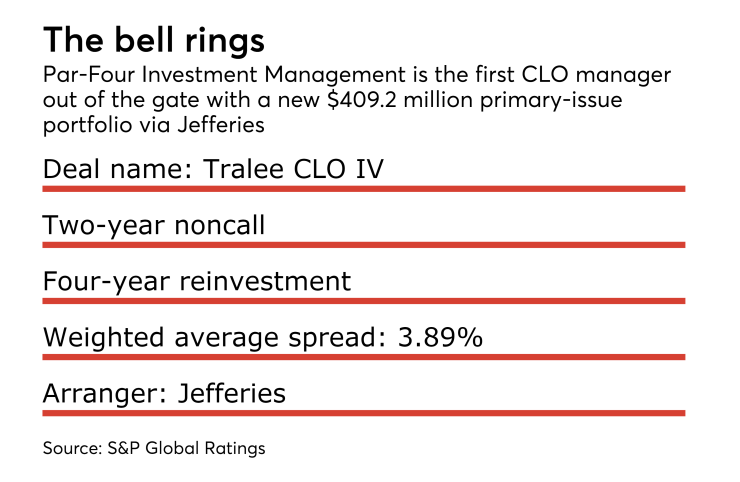

Par-Four Investment Management is launching the first new-issue collateralized loan obligation of 2018, according to S&P Global Ratings.

Tralee CLO IV is a $409.2 million securitization of broadly syndicated senior loans. The $256 million senior, triple-A-rated tranche is expected to price at Libor plus 119 basis points – slightly above the average 113-basis-point spread for AAA discount margins that Thomson Reuters LPC reported for December.

The deal nearly doubles Par-Four Investment Management’s assets under management to $798.5 million, according to S&P. Par-Four, of Woodcliff Lake, N.J., was formerly Par-IV Capital Management, according to Bloomberg, and is headed by a former Lehman Brothers managing director, Robert Burke.

The deal is among the higher-leveraged CLOs in the past three months at an 11.33x debt-to-equity ratio, but an above-average weighted average spread of 3.89% between CLO investor obligations and the cash flow of underlying loan portfolio proceeds.

The deal, arranged by Jefferies, has a standard two-year non-call period but only a four-year reinvestment period and a 6.18-year weighted average life of the portfolio measuring the expected maturity of the deal.

Par-Four is coming to market in what is normally a slow period for new issuance. In January 2017, only two deals totaling $981 million were priced (though the year turned out to be the second-busiest on record with a total of $117 billion in new issuance).

The inaugural primary CLO portfolio for 2018 comes a week after BMO Asset Management priced the first refinancing of the year with its Great Lakes CLO 2015-1 ($363.56mn) via Citi, according to JPMorgan. Great Lakes was originally launched in July 2015 with a mix of middle-market and broadly syndicated loans in the portfolio.

Great Lakes is the first of four publicly rated CLO deals to enter the pipeline, according to ratings agency reports. S&P also on Tuesday issued ratings on a proposed Jan. 16 refinancing to the $365.8 million Z Capital Partners CLO 2015-1 transaction (also previously arranged by Jefferies).

Last week S&P published presale reports on a refinancing and extension of Shackleton 2013-III CLO, a $563.3 million deal managed by Alcentra, and AXA Investment Managers’ replacement notes offering for the $359 million Alleggro CLO III deal from July 2015.