Borrowers typically refinance in order to lower their debt servicing costs by taking advantage of an improvement in either market conditions or their own creditworthiness.

But both Carlyle Investment Management and Voya Investment Management recently worked out arrangements to pay higher interest to investors in the senior notes of a pair of collateralized loan obligations. The CLO managers issued replacement notes for existing tranches, in the process obtaining consent to extend the maturities of the two deals as both approached the end of their reinvestment periods.

While this cost them in terms of the interest rate spread on the notes, they gained a reprieve from pending rules requiring managers to keep “skin in the game,” of their deals. After Dec. 24, managers will be required to keep 5% of the economic risk in CLOs (and other kinds of asset-backeds).

Existing CLOs will be grandfathered from the requirement, but it’s not clear whether refinancing the notes after Dec. 24 would

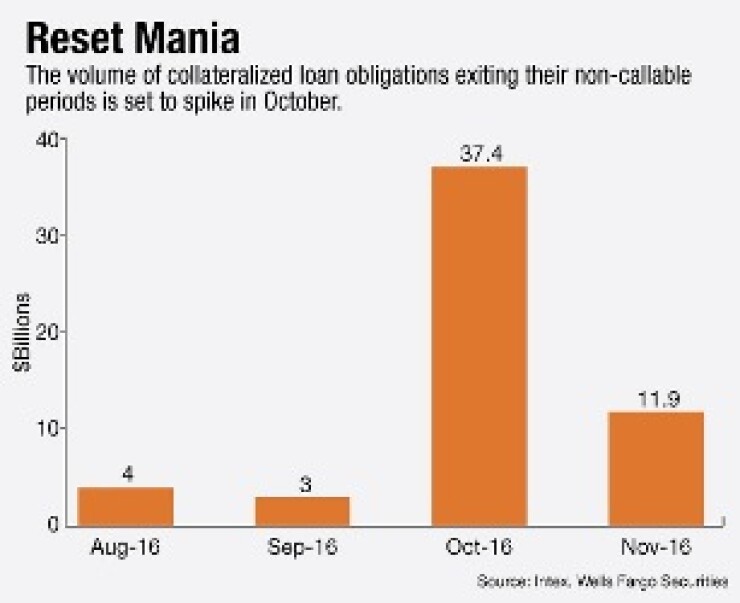

Some $50 billion of U.S. CLOs exit their non-callable periods in the fourth quarter, according to Wells Fargo. In total $250 billion will be eligible to be refinanced, an amount equal to 72% of the outstanding market. Analyst at the bank, as well as at Deutsche Bank, expect that many managers will follow the example set by Carlyle and Voya.

In the month of October along, roughly $40 billion CLOs will become callable, giving managers with a required payment date only a month in which to refinance before the risk retention requirement kicks in.

While managers could simply call a deal and issue a new one, this would be challenging in the current market environment, collateral for new deals is scarce – and expensive. Issuance of below-investment grade corporate loans is down 19% so far this year from 2015’s pace, according to Thomson Reuters.

Calling deals and issuing new ones is also more time consuming.

Resets offers a much simpler means to extend a deal’s reinvestment period as well as the weight average life test (indicating the expected time period for bondholders to receive principal returns). Managers do not have to obtain new assets, redeem old notes and invest in the ramp-up costs of a new issuance.

“This way the CLO can be restructured to have most of the attributes of a new issue CLO, while keeping the assets in place and not having to go through liquidation of the old CLO and then ramping up a new one,” Deutsche Bank analysts wrote in an Aug. 19 report.

“The main advantage of the reset is that the coupons of the tranches don’t necessarily have to be lowered that much for the reset to make sense.”

Resets “allow managers to manage through a credit cycle downturn, rather than deals going static as defaults rise,” the Wells Fargo report stated.

Maintaining, or even increasing, existing spreads on CLOs is certainly an attraction to investors. So is avoiding the deployment of new capital to obtain new CLO investments as they sell out of old positions that – in a traditional refi – are offering tighter spreads and returns. There’s no waiting for deals to ramp up, either.

For CLO equity investors, resets can be a way of maintaining distribution levels and income streams that otherwise would take a downturn as deals amortize. Resets could not be happening at a better time for business development companies, some of the biggest buyers of CLO equity. Many have suffered from declining net asset-values this year, making it difficult to sell off CLO assets without taking losses.

According to Wells Fargo, the idea of resets was established just last year by Apollo Global Management and its ALM CLO VI portfolio. ALM extended its reinvestment period three years, reduced the weighted average coupon by 15 basis points and also used the opportunity to raise its cap on covenant-lite loan assets. (Three other deals were reset last year, according to Deutsche).

For Carlyle, its 2012-3 deal was set to exit its reinvestment period in October. So in mid-August, Carlyle proposed replacement notes through a supplemental indenture that would extend the reinvestment period, the legal final maturity and the WAL test dates by four years. Those notes carried a slight spread bump to triple-A paper investors, widening the rate to 145 basis points from the original rate of Libor plus 1.41% for the $391.5 million tranche. While wider, the 145 basis points spread was still tighter, however, than the 151 point spread Carlyle received on the ‘Aaa’-rated notes on its third CLO for 2016 that priced on Aug. 9.

Some investors in the tranches took tighter spreads, however. According to Standard & Poor’s, bondholders of the Class A-2 notes (rated ‘Aa’) had their rate narrowed to 185 basis points from 225, and B noteholders were squeezed to 250 basis points from 350 basis points (those coupons are in line with the spreads for the contemporary Carlyle CLO).

Voya’s triple-A investors also benefited from widened spreads, moving to Libor plus 145 basis points from 139 basis points. Voya obtained extensions to the non-call end date, reinvestment end date, weighted average test as well as the final maturity date. Voya also obtained looser restrictions on industry concentration limits, according to S&P.

Voya and Carlyle are among three resets and 14 refinancings that have taken place thus far in 2016. In March another CLO, American Money Management’s AMMC CLO IX, reset terms in March on its $430 million portfolio. That deal’s modifications only extended the reinvestment period for two years, but granted a WAL life test extension three more years until December 2021 and permitted an expansion of covenant lite allowances to 50% of the portfolio.