LendingClub is marketing its first rated securitization of consumer loans through an offering shelf that co-mingles loans from different investors.

The $279.39 million Consumer Loan Underlying Bond (CLUB) Credit Trust 2017-NP1 is backed by near prime loans made on LendingClub's online platform; the loans were purchased by seven third-party investors and subsequently contributed to the collateral pool.

Prior securitizations of LendingClub loans (at least the rated ones) were backed by loans contributed by a single, large investor. Most recently, Cirrix Finance completed a $213 million deal in March that was backed by prime loans. Jefferies has also completed several securitizations of LendingClub loans.

Following a leadership shakeup in May 2016, however, the marketplace lender has diversified its investor base across individual retail investors through self-managed accounts, individual investors in managed accounts or private funds, banks and institutional investors. The CLUB shelf allows a broader range of investors to securitize their loans on common platform.

According to Kroll Bond Rating Agency, which is rating the deal, LendingClub also uses some of its own capital to purchase loans originated on the platform and contributes collateral to its securitizations; however, Kroll's presale report does not indicate whether any of the collateral in CLUB 2017-1 was contributed by LendingClub.

Another departure from previous transactions: the sponsors have decided to pay up for a higher credit rating. The senior tranche of notes to be issued is rated A by Kroll; by comparison, the senior tranche of Cirrix' March transaction was only rated BBB - and the loans were of prime quality. The higher credit rating for this deal comes at a significant cost however: credit enhancement for the senior tranche is 52.25%.

The single-A rating is in line with ratings on bonds backed by unsecured consumer loans originated by Prosper and Avant.

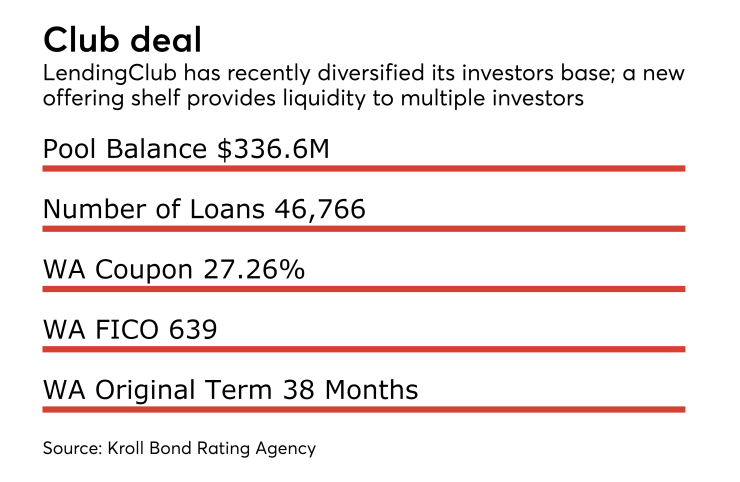

The collateral pool consists of 46,766 loans with terms of either 30 or 60 months and a combined balance of $336.6 million. The loans have a weighted average interest rate of 27.26% and are seasoned six-months. The loans are primarily to borrowers with FICO scores between 600 and 659, with 56.61% of the pool in the 640-659 tier.

KBRA has established a base case loss range of 20-22%, slightly above the range of two prior Lending Club transactions rated by the agency (which also includes

The proceeds will be used to fund a reserve account supporting the notes as well as to acquire the loans from seven third party firms unaffiliated with LendingClub. All the loans were underwritten and originated by WebBank before the transferors acquired the loans.

KBRA reports only two loans are not current, and none more than three days past due.