Hyundai is taking steps to limit exposure to falling car prices in its next auto lease securitization.

Moody’s Investors Service expects losses on the the $1.0 billion Hyundai Auto Lease Securitization Trust 2017-C to reach 1.0% over the life of the transaction; unchanged from the sponsor’s previous deal. While that is low, it is high relative to most auto lease deals Moody’s has rated recently. Moreover, the performance of Hyundai’s deals began to worsen two years ago, in 2015, as used car prices moved off their peaks.

To compensate for weaker used car prices, Hyundai has lowered the base residual value, or the amount it expects to be recovered when cars come off lease or are repossessed and then resold. This value is used to set other lease terms, such as payments. They might require higher lease payments if they expect to recover less from the sale of the car when it comes off lease, for example.

The base residual value for the 2017-C transaction is set at 45.3% of manufacturer's suggested retail price and the discounted residual value is 55.6% of securitization value. According to Moody’s, this is low relative to other recent peer lease transactions and relative to previous Hyundai transactions; it did now specify how much lower, however.

Moody’s expectations for cumulative net losses for the latest transaction are unchanged from the Hyundai’s previous transaction. In its presale report, it said that declining used vehicle prices could still result in lower recoveries.

Among other ratings considerations, the collateral pool's credit quality, as measured by weighted average FICO score (746) and original term (40 months), is similar to that of previous Hyundai securitizations.

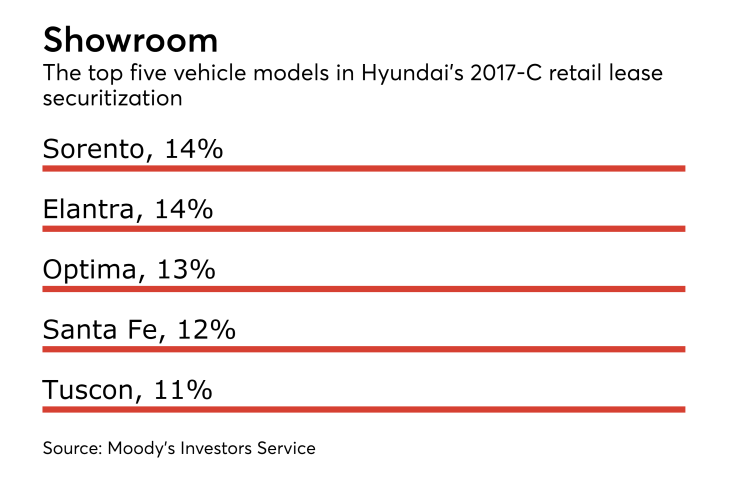

Each lease provides for level payments that fully amortize at a rate implicit in the lease over a period of not less than 24 months and not greater than 48 months. Each lease is written with respect to new cars, sports utility vehicles and crossovers.

Four tranches of senior notes will be issued: a $130 million money market tranche, two tranches totaling $335 million (one floating-rate, one fixed) mature in March 2020; a $296 million tranche maturing in February 2021, and an $83 million tranche maturing in September 2021. All of the term tranches are rated Aaa by Moody’s Investors Service and benefit from 17.5% credit enhancement.

Barclays Capital, BNP Paribas Securities, and Mizuho Securities are the lead underwriters.