Fannie Mae and Freddie Mac sold 30% of their nonperforming loan portfolio during 2021, the highest share ever, the latest Federal Housing Finance Agency report stated.

The government-sponsored enterprises sold 24,164 nonperforming loans last year from a portfolio of 79,591 that they held as of Dec. 31, 2020. The sales consist of loans in the portfolio for at least a year.

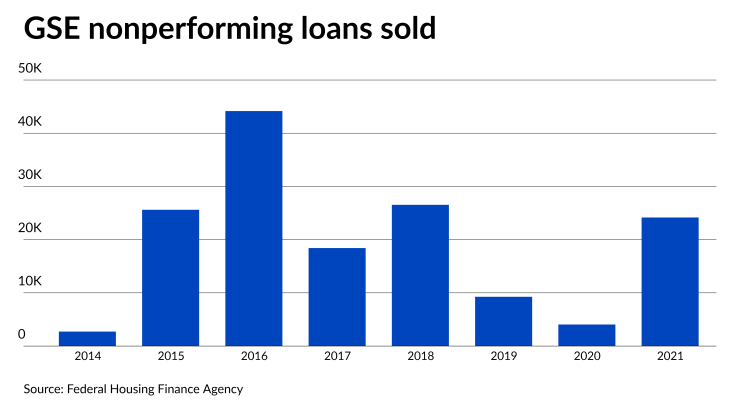

In the pandemic year of 2020, units sold totaled just 4,051 or 8% of the total 51,512 held on Dec. 31, 2019.

However, because of the pandemic and related loss mitigation programs, the GSE nonperforming loan portfolio zoomed up to 208,147 loans during 2021, with 175,065 units being delinquent between one and two years.

That will likely lead to a ramp up in NPL sales during 2022, some in the business have

Since these sales started, Fannie Mae and Freddie Mac sold 154,972 NPLs with an aggregate unpaid principal balance of $28.7 billion. These loans were delinquent for an average of 2.8 years and had an average current mark-to-market loan-to-value ratio of 86%.

The primary benefit of selling the loans was measured in the outcomes, the FHFA report said. From 2014 through June 30, 2021, 81% of all sold loans were resolved in some fashion, including becoming reperforming or foreclosure.

Foreclosure was avoided on 36% of the sold loans within a four-year period, compared with 27% of a benchmark grouping that the GSEs did not sell.

Further breaking down that 36%, almost 11% received a permanent modification, while just under 9% of the loans cured as the borrower resumed making payments. Another 8% were paid in full. Short sales took care of 4.6% while a deed-in-lieu transaction resolved 3%.

However, 45% of the sold loans ended up in foreclosure. Another 17% have yet to be resolved, the report said.

Occupancy status had a big effect on foreclosure avoidance. For homes still occupied by the borrower, 42.3% avoided foreclosure versus 17.1% for vacant properties.

Vacant properties had a 77.9% foreclosure rate compared with 33.7% for borrower-occupied properties. That is actually good news, especially for those concerned about

"Foreclosures on vacant homes typically improve neighborhood stability and reduce blight as the homes are sold or

The GSE nonperforming loan portfolios are much lower today than when FHFA first authorized sales in 2014. The prior year, Fannie Mae and Freddie Mac had 378,331 NPLs.

The year with the most unit sales was 2016, when the GSEs sold 44,169 (22%) of the 199,619 NPLs they held on Dec. 31, 2015. By share of portfolio, 2018 was the second highest, with 29% sold or 26,545 out of 90,456 at year-end.