flow to help them pay their auto loans.