WASHINGTON — The Federal Deposit Insurance Corp. says it will give potential suitors more time to bid for Silicon Valley Bank and will break up the bank, the latest steps in a protracted effort to find a buyer for one of the institutions at the heart of the recent banking panic.

The FDIC said that it will allow parties to submit separate bids for Silicon Valley Bridge Bank N.A. and its subsidiary Silicon Valley Private Bank. Nonbank firms, as well as banks, will be allowed to bid on the asset portfolios of either institution. Qualified, insured banks can submit whole-bank bids on the deposits or assets.

The FDIC said that there's been "substantial interest" from multiple parties, and that the bidders "need more time to explore all options in order to maximize value and achieve an optimal outcome."

The agency is in a tough spot to find a buyer for the second largest failed bank in U.S. history, as the list of prospective institutions is low since Silicon Valley Bank is too large for most banks to absorb.

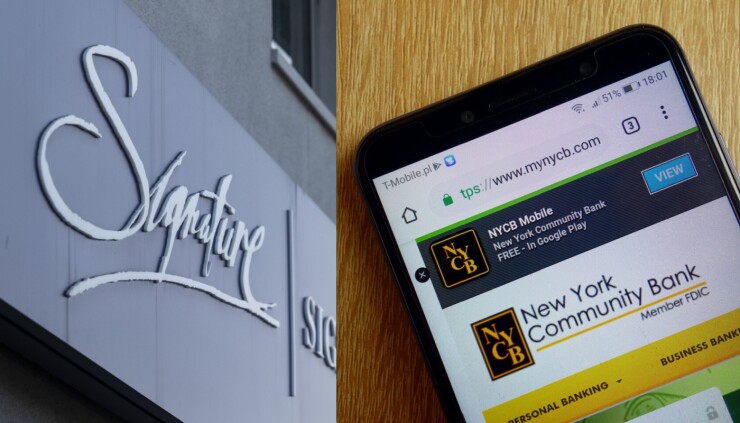

Still, the FDIC on Sunday evening said that Flagstar Bank, a subsidiary of New York Community Bancorp,

The

Bidders now have until 8:00 p.m. Wednesday to make offers for Silicon Valley Private Bank, and until 8 p.m. Friday for Silicon Valley Bridge Bank N.A.

The FDIC has reportedly received some interest in Silicon Valley Bank's credit business from

Silicon Valley Bank's failure on March 10 prompted concerns about the balance sheets of similar regional banks. Signature Bank failed two days after Silicon Valley Bank, and First Republic Bank received a $30 billion deposit infusion from a group of larger banks.

The panic has spread beyond U.S. banks: UBS agreed to buy the troubled rival Credit Suisse over the weekend in a shotgun arrangement from Swiss regulators to prevent the banking crisis from spreading further in Europe.

While Deputy Treasury Secretary Wally Adeyemo has said that deposit stability is returning to regional banks, shares of First Republic fell 12% to $20.24 in early trading Monday