Thirty-year mortgage rates increased for the first time in seven weeks, as

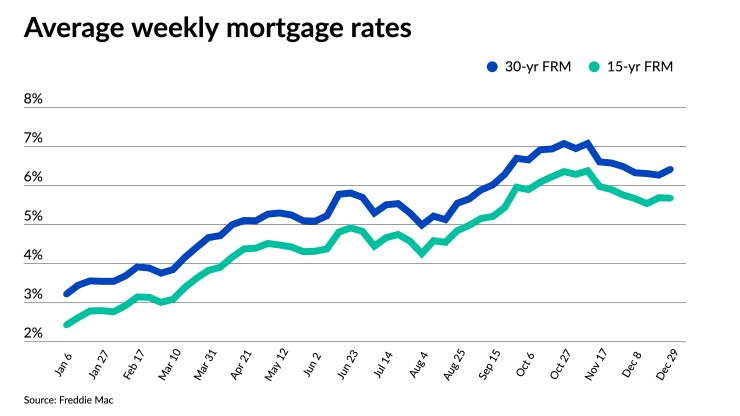

The 30-year fixed-rate average interest rate came in at 6.42% for the weekly period ending Dec. 29 in Freddie Mac's Primary Mortgage Market Survey, up 15 basis points from 6.27% seven days earlier. The latest average is also more than two times higher than its level in the last week of 2021, when it was 3.11%.

While mortgage rates have deviated from the

The 15-year fixed rate slipped by a notch, down 1 basis points to average 5.68% from 5.69% last week. At the same time last year, the 15-year rate was at about half of its current level, coming in at 2.33%.

The large and swift increase in rate averages over this year have helped to put the brakes on a hot housing market. Pending home sales fell to their

While evidence of increased interest among buyers appeared in

"While the intensity of weakness is moderating, the market continues to decline and forward-leading indicators suggest housing will remain weak throughout the winter," he said.

As the mortgage industry enters what is normally the slowest buying season, it will likely be months before a turnaround can reasonably be expected, with researchers at the Mortgage Bankers Association, Fannie Mae and First American all warning current conditions will likely remain for several more months.

"Pending-home sales in November reflect a freeze in the housing market, as buyers remain on the sideline and sellers are staying put," said Odeta Kushi, First American deputy chief economist.

"Yet, mortgage applications point to a thawing, but still cold, housing market as mortgage rates come down," she said.