It’s no coincidence that the first two transactions of the year financing the installation of residential solar panels were backed by loans, as opposed to leases.

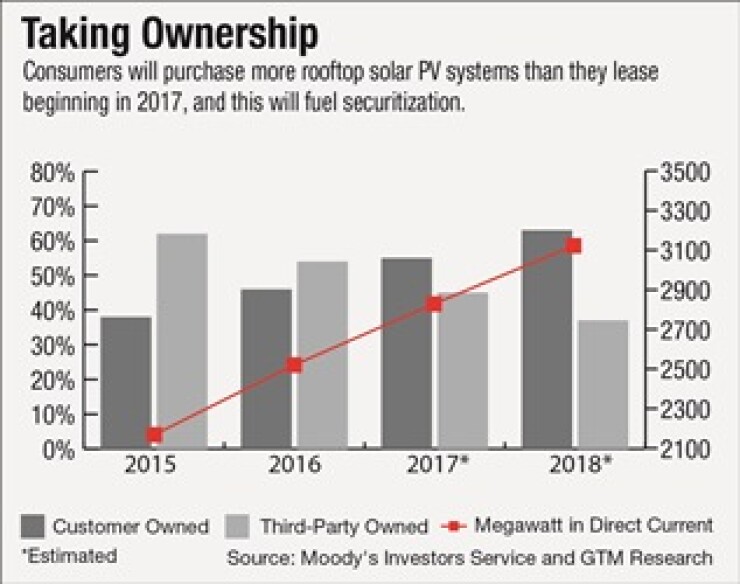

As costs continue to fall, homeowners are increasingly opting to purchase solar photovoltaic (PV) systems, rather than allowing a developer to pay for installation and entering into a long-term power purchasing agreement (PPA).

Owning could offer more savings than leasing, since homeowners who own their PV system have a claim to the federal Investment Tax Credit (ITC) of 30%. They may also enjoy additional savings once they pay off the loan.

“Loans are faster and easier [to issue], and loans are more straightforward and easier to understand” for consumers, said Tracy Rice, a vice president and senior credit officer at Moody’s Investors Service.

Better Savings, Easier to Understand

A report Moody’s published in December called for increased issuance of bonds backed by solar loans as loan originations are expected grow this year. This call is based in part on a forecast by GTM Research that in 2017 customers will own more than half of the new residential solar PV systems.

Moody’s noted that the fixed monthly payments of solar loans are likely to be more appealing to consumers than solar leases and PPAs with annual escalators.

Right on cue, two developers,

SolarCity’s $145 million deal pools more than 9,600 “MyPower” loans, a product that was launched early in 2015, but has been scratched in favor of another product. The weighted average FICO score of customers in the pool is 728; the average remaining term of the loans is 352 months, according to KBRA, which assigned an ‘A-‘ to the senior tranche of notes to be issued.

This was SolarCity’s second offering backed by loans, as opposed to leases; the first was completed in December 2015. The company has also issued five transactions backed by leases.

Solar Mosaic’s $138.95 million offering is backed by 6,487 installation loans made primarily to prime borrowers (with a weighted average FICO of 746) who take out an average of $27,947 at 4.34% interest over 17 years to fund installations, according to KBRA.

The collateral is comprised of two loan types: “dual rate” loans (which are no longer originated) and “PowerSwitch" products. Both amortize rapidly, allowing consumers to pay down at least 30% of the loan balance within 18 months. The dual rate loans, which make up nearly 40% (or $71.09 million) of the pool, impose a step-up rate on consumers that don’t hit the balance reduction mark; for the pool of $106.8 million single-rate PowerSwitch loans, the rate does not change but the principal can be re-amortized if it is not repaid rapidly enough.

The single tranche to be issued in the deal is rated ‘A’, one notch higher than the senior tranche of SolarCity’s deal.

The first rated transaction with any loans used as collateral may have been by SunRun, in 2015. The $111 million offering was backed by a mix of loans and leases.

Issuance of bonds backed by solar loans and lease reached $242 million in the first 11 months of 2016, according to Moody’s. That brought outstandings to $700 million.

