Lone Star Funds plans to issue $281 million of commercial mortgage bonds backed by 211 mortgage loans secured by mostly multifamily properties, according to a presale report published by DBRS.

Wells Fargo and Citigroup are lead managers on the deal.

The loans were either purchased by Lone Star from Fannie Mae or were originally part of the following deals: LASL 2006-MF2 (MF2) and LASL 2006-MF3 (MF3). Five loans are newly originated loans (four fixed and one floating-rate) by Lone Star’s lending arm, Relius.

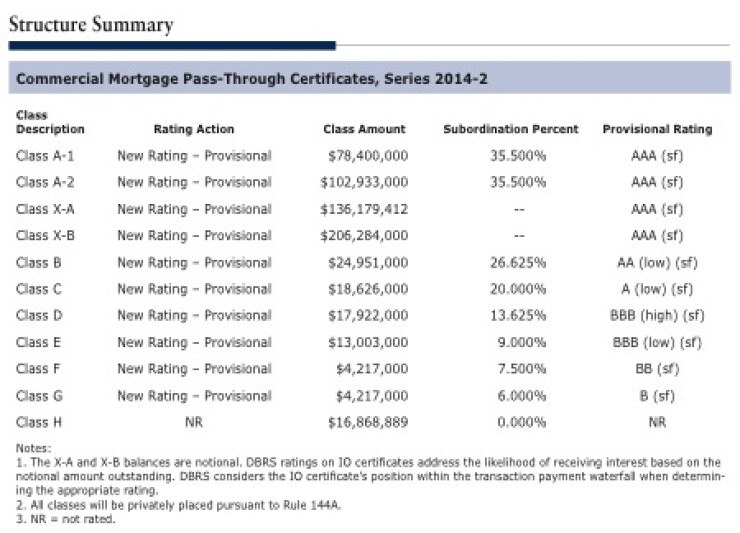

The chart below outlines how the tranches are sized and their respective DBRS ratings.

The five newly originated loans represent 43.5% of the pool. These loans are considered to have higher leverage, with a DBRS Term and Refi DSCR of 1.15x and 0.90x, respectively. Two of the newly originated loans representing 13.6% of the pool are secured by full-service hotels.

"Hotel properties have higher cash flow volatility than traditional property types, as their income is derived from daily contracts rather than multi-year leases, while their expenses, which are often mostly fixed, are quite high as a percentage of revenue," the presale report states. "These two factors cause revenue to fall swiftly during a downturn and cash flow to fall even faster because of the high operating leverage."

The seasoned loans are secured primarily by multi- family properties — 52 of these loans, representing 11.8% of the pool, are located in seismic zones 3 and 4 and are not covered by seismic insurance. Seismic zones 3 and 4 indicate a moderate-high and high probability of damaging ground motion, explained DBRS.