Expanding the debt-to-income criteria and including investors under the new Home Affordable Modification Program (HAMP) proposal can have a significant impact on non-agency RMBS modification volumes, Bank of America Merrill Lynch analysts said.

Last Friday the Treasury Department unveiled its new plan to expand the HAMP. Among the changes it will consider are a lowering of the first-lien DTI threshold. Borrowers will no longer be required to have a 31% first-lien DTI to qualify for the program.

"We think the potential impact from expanding the DTI criteria, opening up HAMP to investors, and increasing incentive payments has the potential to be somewhat significant for modification volumes," BofA Merrill analysts stated. They added that the program, with its expanded eligibility requirements, can potentially result in 27,000 additional permanent HAMP modifications per month versus roughly 25,000 per month currently.

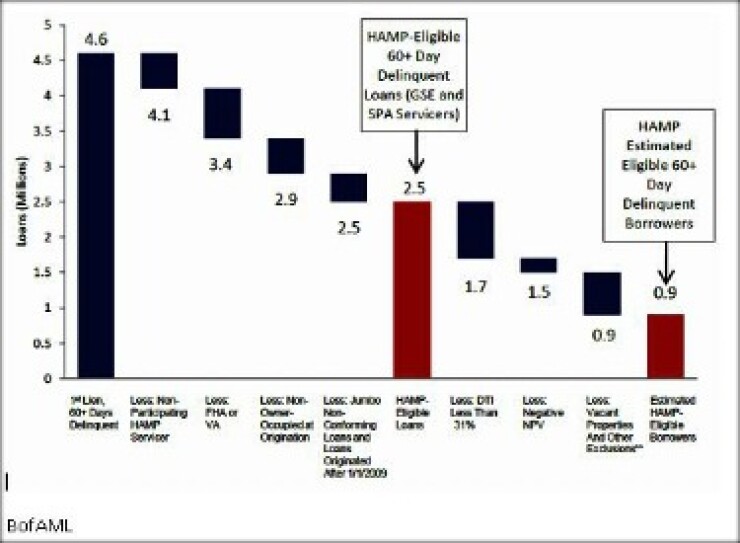

There is a sizeable amount of non-agency borrowers who would meet the expanded HAMP guidelines if LTV/DTI limits are relaxed. According to BofA Merrill anallysts, roughly 800,000 borrowers that were excluded from HAMP consideration as a result of a DTI below 31% will now be eligible for modifications.

The program will also be expanded to include properties occupied by renters. HAMP was previously only open to owner-occupant properties and not investor properties. According to the BofA Merrill report, this limitation had also excluded around 500,000 borrowers of non-owner occupied mortgages at origination and around 600,000 borrowers due to the property being no longer owner-occupied after origination.

"Non-agencies would benefit as an asset class," said Barclays Capital analysts in a report. "In particular, the biggest beneficiaries should be pro-rata mezzanine bonds, which are getting most of their returns from principal paydowns. Within subprime, front cash flows and seasoned (03-04) mezzanine bonds are likely to benefit the most."