North Carolina's highest court is expected to rule later this year on how much detail debt buyers must provide to consumers about the amount of money they allegedly owe.

The state Supreme Court heard oral arguments Tuesday in a case involving Portfolio Recovery Associates, which is one of the country's largest debt buyers.

Consumer advocates say that a pro-consumer ruling in the suit could make it difficult for debt buyers operating in North Carolina to churn out a high volume of lawsuits, which frequently lead to default judgments against borrowers.

"This has the potential for disrupting the assembly line, because the debt buyer is held to a higher standard," Nadine Chabrier, senior policy and litigation counsel at the Center for Responsible Lending, said in an interview Wednesday.

The case involves a 13-year-old North Carolina law that was meant to increase consumer protections. Lawyers for the two sides offered opposing interpretations of the 2009 law during Tuesday's court hearing.

Jason Pikler, who represents a borrower from whom Portfolio Recovery Associates sought to recover charged-off debt, argued that the law requires debt buyers to provide an itemization of the debt they have purchased.

But John Berkelhammer, a lawyer for Portfolio Recovery Associates, contended that the itemization required by the law applies only to charges incurred after the debt's purchase.

The lawsuit grew out of an HSBC credit card account that a consumer named Pia Townes opened back in 2006. Townes stopped making payments in June 2012 after HSBC had sold its credit card business to Capital One FInancial. McLean, Virginia-based Capital One sold the charged-off account to Portfolio Recovery Associates in 2013, according to records cited in the litigation.

In 2015, Portfolio Recovery Associates sued to collect the debt, attaching to its lawsuit a spreadsheet that listed both a charge-off amount of $1,354.65 and a final statement balance of $1,866.90. The suit sought payment of the latter amount.

Portfolio Recovery Associates initially obtained a default judgment against Townes, but a district court later set aside that judgment. Then after the debt-collection company voluntarily dismissed its collection action, Townes sued for alleged violations of the 2009 state law, including a failure to "reasonably verify" the amount owed with an itemized accounting.

In a 2020 appeals court ruling, Townes prevailed, setting the stage for an appeal by Portfolio Recovery Associates to the state Supreme Court.

A spokesperson for Portfolio Recovery Associates said in an email Wednesday that the company does not comment on pending litigation.

Portfolio Recovery Associates has previously found itself in hot water with regulators in connection with its litigation practices.

In 2015, the Consumer Financial Protection Bureau found that the company collected payments by pressuring consumers with false statements and filing lawsuits without verifying the debt. Then in 2021 and again early this year, Portfolio Recovery Associates disclosed that the CFPB had informed the company that the agency believed it may have violated provisions in the 2015 consent order.

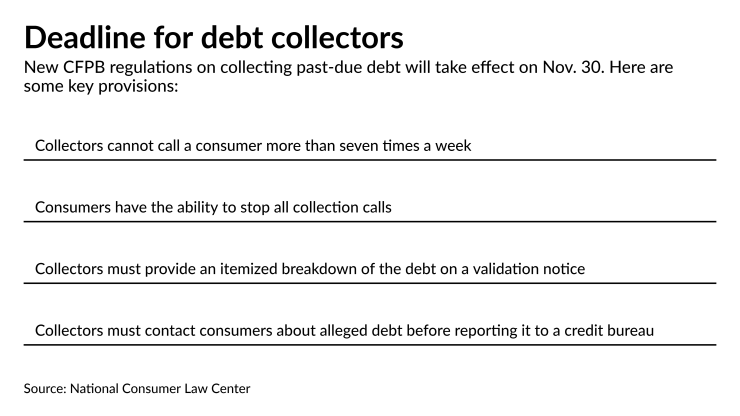

Joann Needleman, a lawyer at Clark Hill who represents financial institutions in compliance matters, said in an interview that itemization requirements have become widespread for debt collectors under both state and federal regulations. But these rules typically require debt buyers to itemize any fees added to the charge-off balance, Needleman said.

She argued that requiring debt collectors to show how the creditor arrived at the charge-off balance — as consumer advocates argue is mandatory in North Carolina — is onerous.

Consumer advocates contend that debt buyers abuse the court system by filing a large volume of cases that rely on borrowers' failure to appear, which allows them to obtain default judgments without providing the evidence that would otherwise be required.

"The high profitability of debt-buyer litigation depends on limited consumer involvement, with economies of scale making even low-value claims worth pursuing," the Center for Responsible Lending and other consumer groups wrote in an amicus brief filed in the case.