Is it time for asset-backed deals to go back to Treasurys as their pricing benchmark?

This is a question that researchers at J.P. Morgan are posing to the market.

Much of the securitization universe—from auto loan deals to commercial-mortgage backeds—uses what’s known as the “swaps curve” to price floating-rate deals. Before 2000, Treasurys were the go-to benchmark.

The swaps curve is derived from swaps, which are agreements to exchange one set of cash flows for another. The pricing of these agreements helps creates a curve of fixed interest rates across different maturities in time.

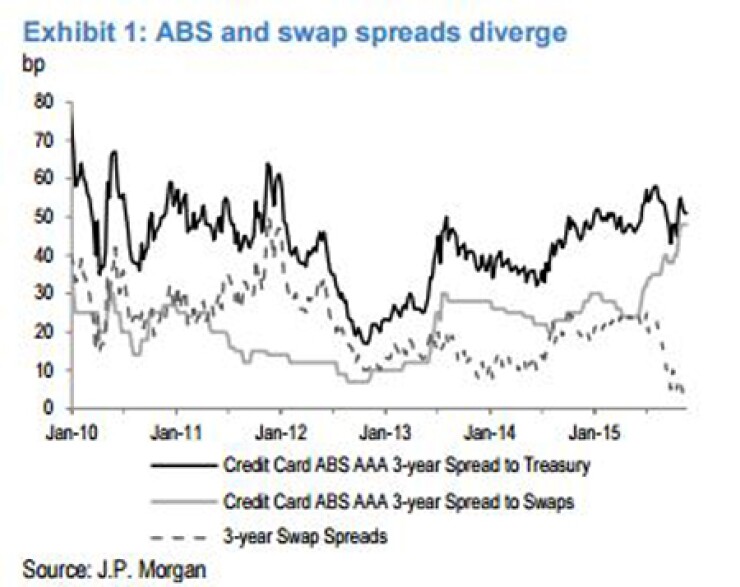

More often than not, the spread between the swaps curve and Treasurys, and the spread between asset-backeds and the swaps curve, have moved more or less in tandem.

But since the summer this hasn’t been the case.

While spreads between the swaps curve and asset-backeds have widened since mid-year—an expected effect of global economic uncertainty and a looming rate hike by the Fed—the spread between the swaps curve and Treasurys has plummeted.

As an example, the analysts use three-year, triple-A deals backed by credit card receivables. They’re now pricing against swaps about 24 basis points above the level of early June. But the three-year swap spreads on corresponding Treasurys has tightened 21 basis points.

So on a net basis, triple-A credit card deals have actually inched out only three basis points over three-year Treasurys.

While there are factors particular to securitization and this particular sector that explains this divergence, it doesn’t justify all of it, in the view of the analysts.

It also is causing market participants to question the efficacy of the swaps curve as an ABS benchmark in the U.S. In Europe, swaps are used to price asset-backeds as well as corporates.

Legacy of LTCM

It was in 2000 that asset-backed deals in the U.S. switched from pricing against Treasurys to using swaps.

The catalyst was the 1998 financial crisis. The turmoil fueled by Russia’s economic tailspin and the collapse of the hedge fund Long-Term Capital Management “highlighted the risks of using government bonds” as hedging instruments.

As investors fled to the Treasury market, they focused on the most liquid ones, creating massive pricing

A couple of years later, auto loans deals from Ford and GMAC initiated what is now standard practice: using the swaps curve as a pricing benchmark.

Still, the corporate bond market has stuck to Treasurys.

The J.P. Morgan analysts said the swap curve has worked well since its widespread adoption among asset-backeds.

But that might not be so true anymore.

“The structural changes mean that swap spreads will not simply follow Treasuries higher,” the analysts said.

Among these changes: “The move to centralized clearing, the exit of many mortgage hedgers, plus more recently, shrinking dealer/hedge fund balance sheets, heavy corporate issuance, and most recently FX reserve outflows have landed swap spreads where they are today, with no buffer to the zero bound.”

So there might be an argument to be made that pricing ABS to Treasury is becoming more preferable.

JP Morgan has launched