(To some extent, PV developers compete with financing provided by Property Assessed Clean Energy (PACE), property assessments that are used to finance all kinds of energy efficiency upgrades. PACE providers have tapped the securitization market more frequently; market leader Renovate America surpassed $2 billion in outstanding green-bond deals on its HERO platform in December.)

Pros and Cons for Investors

While loans offer potential benefits over leases for consumers, they also have different kinds of risks for investors. Ownership bestows on consumers the cost of maintenance and service, which may impact their willingness to pay back the loan if repair costs escalate and they do not have a service agreement (Both SolarCity and Mosaic assume responsibility for defaulted loans). Although lacking historical data on solar loan payments, KBRA assumes an 8.5% default rate on SolarCity's deal, based in part on data from unsecured consumer loans.

KBRA analyst and senior director Cecil Smart, Jr., says there was not much difference in the credit quality of the new solar-loan backed deals vs. the previous lease/PPA securitizations.

But Moody’s noted in December the average credit quality of solar ABS transactions backed by loans may become lower than lease-supported deals because third-party investors who purchase the tax equity from providers impose minimum FICO requirements for lessees. However, the rating agency noted in its December report that FICO scores are likely less predictive in determining the probability of default for solar customers compared with obligors of other consumer leases and loans, owing to the essential nature of electricity and the economic benefits of solar contracts.

As with outstanding deals, new transactions in 2017 will have concentration risk owing to a large portion of the customers concentrated in a few U.S. states, according to Moody’s. “As a result, an adverse regulatory change in one or more of these states will affect a large proportion of the securitized assets,” the report states. “These risks will stem mainly from changes to net metering rules, the imposition of fixed charges by utility companies and the potential change in utility rates.”

Another risk equally true of securitizations of SolarCity and Mosaic loans and leases: the two companies have yet to turn a profit, though they have strong support from their parent companies. SolarCity last November was acquired by Tesla Motors in a controversial $2 billion merger (and placing as chairman tech entrepreneur Elon Musk, owner of Tesla and Space Exploration Technologies). Solar Mosaic last year received a $220 million private equity investment from sponsor Warburg Pincus.

Tax Credits in Question

Uncertainty about the future of tax credits could impact both lending and leasing. Tax equity has been the primary means of financing solar and other renewable energy projects (a $4.5 billion market in 2015, according to Project Finance Newswire). Most solar panel developers are not profitable enough to use the offset, so they sell the credits to third-party investors.

The tax credit is set to be phased out over the next five years. It currently stands at 30%, but will step down to 26% in 2020 and 20% in 2021 before disappearing. While it has been extended before, the concern is now that it could be repealed.

In November, Roth Capital Partners warned that this was a "meaningful probability" because of political uncertainty under the incoming Trump administration's plans during the campaign to fund a major corporate tax rate reduction through budget cuts. (A similar solar tax credit program was ended in 1986 as part of Reagan-era tax cuts, noted Greentech Media).

Should the tax subsidy end early, though, it won't necessarily be an ominous development, said Benjamin Shih, vice president and senior credit officer at Moody's. "Five years from now, you can see the prices for solar competing head to head with utility companies" for customers, even without the subsidies. An early end to the ITC "might have some impact but it would not kill the solar industry," said Shih.

Cautionary Tale

Interestingly, the loans serving as collateral for SolarCity’s deal have proven to be a bust for the firm, in part because they are too similar to PPAs. The company launched the MyPower product in 2014 and originally projected it would account for half of financing in 2015. At the end of that year, however, the product only accounted for 13% of business.

Reportedly, this was because borrowers forfeited the tax credit to SolarCity, as they do with leases. Also, the loan included a 2.9% cost escalator that could increase annually without regard to system production. The loans also have a 30-year tenor, compared with 10 to 20 years for leases. The firm stopped originating MyPower loans in February 2016.

In June, it launched a loan program in 14 states with shorter tenors and fixed-rate payments that allowed borrowers to use the tax credit.