In a bid to cut time and costs from the mortgage process, Fannie Mae is testing whether appraisers can accurately determine a home's value without actually visiting the property.

Instead, the government-sponsored enterprise is asking appraisers to combine local market data with property-specific details from a home inspection to create a "hybrid appraisal" report.

Fannie Mae declined to comment about the program, but the pilot was described to NMN by multiple sources familiar with the tests.

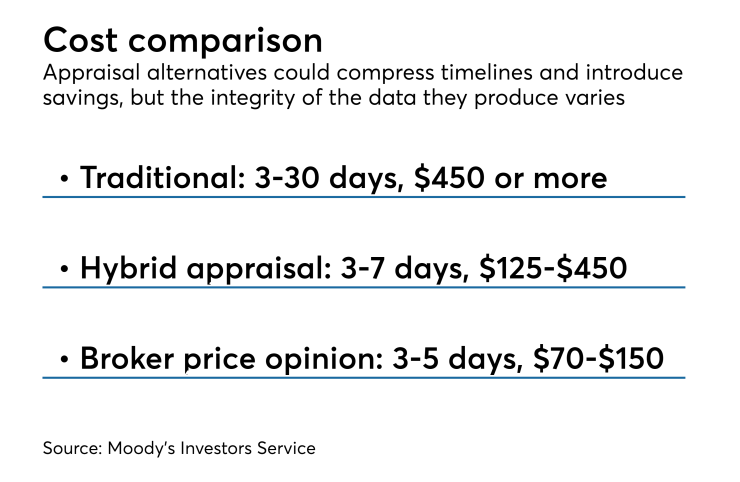

Hybrid appraisals tend to be faster for lenders and cheaper for borrowers than traditional, "full" appraisals, particularly in

"We think it's a game changer, the fact that they're going down the path of testing it," said Jim Smith, president of Property Solutions, the valuations, title and asset management division of Computershare.

The use of alternative appraisal products has long raised questions about data integrity and accuracy. For example, the quality of the subject-property data in a hybrid appraisal will vary based on the skill and experience of the home inspector, said Mark Johnson, president of property valuation company LRES.

"The pro for the lenders is everything is faster and easier. Really what you are doing there is taking the appraiser out of the drive-time and appointment equation, and allowing them to focus on the analysis and conclusion. An appraiser can do more appraisals per day sitting at his desk," Johnson said.

"The disadvantages are obviously it's a different pair of eyeballs out there and boots on the ground writing the report," he continued. "The guy writing the report can't really know what the other guy saw out there. You don't have a real, true licensed appraiser noticing all those nuances."

If the GSEs approved hybrid appraisals, "I think we'd gladly follow along," said Rick Bechtel, head of U.S. mortgage banking at TD Bank, which recently started gearing up to use hybrid appraisals in conjunction with home equity lines of credit.

However, Bechtel said he'd be cautious about using hybrid appraisals to evaluate distinct jumbo properties or for use with higher-risk government loans.

Meanwhile, GSE acceptance of hybrid appraisals, while by no means certain, is looking more likely.

Both GSEs already are using

Some appraisal alternatives are more reliable than others, Moody's Investors Service noted in

The GSEs also may need to identify a practice that bridges variations in state laws governing appraisals.

For example, while a real estate agent or broker can collect on-site information in some types of hybrid appraisals, the West Virginia Real Estate Commission has a 2007 memorandum that can be interpreted as disallowing real estate brokers from doing inspections related to valuation reports or broker price opinions in the state, Smith noted. Fannie is testing hybrid appraisals based on information collected by home inspectors.

If hybrid appraisals do get approved by either or both GSEs, they will likely have limited applicability based on the amount of comparable data available to back them up and how distinct the property in question is.

"It all comes down to homogeneous properties," said Johnson. A hybrid appraisal may be appropriate to size up similar low- or mid-tier properties with lot of recent comparable data, but with more high-end homes that tend to be more custom-built, using a hybrid appraisal "gets complicated," he said.